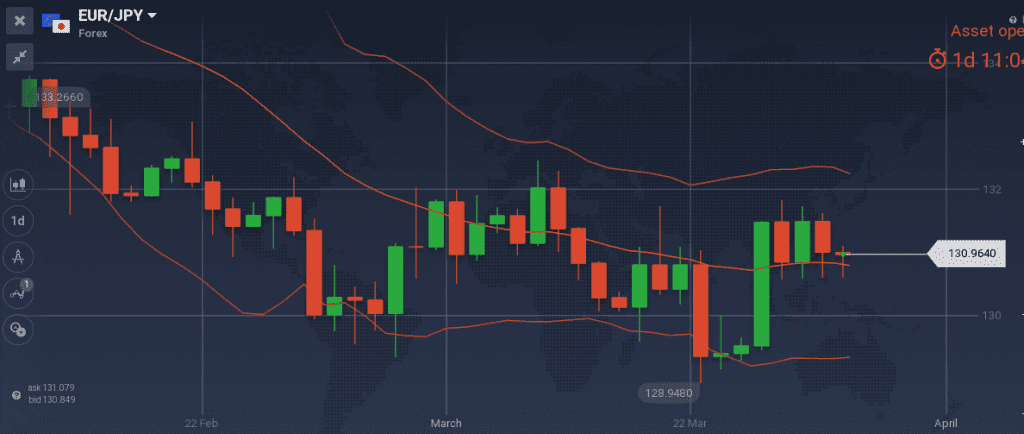

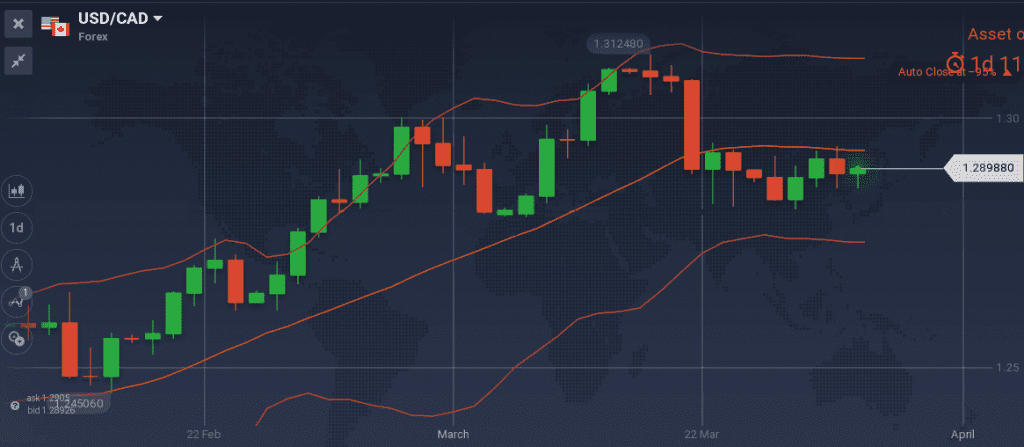

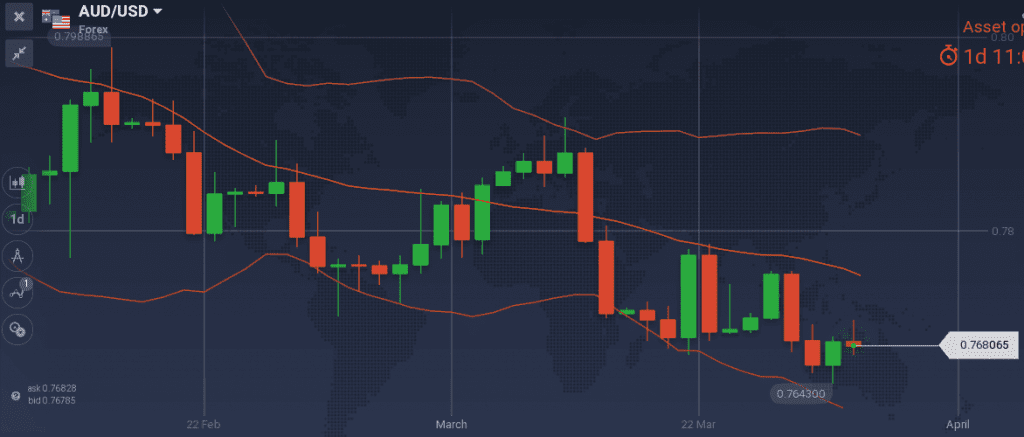

For the most part, last week’s views proved correct.

- Adding to the short EUR/JPY position when the 200-Day Moving Average was retested on Tuesday, paid off

- Keeping the long position on USD/CAD did not yet paid off. The pair consolidated and could well head north next week.

- AUD/USD moved between 0.7640~0.7756, at a 50pips narrower corridor than my call (0.76~0.78 range) and indeed closed the week a bit lower.

- EUR/USD moved south as I was expecting. Yet the Monday’s break of the mentioned downtrend could have panicked investors.

- Except for 1.8058 GB/PCAD that was triggered and is in green, no other advised level was triggered for me to play the strengthening GBP scenario

Major last week’s events:

- EU discussions on how to cover UK’s contributions to the budget, that will not be there in 2019

- EU and Turkey talks, one week after Afrin bombing, 30 days after the capture of two Greek soldiers at Greek-Turkeys borders

- Kim (North Korea) had a 3 day visit in China with Xi (China) as we are heading to inte-Korean talks within April and North Korea-USA talks in May. The world learned for the meeting after the fact.

- Nothing new on the tariffs front

- The expulsion of Russian diplomats from UK, was followed by many countries of the West. Russia responded on Thursday. Russia expelled 150 diplomats and asked for the closure of US consulate in St. Petersburg.

- Back to back bad news for flagship high tech companies. Following Facebook, Amazon is taking a hit by rumors of Trump trying to impose more taxes, Tesla recalled 130K cars over a steering component

I keep betting on the high tension, high volatility, increasing inflation, increasing bond yields, decreasing equities scenario that favors haven currencies. I should point out though, that long term government yields are starting to decline.

Major next week events:

- It is the Orthodox Christians turn to celebrate the Holy Week. Remember that on Monday major part of Europe and UK are having a holiday for the same reason.

- Tuesday’s 4:30GMT monetary decision of Central Bank of Australia (RBA)

JPY

My EUR/JPY short bias and last week’s remarks remain valid. Using 131.70 level or the 200-Day Moving Average level as entry levels to short makes sense.

Last week’s unchanged BOJ Core CPI reading of 0.8% or the slightly increased unemployment reading of 2.5% did not change the picture.

Snapshot:

- 0% GDP growth, all time low unemployment at 2.5%

- Inflation (excluding food-National core CPI) at 1.0% (vs 2.0% target)

- 05% 10y Bond yields vs BOJ’s target of 0.00% level (next auction on 4th April)

Strengths of JPY:

- decisiveness communicated by the Central Bank. Next meeting is scheduled within 26 April

- Trump’s tariff drama or any other turbulence favors JPY as it maintains it’s haven

Weaknesses of JPY:

- We may witness another peaceful week that would postpone the further JPY weakening.

Watch:

- Tuesday’s (03.45GMT) 10-y Bond Auction. An unexpected number below 0.04% could weaken JPY, an unexpected number above 0.06% could strengthen JPY. Yet the expected number is 0.05%.

CAD

I am keeping long positions on USD/CAD at higher level than current week’s close. Even if I am wrong with my reasoning that BOC (the Central Bank) will keep rates unchanged on the 18th of April meeting, I strongly believe that there are enough reasons for the pair to retest the 131.50-131.66 level or at least 129.80 level.

Last Thursday’s lower GDP m/m reading (-0.1%) failed to send USD/CAD higher and that is worrying me. If US Crude oil inventories number is again bellow 2.5Mbarrels, I will need to change my outlook for USDCAD and close my long positions taking the losses.

Snapshot:

- Inflation at 2.2% (vs 1.0%~3.0% target range). Increased as expected.

- GDP at 2.9% annual, 0.4% QOQ, 10-Y Government bonds yield (decreased 11bps) at 2.09%

- Unemployment at 5.8% and expected to increase slightly until the end of the year

- Crude oil prices have strengthened alleviating pressure from CAD.

Strengths of USD/CAD, weakness of CAD:

- Central Bank, needs to price in the outcome of NAFTA talks. I am waiting the release of Business Outlook Survey, expected on 9th of April. Until then, CAD is under pressure.

- I continue correlating any increase of inflation with further weakening of CAD

- I believe that no rate hike is considered for the next meeting on 18 of April.

Weaknesses of USD/CAD, strengths of CAD:

- Crude oil prices have strengthened.

Watch:

- Wednesday’s 14:30 GMT US Crude oil inventories. I am regarding 2.5-M barrels as a threshold for decisions. A higher reading is weakening CAD. Last week’s number was 1.6Mbarrels and moved CAD higher (USD/CAD lower).

- Thursday’s 12:30 GMT Trade balance. Any number below -2B CAD is within my long USD/CAD scenario

- Friday’s 12:30GMT unemployment rate.

AUD

I keep my view that AUD/USD is in a well-defined downtrend. Last week the pair consolidated in the narrow range of 0.7640~0.7756. This week the catalyst for a further south move could be the communication of RBA if we do not witness new aggression at the tariffs front.

I could add short positions at 0.7820 and 0.7880 levels.

Snapshot:

- Central bank ‘s interest rate is at 1.50% with no hike yet in this cycle.

- Inflation at 1.9% (vs 2.0~3.0% target), Unemployment at 5.6% and expected to decline

- GDP latest reading at 2.4% growth (2.8% was 2017 reading)

Strengths:

- Nothing to note

Weaknesses:

- Latest declined GDP reading

- Declining terms of trade

- Latest increased unemployment reading at 5.6%

- possible further fall of US equities

Watch:

- Tuesday’s 4:30 GMT Monetary meeting. I expect no change. Latest increased unemployment reading gave another good reason for the RBA to wait.

- Thursday’s 1:30 GMT Trade Balance. Any number below 1.06B is within my scenario.

- Remember that next release of Australian wages expected on the 16th of May. I believe that this is the only reading that could trigger an updated Central Bank’s view. Note that markets are expecting the first-rate hike no earlier than the first half of 2019.

USD

Last week had no new episodes of tariffs drama and USD strengthened. Our long USD scenario was helped by Wednesday’s GDP final higher reading of 2.9% but was challenged by both consumer confidence and Core PCE index (watched by the FED for measuring inflation) that were both lower.

I am keeping my long bias on USD and watch S&P500 trying to stay above the 200-Day Moving Average. There are articles arguing in favor of an April’s US equity rally based on strong expected dividends, but I do not buy them.

Snapshot:

- US economy is growing at 2.9% (FED expects 2.7% GDP growth in 2018), unemployment is at 4.1% (FED expects to fall at 3.8% in 2018), inflation measured by PCE is at 1.7% (FED expects 1.9% reading in 2018)

- We are counting 6 hikes of 25bps since Dec ’15, resulting to a current FED rate of 1.75%. FED’s dots are currently pointing to another 6 hikes within two years (peak of 3.25% in this cycle) and FED’s view of long run rate remains at 2.75%~3.00%

Strengths of USD:

- strong macroeconomic announcements and yields of Government bonds (now at 2.73%)

- weakening of US equities.

Weaknesses of USD:

- Tariffs drama is proving to be the market mover of 2018. Note that, 20% of USA imports comes from China. Trumps wants to decrease the 300B$ deficit with China by 100B$

Watch:

- Friday’s 12:30GMT employment readings (earnings, non-farm employment change and unemployment)

- Next Monetary Meeting on 2nd of May

EUR

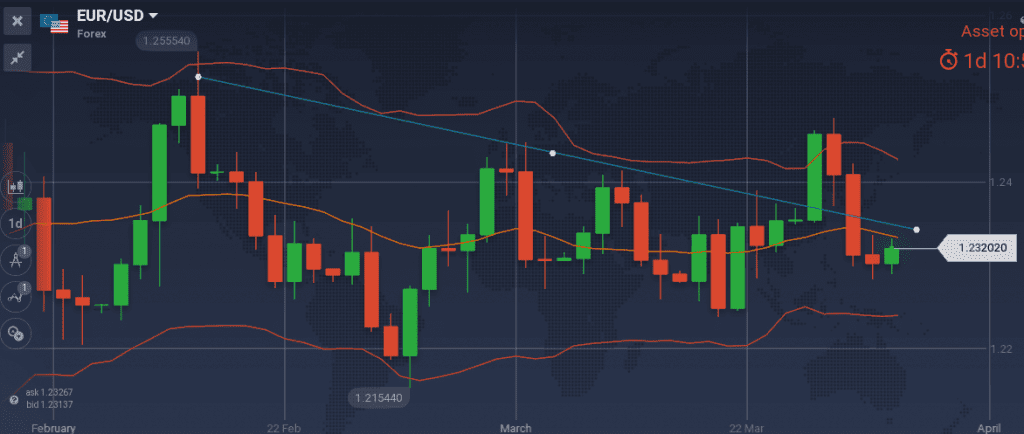

Starting from Tuesday’s opening of European Markets EUR/USD moved south and managed to close lower than last week’s close. Monday’s aggressive break of the repeatedly mentioned trend-line worried me a lot and as of now, I cannot offer a convincing explanation.

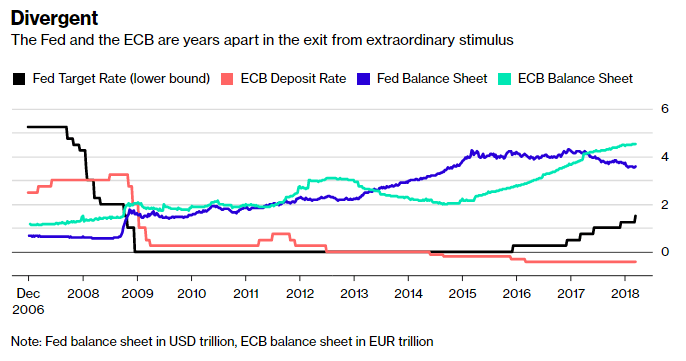

I am keeping my short bias on EURUSD playing the divergence scenario. Note that the 10y Government bond yields of major European countries stand at 0.50% Germany, 0.72% France, 1.16%Spain, 1.79% Italy vs 2.73% USA

Snapshot:

- European’s Economy is doing well. Actual GDP growth at 2.7% but the rosy picture seems to have already been priced at the 1.25 peak

Strengths of EUR/USD:

- tariff drama strengthens the pair. With the absence of fresh bad news, the pair last week moved lower.

- Destroyed double top formation at 1.25 level and bridged downtrend

Weaknesses:

- divergence of EU’s and USA’s economy. Note that last week’s Italian Bond’s auctions resulted in a decreasing yield of 1.83% (vs 2.06% number just before the elections)

Watch:

- Monday is a Holiday

- Tuesday’s and Thursday’s manufacturing and services PMI readings. I want to see decreasing numbers to strengthen my scenario

- Wednesday’s 9:00GMT CPI and unemployment numbers. Any reading of CPI above 1.4% or Core CPI above 1.1% weakens my scenario and postpones taking short positions on the pair.

- Thursday’s French and Spanish Government bond Auctions. I want to see decreasing yields to strengthen my scenario

GBP

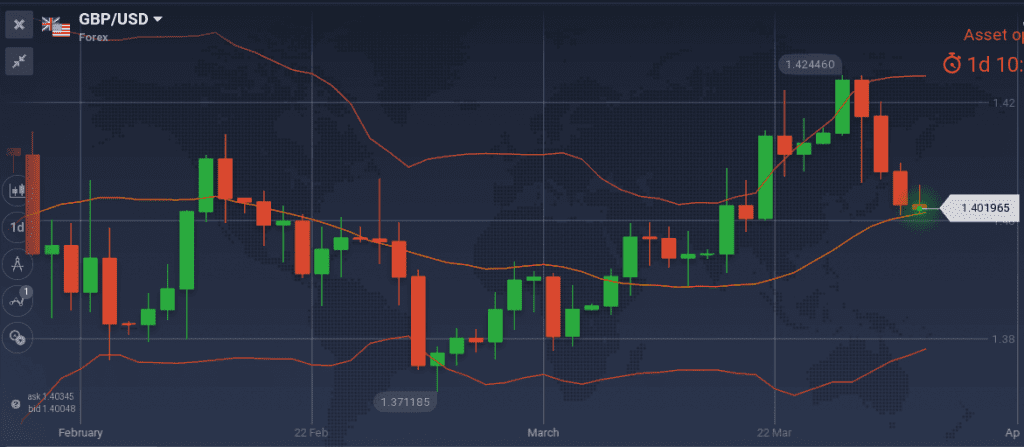

The picture for GBP is getting rosier. Last week I was pointing to the agreed extension of the Brexit deadline and the finally decreasing number of CPI (2.70% latest reading). This week I am pointing to the improvement of Current Account (latest reading -18.4B GBP), the increased lending to individuals (latest reading 5.4B GBP), the increased revision of business investments (0.3% qoq) that would push GDP higher.

I keep my long bias on GBP and note the levels I am thinking of entering the market

- long GBP/USD at 1.3965-1.3930 range

- long GBP/CAD at 1.8005 or even 1.7950 (The 1.8058 was triggered last week)

- long GBP/AUD at 1.8090, 1.8000 and 1.7955

- short EUR/GBP at 0.8836 and 0.8805

Snapshot:

- 4% GDP growth, 4.3% unemployment(record low) and 2.70% inflation (only major economy with higher inflation than the targeted 2%, but finally now it is decreasing)

- Second rate hike on the 10th of May is turning even more probable.

Strengths:

- Macro announcements showing that the economy is strong

Weaknesses:

Watch:

- PMI readings on Tuesday, Wednesday and Thursday at 8:30GMT. Note that market consensus is that the last PMI numbers were the ceiling and that slightly decreased numbers are expected. Opposite to that consensus, I want to see increased numbers to be confident with my long GBP scenario

- Friday’s Governor’s Carney speech at 15:30GMT

- Next Monetary meeting on 10th of May