The US dollar gained some strength on Monday morning as fear driven by trade-tensions eased and traders geared up for a week of important data. Top of the list is a round of potentially market moving inflation data that will be closely watched for cues to what the FOMC may do at the next meeting.

On Monday the Producer Price Index is released at 8:30 AM. The gauge of producer level inflation is expected to rise a cool 0.1% month to month, the concern is that inflation is also expected to edge higher to 2.9% year over year. Tuesday traders will be looking for the CPI, consumer price index, for signs of consumer level inflation. CPI is expected to hold flat on the headline but rise to a rate-hike inducing 2.4% YOY, 2.1% at the core. With inflation accelerating above the FOMC’s 2% target rate expectations for further rate increases are rising, a hot number from either figure could send the dollar moving up against many of the world’s currencies.

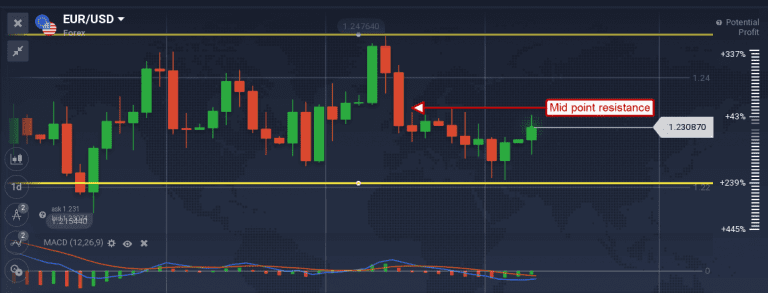

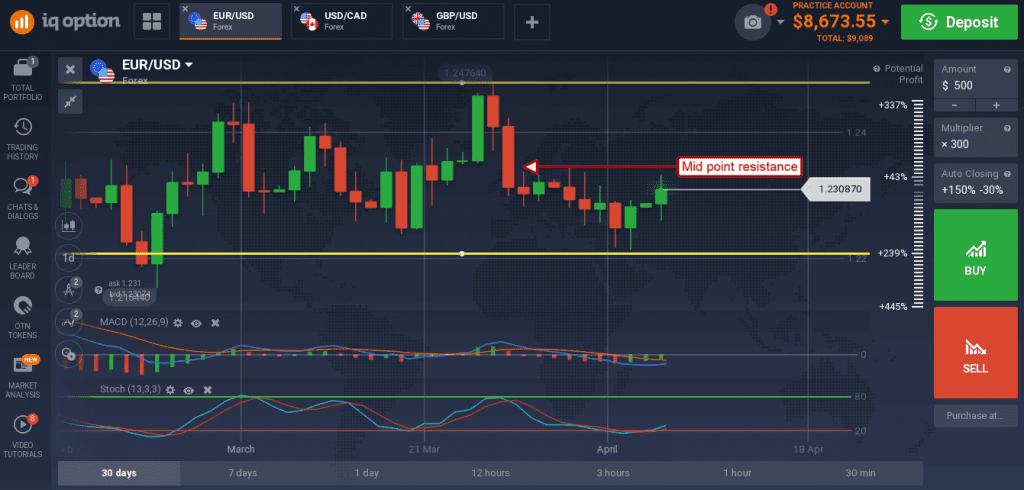

The US dollar gained versus the euro, sending the EUR/USD up to test resistance at the mid-point of the current trading range. Resistance is near 1.2300 and may hold if the US PPI and CPI data does not meet or exceed expectations. A break above this level would be bullish but only within the trading range with resistance targets at 1.23600 and 1.24600. Later in the week a speech from Mario Draghi (Wednesday) and ECB meeting Minutes (Thursday) could cap gains or send the pair back to support within the range.

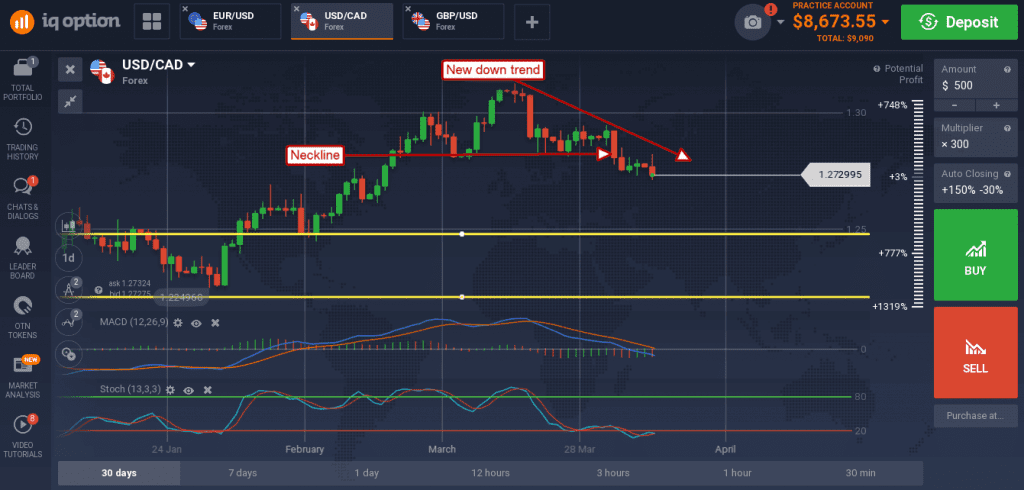

The greenback had been gaining versus the Canadian dollar, but the loony bounced back on a positive report from the BoC. The Bank of Canada, in their Spring Business Outlook Survey, says that business outlook continues to be positive despite NAFTA hang-ups and recent demand points to further growth this year.

The USD/CAD reversed a white candle to form a black candle with long upper shadow confirming support at the short term moving average. This move confirms a head & shoulders pattern and new downtrend with target near 1.2500 and then 1.2300 in the near to short term.

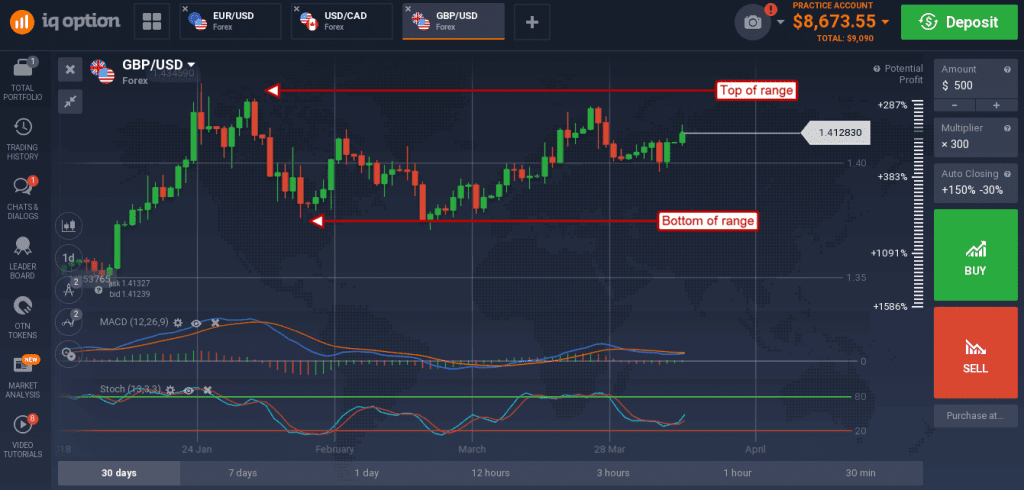

The British pound tried to move up on strength in UK housing, but the gains were capped by expectations for US inflation data. The Halifax Housing Price Index made strong gains for the month and the year, both above expectations, showing renewed vigor in the housing sector.

The news has helped strengthen the idea of BoE tightening but that outlook is offset by similar expectation from the FOMC. The pair may drift higher now but is likely to remain range bound longer term.