Trade wars, tariff negotiations between US and China and the annual Fed Jackson Hall Central Bank Symposium are some of the key news today in the forex market. In the economic calendar there is the release of the German GDP Growth Rate and the US Durable Goods Orders. The speech by the Fed Chair Powell at Jackson Hall about the economy and monetary policy is very important as his statements and projections can move the US Dollar in the short-term.

After the recent FOMC Minutes that increased significantly the odds of another US interest rate hike in September the forex market participants will weigh on latest economic data to determine the level of risk sentiment and form new trends or continue existing ones. There are also political risks with the Australian Government which most probably will have an influence on the Australian Dollar.

These are the key economic events in the forex market today to focus on, time is GMT:

European Session

Germany: Gross Domestic Product (YoY, QoQ) (Q2), UK: Finance Mortgage Approvals

Time: 06:00, 08:30

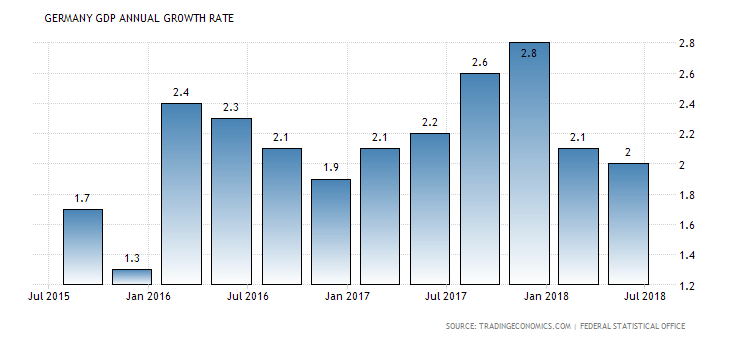

The Gross Domestic Product is a measure of the total value of all goods and services produced by Germany. The GDP is considered as a broad measure of the German economic activity and health and the most important indicator of economic performance for the broader economy. Higher than expected figures are considered positive and supportive for the Euro.

“Germany’s economy expanded a calendar-adjusted 2 percent year-on-year in the second quarter of 2018, following a 2.2 percent growth in the previous three-month period and slightly below expectations of 2.1 percent. On an unadjusted basis, the GDP rose by 2.3 percent, much stronger than an upwardly revised 1.4 percent increase in the March quarter.”, Source: Trading Economics.

After a strong expansion in early 2018 the German Annual GDP Growth Rate has decreased in the following quarters. The forecast is for an unchanged yearly reading of 2.0% for the second quarter and an unchanged figure of 0.5% for the quarter.

The Mortgage Approvals in UK measure the number of home loans issued by the British Bankers’ Association (BBA) during the previous quarter. It is considered as a leading indicator of the UK Housing Market. In general, higher than expected readings for the Mortgage Approvals indicate a strong housing market which can stimulate economic growth. An increase to 40.600K is expect4d from the previous figure of 40.541K.

American Session

US: Jackson Hall Symposium, Durable Goods Orders, Durable Goods Orders ex Transportation, Fed’s Powell Speech

Time: 12:30, 14:00

The Jackson Hall symposium focuses on an important economic issue that faces U.S. and world economies, and the focus will be on global growth and trade implications from the recent trade wars.

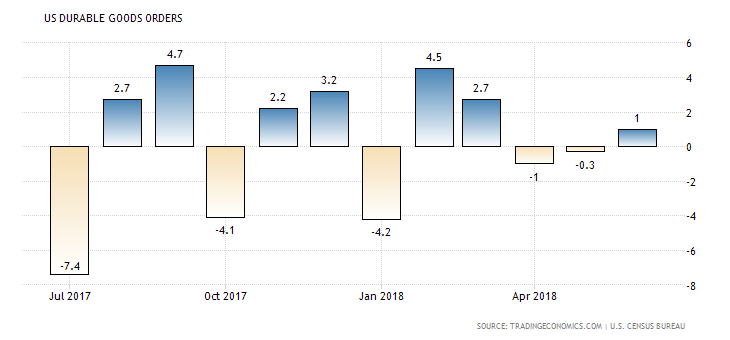

The US Durable Goods Orders measure the cost of orders received by manufacturers for durable goods, lasting three years or more, such as motor vehicles and appliances. The US Durable Goods Orders are an important indicator for the state of the US economy reflecting optimism on current and future economic conditions having sensitivity to economic and business cycles. Sustained declines or increases are considered negative or positive for the US Dollar but as we can see from the chart below the US Durable Goods Orders exhibit increased volatility with significant declines and increases during the past 12-months.

“New orders for US manufactured durable goods rose 1 percent month-over-month in June 2018, following a downwardly revised 0.3 percent drop in May and missing market expectations of a 3 percent jump. Transportation equipment led the increase.”, Source: Trading Economics.

Higher than expected readings are considered positive for the US Dollar. A monthly decrease to -0.5% from the previous figure of 0.8% is expected but the monthly Durable Goods Orders excluding the transport sector are expected to increase to 0.5% from the previous figure of 0.2%.

The speech by the Fed Chair Powell has the potential to add further volatility for the US Dollar with statements on global trade, US economic growth and risks from the recent trade war environment and will be monitored by the forex market participants.