The forex market economic calendar for today Friday 9th February 2018 is full of important fundamental events related to the economies of UK, US, Canada, Switzerland, Japan and Australia, and also France and Italy, so in essence all the major currencies. This plethora of economic data can move the forex market and especially the British Pound, as after the yesterday release of monetary policy decision and inflation report, the focus is now on the balance of trade in UK.

These are the main economic events in the forex market today to focus on:

European Session

- Switzerland Unemployment Rate, Norway GDP Growth Rate, France Industrial Production, Italy Industrial Production

Time: 06:45GMT, 07:00 GMT, 07:45 GMT, 09:00 GMT

The unemployment rate in Switzerland is expected to increase marginally at 3.4%, higher than the previous reading of 3.3%, which is considered negative for the Swiss Franc, as lower rates of unemployment lead to higher economic growth. The forecast for the quarterly GDP growth rate in Norway is for a reading of 0.5%, lower than the previous reading of 0.7% which indicates a lower yet positive economic growth, and is considered negative for the Norwegian Krone, but an analysis of trend is important as this may be due to potential seasonality factors. The industrial production in France and Italy on a monthly basis is expected to increase for both countries, reflecting increased business activity, which is positive for the Euro.

- UK Balance of Trade, Industrial Production, Construction Output, Manufacturing Production

Time: 09:30 GMT

Several important economic data releases about the state of manufacturing, industrial and construction sectors will either provide support or have a negative effect on the value of British Pound against other currencies. Rising or better than expected figures for all mentioned business sectors will be positive and supportive for the British Pound reflecting positive effects on consumer spending and exports, and mainly on economic growth. The construction output reflects the state of the housing market, which is highly correlated with the overall growth of the economy.

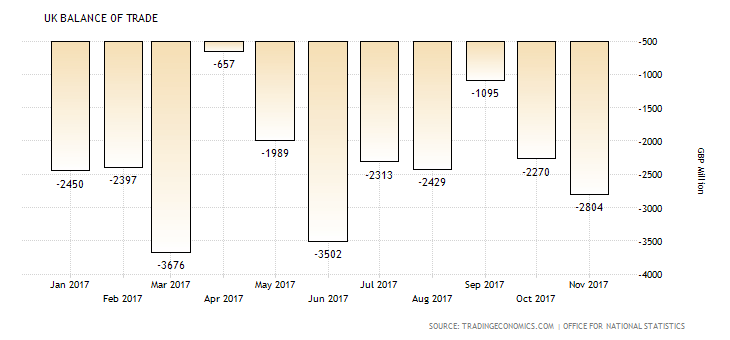

The forecasts are for declines for all three business sectors on a yearly basis, which probably will have a negative effect on the British Pound, indicating a lower output from these sectors, and a contraction in the economy. The balance of trade which shows the difference between exports and imports is expected to narrow but still being negative, having a deficit. Exports surpassing imports mean there is a surplus and is healthy for the economy.

In general trade deficits should lead to the depreciation of the British Pound over time, as there are capital outflows from the country and less demand for the local currency. The 1-year UK Balance of Trade chart shows that for the past three consecutive months there is a widening of the trade deficit, so any narrowing of it could act as supportive for the British Pound.

- Bank of Russia Interest Rate Decision, Balance of Trade

Time: 10:30 GMT, 13:00 GMT

There are two important fundamental events which can move the Russian Ruble, with the expectations being for an interest rate cut of 25 basis points by the Bank of Russia, which is negative for the currency and the expectation of an increase in the trade surplus, which is positive for the Russian Ruble. As these economic data and their expectations have an opposite effect on the value of the currency, there could be increased volatility, and a potential depreciation of the currency upon the release of the interest rate cut, followed by a potential appreciation later on after the release of the trade balance surplus actual figure.

American Session

4. Fed George Speech, Canada Employment Change, Participation Rate, Unemployment Rate, US Wholesale Inventories

Time: 02:00 GMT, 13:30 GMT, 15:00 GMT

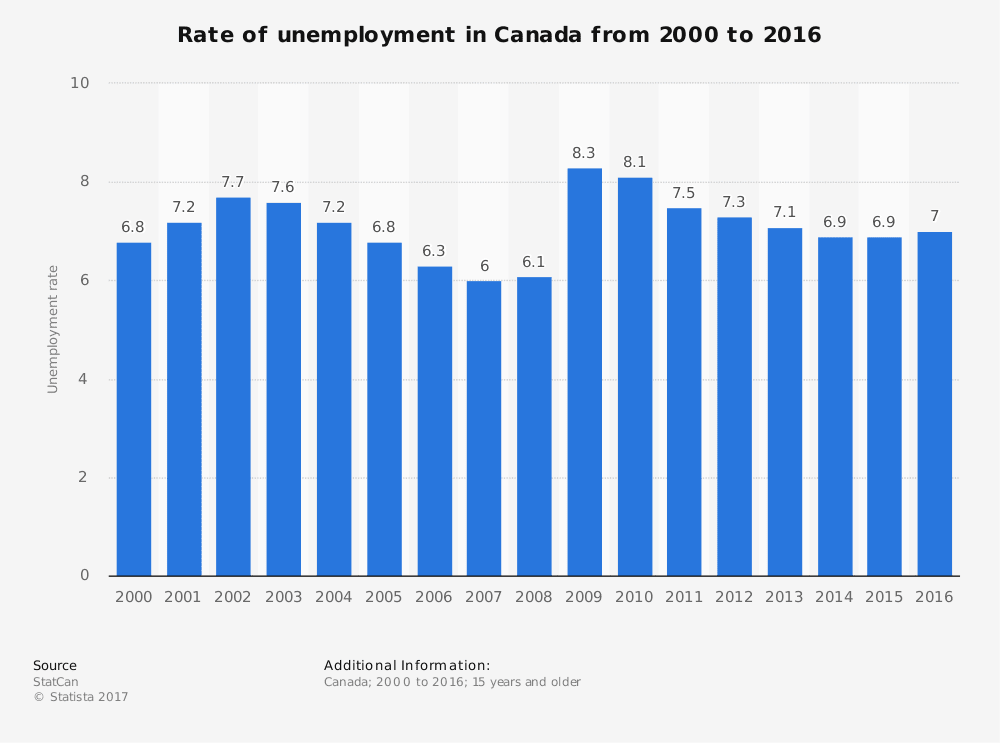

Increased volatility is expected for the Canadian Dollar as the release of the unemployment rate and employment change will provide useful information on the state of the labor market which has a strong influence on the economic growth. Lower rates of unemployment and higher readings of employment change and participation rate are positive for the economy and the Canadian Dollar supporting a higher economic growth and higher consumer spending.

The forecast is for a marginal increase in the unemployment rate at 5.8%, higher than the previous rate of 5.7% and an employment change of 10K, significant lower than the previous reading of 78.6K. These readings are considered neutral to negative but as seen from the graph the long-term trend of the unemployment rate in Canada is a downtrend, which is positive for the Canadian economy and its currency.

Pacific Session

5. Australia Home Loans

Time: 00:30 GMT

An increase in the home loans is positive for the state of the housing market in Australia, reflecting a robust housing market which is correlated with confidence in the economic prospects of the economy and higher economic growth. The forecast is for a figure of -1.0% on a monthly basis, lower than the previous reading of 2.1% which should be considered negative for the Australian Dollar.

Asian Session

6. Japan Tertiary Industry Index

Time: 04:30 GMT

This index measures the monthly change in output in the services sector in Japan, which increases of the figures being positive for the Japanese Yen reflecting expanding economic and business activity. The forecast is for a figure of 0.1% much lower than the previous figure of 1.1%, which is considered negative for the Japanese Yen.