There are plenty of economic data releases still to come today, the last trading session of this week. First there is the GDP Growth Rate in Germany, followed by the Inflation Rate in the Eurozone and later on the Inflation Rate in Canada. There are no major economic data related to the US economy today, but as the Fed released the minutes from its January meeting, which revealed that officials are optimistic on increased economic growth and an uptick in inflation as justification to continue to raise interest rates gradually, the benchmark 10-year yield hit a four-year high and the US Dollar strengthened against major other currencies. The fundamentals will show if this strength of the US Dollar is short-lived and sustainable during the 2018. Moderate to high volatility is expected today for the Euro and the Canadian Dollar.

These are the main economic events which can move the forex market today:

European Session

- Germany GDP Growth Rate, European Council Meeting, Eurozone Inflation Rate, Bank of England Ramsden Speech

Time: 07:00 GMT, 08:0 GMT, 10:00 GMT, 12:00 GMT

Two major economic events can move significantly the Euro today. First the GDP Growth Rate in Germany, with the forecast being an increase on an annual basis with a reading of 2.9%, higher than the previous reading of 2.8%, and later on the Inflation Rate in the Eurozone, with the forecast being a decline and a rate of 1.3%, lower than the previous reading of 1.4%. However the Core Inflation Rate in the Eurozone, is expected to increase with a reading of 1.0%, higher than the previous reading of 0.9%.

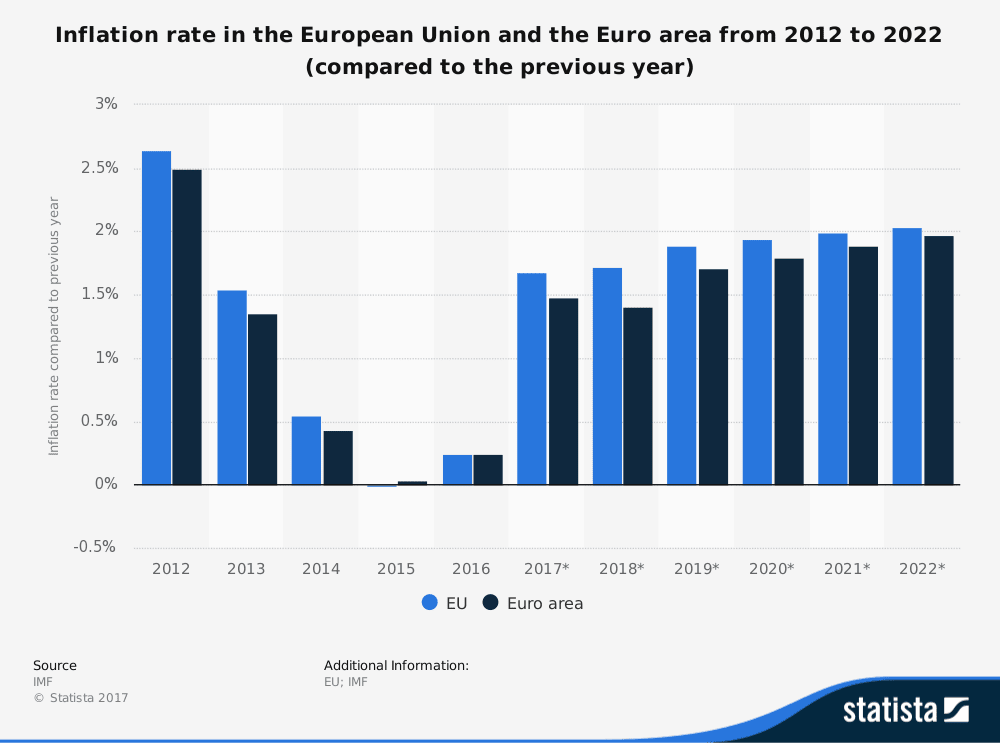

As shown on the chart above, the inflation rate in the European Union and the Euro area is presented from 2012 to 2016, with projections up until 2022. The term inflation, also known as currency devaluation (drop in the value of money), is characterized by a steady rise in prices for finished products (consumer goods, capital goods). The consumer price index tracks price trends of private consumption expenditure, and shows an increase in the index’s current level of inflation. In 2016, the inflation rate in the EU was about 0.24 percent compared to the previous year.

The forecast is for a gradual increase of the inflation rate in the Eurozone from 1.41% in 2018 to 1.97% in 2022. While higher than expected or rising figures for both the GDP Growth Rate in Germany and the Inflation Rate in the Eurozone will be positive and supportive for the Euro, we see that there are very low inflationary pressures in the Eurozone at the moment, and in the future. As the ECB has stated that interest rate increases in 2018 are probably out of the question, the economic conditions do not seem to justify any imminent interest rate increases for the Eurozone, a complete divergent monetary policy compared to the Fed, and this interest rate differential in favor of the US Dollar may be the key driver behind the potential appreciation of the US Dollar against the Euro in 2018.

American Session

- Canada Inflation Rate, Core Inflation Rate, Fed Dudley Speech, US Monetary Policy Forum, Fed Mester Speech, Fed Williams Speech

Time: 12:00 GMT, 13:30 GMT, 15:15 GMT, 16:00 GMT, 18:30 GMT, 20:40 GMT

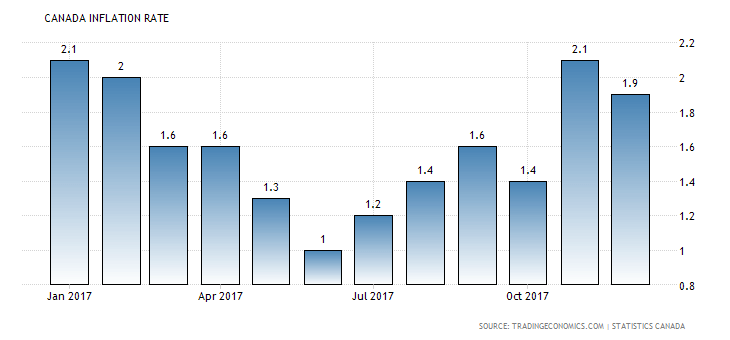

The forecast for the Inflation Rate in Canada is for a decline and a reading of 1.4%, lower than the previous reading of 1.9% on a yearly basis. The Bank of Canada has a target inflation band of 1 – 3 % and uses CPI and Core CPI as its key measurement of Inflation Rate. A rising figure and sustainable uptrend of the Inflation Rate in Canada may prompt the central bank to raise interest rates in order to manage inflationary pressures and slow economic growth. Higher than expected or rising figures for the Inflation Rate in Canada are positive and supportive for the Canadian Dollar. As seen from the chart, there is an inconsistent trend for the Inflation Rate in Canada during the past 1-year time period, so it is hard to predict if the uptrend in the Inflation Rate as of early summer in 2017 will continue in the future or not.

Other than this important economic event in the American Session there are several speeches from Fed Officials, and the release of the Monetary Policy Report in the US, which can move the US Dollar depending on the statements hinting at two or more interest rate increases in 2018. The Fed will have to strike a balance between the actual number of interest rate increases so as not to derail the strong performance of the US economy and its projected economic growth and a tighter monetary policy which should strengthen the US Dollar against major currencies.