The economic calendar for today does not have any economic data related to the US economy, but only economic events which can move the Euro, the Canadian Dollar, and the Japanese Yen. The most important events for today are the Consumer Confidence in the Eurozone and the Inflation Rate in Canada.

Key economic events to focus on today:

European Session

- Germany PPI, Spain Balance of Trade, BoE Saunders Speech, Bundesbank Weidmann Speech, Eurozone Consumer Confidence Flash

Time: 06:00 GMT, 08:00 GMT, 09:30 GMT, 11:30 GMT, 14:00 GMT

The Producers Price Index (PPI) measures the average changes in prices received by domestic producers for their final output in goods and is considered as a leading indicator for the Consumer Price Index (CPI). It is most probable that when producers are faced with input inflation, those rising costs are passed along to the retailers and eventually to the consumer, increasing the inflationary pressures in the economy. Rising figures for PPI are considered positive for the Euro as also a trade surplus for the Balance of Trade in Spain. The forecast is for a monthly reading of 0.2% for the PPI in Germany, higher than the previous figure of -0.1%.

The Consumer Confidence index tracks the consumers’ insights regarding business conditions, employment situation, income and overall economy. Increased figures are positive for the Eurozone reflecting optimism on the economic outlook. As seen from the chart the consumer confidence index in the Euro Area was unchanged at 0.1 in March 2018, after a large increase in January 2018. As of December 2017, the consumer confidence index in the Euro Area has turned to positive readings, indicating increased optimism on the broader economic conditions. The forecast is for a reading of -0.6, lower than the previous 2-month consecutive reading of 0.1.

American Session

- Canada Inflation Rate and Retail Sales, Core Inflation Rate, Fed Evans Speech, Fed Williams Speech

Time: 12:30 GMT, 13:40 GMT, 15:15 GMT

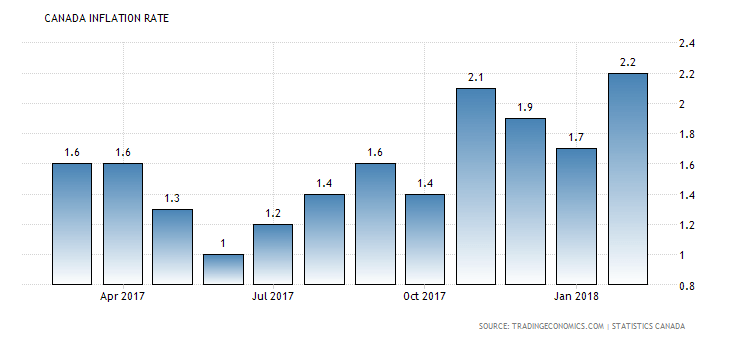

On Wednesday, April 18, 2018 the Bank of Canada kept the key interest rate unchanged at 1.25%, but mentioned that will be monitoring the Inflation Rate, as sustained inflationary pressures my lead to a tighter monetary policy, with interest rate increases soon, depending on economic growth and condition. As seen from the chart “The consumer price inflation in Canada increased to 2.2 percent year-on-year in February of 2018, up from 1.7 percent in the prior month and well above market consensus of 2 percent. It was the highest inflation rate since October of 2014.”, Source: Trading Economics

This increase in the Inflation Rate should be monitored as if sustained most probably increases significantly the probabilities of future interest rate increases by the Bank of Canada. The forecast is for a year-over-year reading of 1.9%, lower than the previous reading of 2.2.%. Increased Retail Sales will also be supportive and positive for the Canadian Dollar, as they reflect consumer spending, a key driver of economic growth measured by the GDP level. The expectation is for a year-over-year reading of 4.1% for the Retail Sales in Canada, higher than the previous reading of 3.6%. Also, on a month-over-month basis the Retail Sales are expected to increase with a figure of 0.7%, higher than the previous reading of 0.3%. Some mixed economic data are expected for the economy of Canada.

Asian Session

- Japan Tertiary Industry Index

Time: 04:30 GMT

The Index measures the change in output for the Services Sector, an important indicator of the broader economy. Increased readings are considered positive for the Japanese Yen, reflecting increased economic activity in Sectors such as retail trade and financial services. The forecast is for a reading of 0.1%, higher than the previous reading of -0.6%, which should be supportive for the Japanese Yen.