Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

Merkel: Europe must take its fate into its own hands

Germany’s Chancellor Angela Merkel does believe it is time for Europe to go alone. Or, as she put it, to take Europe’s “destiny into our own hands”. The political divide between the United States leadership and German officials apparently began long before President Trump’s visit to Italy, where the recent G7 summit took place. And while Europe did not seem to care about the US political influence during the reign of left-leaning President Obama, Trump’s conservative views and anti-immigration narrative alienated liberal leaders all over Europe.

Currency pairs with EUR and USD can be expected to fluctuate should the United States and the EU drift even further apart.

Hong Kong downgraded

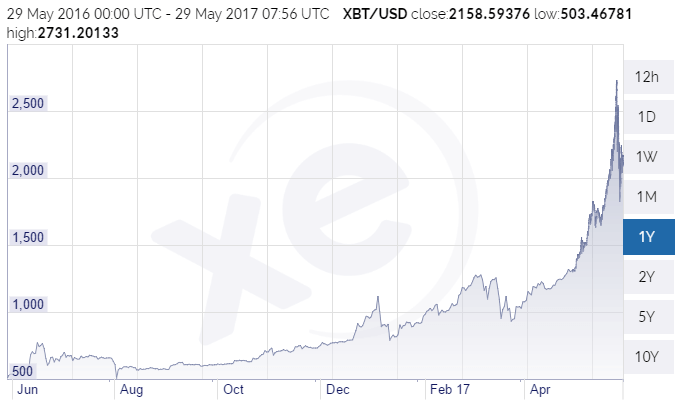

Paul Chan, Hong Kong Financial Secretary, is convinced that the territory’s debt rating cut, which followed the downgrade of the Chinese debt, is based on shallow evidence. The market, however, showed little to no interest in the Moody’s decision, leaving HKD exchange rates almost intact. Bitcoin became the sole beneficiary of the Chinese debt rating downgrade so far with its value skyrocketing during the previous week.

Should China become the next Thailand (the country “responsible” for the 1997 Asian financial crisis), triggering a major economic disruption? Or should it continue its victorious march and join the community of first world countries? Time will tell whether China’s desire to prioritize financial stability over openness delivers.

Financial mogul warns of an upcoming crisis

Stephen Lewis, chief economist at ADM and a man dubbed ‘Fifth Horseman of the Apocalypse’ by ‘The Times’ for his gloomy forecasts back in the 80s, is retiring after 47 years of financial career.

In a must read final newsletter, a renowned analytic warns market participants of an upcoming crisis. According to Lewis, economics, as an intellectual discipline, fails to come to grips with the real world. What market participants believe is not always true. And if too many of them start to believe in certain things, quite the opposite can be expected.

There is one statement that particularly stands out: “The post-2008 growth in global credit massively raises the risk of a future crisis, despite official measures requiring more stringent bank capital requirements.” The message is not supposed to cause any short-term fluctuations in currency exchange rates. However, it can become a red flag for long-term investors and provoke a spike in short positions open.

China, North Korea’s closest friend

Kim Jong-un, following the example of his father, watched the test of a brand-new anti-aircraft weapon system, which is now expected to be mass-produced and deployed all over DPRK. Tensions surrounding North Korea seem to escalate with each day as the United States have deployed their third carrier in the Western Pacific.

China, in words loyal to the common strategy of containment, increased grain exports to North Korea almost fivefold lass month from a year ago. Macroeconomic and geopolitical instability, surrounding the East Asian communist dictatorship, can become a pretext for a proxy war between China and the US.

The market has not yet reacted to the North Korean threat. However, it does not mean that in case of a future confrontation between the world’s first and second economies it will remain as still.

Bitcoin. New power is rising

Not only Bitcoin has appreciated in the heat of China’s credit rating debates, it is foretold to forever change the nature of financial markets.

A whole number of organizations worldwide announced that bitcoin is now a form of accepted currency. This without a doubt will affect operational activities of the Forex market. Traditional currencies, deprived of their monopolistic status, may appreciate or depreciate depending on how good Bitcoin is doing.

The true impact of Bitcoin on the world’s economy is hard to overestimate as it gave birth to over 800 other cryptocurrencies. In May 2017, for the first time since its appearance, Bitcoin makes up a minority — 47.9% — of the cryptocurrency market.

Exchange rates of bitcoin can be expected to fluctuate in the upcoming days as major macroeconomic events unfold.