The trading session for the week 9-13 April 2018 is ending today with a thin economic calendar. Some of the key economic data to pay attention to are the Inflation Rate in Germany, the Eurozone Balance of Trade, and the University of Michigan Consumer Sentiment Index. Moderate to high volatility is expected for the Euro and the US Dollar.

These are the main economic events for today which can move the forex market:

European Session

- Germany Inflation Rate, IEA Oil Market Report, Eurozone Balance of Trade

Time: 06:00 GMT, 08:00 GMT, 09:00 GMT

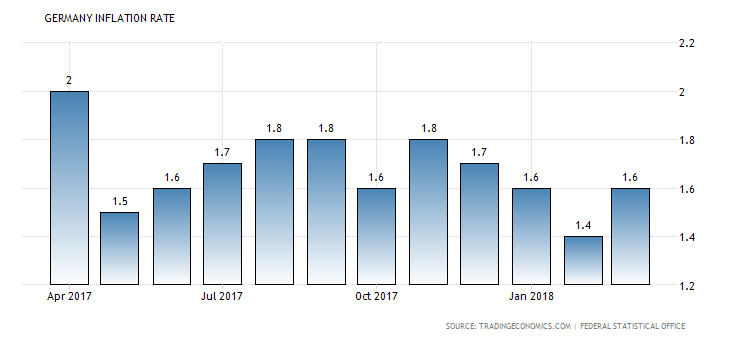

The yearly Inflation Rate in Germany is expected to 1.6%, higher than the previous figure of 1.4%. Higher than expected or rising Inflation Rate in Germany is considered positive for the Euro, as Germany is the largest economy in the Eurozone, and its Inflation Rate weights significantly to the Inflation Rate in the Euro-zone. High or rising inflation acts as a signal to the ECB to raise interest rates, an action which could result in the appreciation of the Euro against other currencies. As seen from the chart the Inflation Rate is Germany for the past 12 months is in a range of 1.4%-2.0%.

The monthly IEA Oil Market Report provides important information on supply, demand, stocks, prices and refinery activity, which can influence the oil prices. A higher than expected or increasing surplus for the Balance of Trade in the Eurozone is considered positive for the Euro. A trade surplus reflects capital inflows in the Eurozone and increased demand for goods and services denominated in Euros, which should be positive over time for the Euro. The forecast is for a large increase of the trade surplus and a figure of 20.2 Billion Euros, higher than the previous figure of 3.3 Billion Euros.

American Session

- Fed Rosengren Speech, Fed Bullard Speech, University of Michigan Consumer Sentiment Index, JOLTs Job Openings, Fed Kaplan Speech

Time: 11:30 GMT, 13:00 GMT, 14:00 GMT, 17:00 GMT

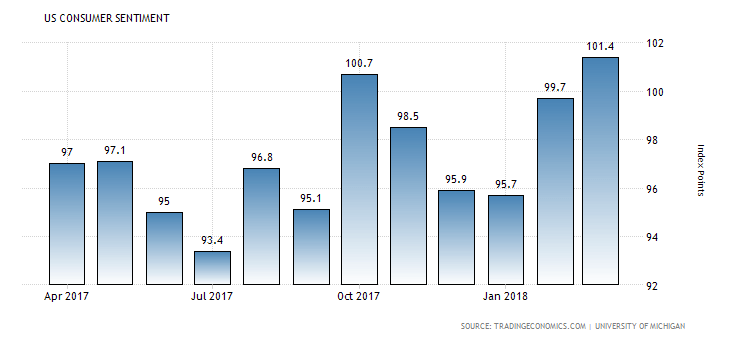

The University of Michigan Consumer Sentiment Index measures the relative level of current and future economic conditions. A higher than expected reading should be taken as positive for the US Dollar, as increased sentiment may have a positive effect on consumer spending, a key fundamental driver for the GDP growth rate.

As seen from the chart the latest reading was higher than 99.7 in February and was the strongest since January 2004. The forecast is for a figure of 100.0, lower than the previous figure of 101.4. A higher than expected or rising figure for the US JOLTs Job Openings is positive for the US Dollar, reflecting an increased number of job open positions, and a strong labor market. The forecast is for a figure of 6M, lower than the previous figure of 6.312M.

Pacific Session

- Australia RBA Financial Stability Review

Time: 00:30 GMT

The Reserve Bank of Australia Financial Stability Review will provide insights on the current condition of the financial system and potential risks to financial stability and will be monitored for any updates on current economic conditions, which may influence the Australian Dollar.