The last trading session of this week 6-10 August 2018 today has a plethora of important economic data to be released. The economic calendar is focused in the European Session on data related to the UK economy such as the GDP Growth Rate. In other trading sessions there are important macroeconomic events, the Unemployment Rate in Canada and the Inflation Rate in US. Moderate to high volatility should be expected for the British Pound and later for the Canadian and US Dollar.

These are the key economic events which can move the forex market today, time is GMT:

European Session

France: Industrial Production MoM, IEA Oil Market Report, Sweden: Inflation Rate MoM, CPIF YoY, Italy: Balance of Trade, UK: Construction Output YoY, Industrial Production (YoY, MoM), Manufacturing Production (YoY, MoM), Balance of Trade, Business Investment (YoY Prel, QoQ Prel), Montlhy GDP, Montlhy GDP 3-Month Avg, GDP Growth Rate (YoY Prel, QoQ Prel), Russia: Balance of Trade, GDP Growth Rate YoY Prel

Time: 06:45, 07:30, 08:00, 08:30, 13:00

Before the important macroeconomic data related to the UK economy better than expected figures for the monthly Industrial Production in France and a trade surplus for the Balance of Trade in Italy are considered positive for the Euro, while a higher than expected Inflation Rate in Sweden is supportive for the Swedish Krona reflecting inflationary pressures in the economy of Sweden which may lead to a tighter monetary policy in the future. The monthly IEA Oil Market Report provides information on supply, demand, stocks, prices and refinery activity and can form a short-term trend for oil prices. The forecasts are for a higher monthly Industrial Production in France with a figure expected of 0.5%, higher than the previous figure of -0.2%, an unchanged yearly Consumer Price Index at Fixed Rate at 2.2% for Sweden and an increase for the trade surplus in Italy with an expected figure of 3.41B Euros, higher than the previous figure of 3.378B Euros.

The plethora of important macroeconomic data for the UK economy most probably will add volatility and price action for the British Pound with an emphasis on the GDP Growth Rate as it is the most representative indicator of the performance of the overall economy.

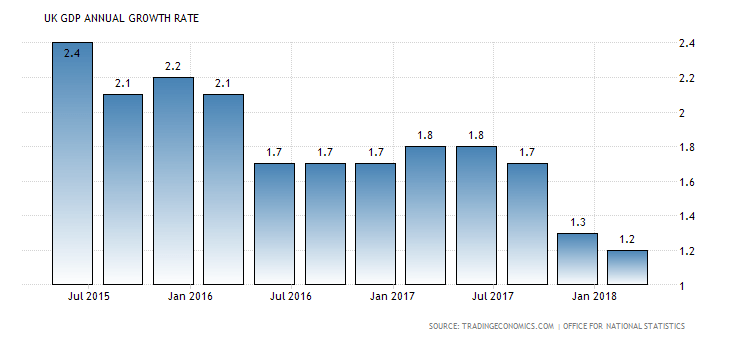

“The gross domestic product in the United Kingdom expanded 1.2 percent year-on-year in the first quarter of 2018, unrevised from the second estimate and following a downwardly revised 1.3 percent growth in the previous period. It was the weakest pace of expansion since the second quarter of 2012, due to a slowdown in both household consumption and fixed investment.”, Source: Trading Economics.

We note that in the previous periods the annual GDP Growth Rate in UK was higher and that the most recent figure was the weakest since the second quarter of 2012 and we can see that as of 2015 there is a downward trend for the annual UK GDP Growth Rate. The forecast is for a GDP Growth Rate Yoy Prel of 1.3%, higher than the previous figure of 1.2%, a monthly GDP of 0.2% less than the previous reading of 0.3% and a GDP Growth Rate QoQ Prel of 0.4%, higher than the previous figure of 0.2%.

In general, mixed economic data is expected for the economy of UK as lower figures are expected for the yearly Industrial Production, Manufacturing Production, Construction Output and Business Investment reflecting less strength in these business sectors and a potential slowdown in the overall economy. Large business investments are indicative of overall growth and demand in the UK economy, so this decline in the Business Investments should be considered negative for the British Pound. The Trade Balance is expected to show a narrower trade deficit of -2.5B British Pounds, compared to the previous figure of -2.79B British Pound, with trade surpluses considered positive for the local currencies. Any economic surprises most probably will add further volatility to the British Pound as there are developments also in the Brexit as well.

For Russia a trade surplus and a higher than expected GDP Growth Rate are both considered positive for the Russian Ruble. A trade surplus indicates increased demand for goods and services denominated in Russian Ruble and capital inflows in Russia which should lead to the appreciation of the currency versus other currencies over time. An increase for the trade surplus is expected at 15.85B US Dollars compared to the previous reading of 15.15B US Dollars.

American Session

Canada: Participation Rate, Unemployment Rate, Employment Change, US: Core Inflation Rate (YoY, MoM), Inflation Rate (YoY, MoM), Monthly Budget Statement

Time: 12:30, 18:00

For Canada higher than expected readings for the Participation Rate and the Employment Change and lower than expected for the Unemployment Rate are considered positive for the Canadian Dollar showing a robust economy, with a strong labor market which can have positive effect on economic growth due to higher levels of consumer spending. The Unemployment Rate in Canada is expected to decline at 5.9%, less than the previous reading of 6.0%, the Participation Rate which shows the percentage of the total number of people of labor-force age (in general 15 years and over) that is in the labor force is expected to decline at 65.4% compared to the previous reading of 65.5% and the Employment Change is expected to decline at 17K, lower than the previous figure of 31.8K. Some mixed economic data for the economy of Canada is expected overall as a rise in this indicator has positive implications for consumer spending which can stimulate economic growth.

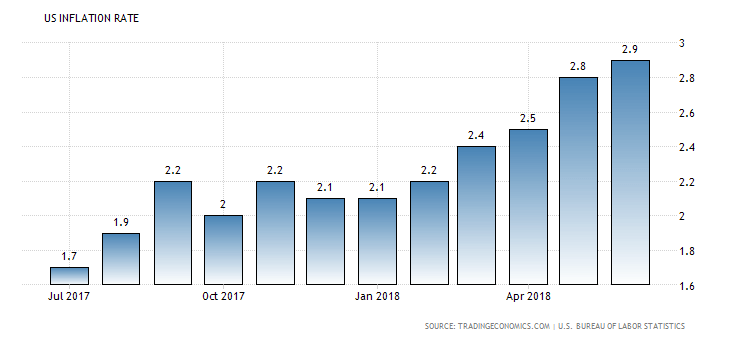

The US economy Inflation Rate is expected to increase both on a yearly and monthly basis at the rates of 3.0% and 0.2% respectively, higher than the previous figures of 2.9% and 0.1% accordingly. Higher than expected readings for the Inflation Rate are considered positive for the US economy and the US Dollar as the Fed is monitoring the inflationary pressures in the economy and may continue to increase the key interest rate if these inflationary pressures are sustainable.

“The inflation rate in the US edged up to 2.9 percent in June of 2018 from 2.8 percent in May, matching market expectations. It is the highest rate since February of 2012 when inflation was also at 2.9 percent, due to rising prices for oil and gasoline. The last time inflation was above 2.9 percent was in December of 2011 when it reached 3 percent.”, Source: Trading Economics

Still the Core Inflation Rate, a more conservative measurement of the real inflationary pressures in the economy excluding the volatile prices of food and energy is expected to remain unchanged on a monthly and yearly basis at 0.2% and 2.3% respectively.

The Monthly Budget summarizes the financial activities of federal entities and Federal Reserve banks. A positive budget is seen as positive for the US Dollar.

Pacific Session

Australia: RBA Statement on Monetary Policy

Time: 01:30

The quarterly RBA Monetary Policy Statement is important as it provides reviews on economic and financial conditions, and assesses the risks related to the goals of price stability and sustainable economic growth. It is considered an important guide to the future RBA interest rate policy. Any changes in this report may affect the Australian Dollar depending on whether the RBA appears to have a hawkish or dovish outlook for the economy and the inflation rate.

Asian Session

Japan: Tertiary Industry Index MoM

Time: 04:30

The Tertiary Industry indicates the domestic service sector in Japan for sectors such as information and communication, electricity, wholesale and retail trade, finance. Generally, a high reading is positive for the Japanese Yen. The forecast is for a decline and a reading of -0.2% compared to the previous reading of 0.1%.