Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

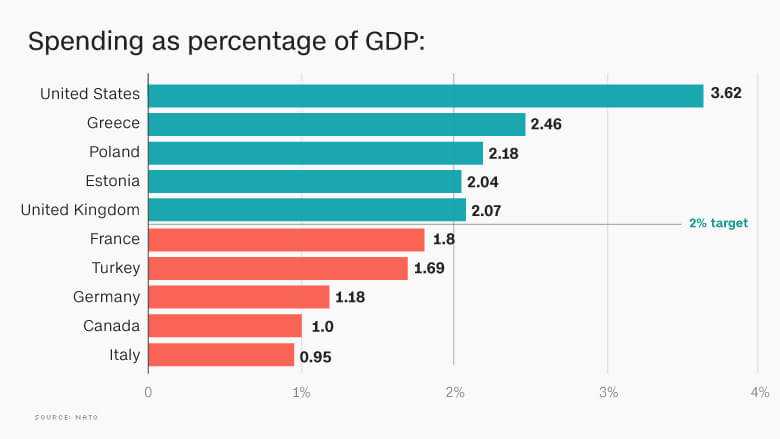

Hostility among NATO members intensifies

It may look sometimes like President Trump, instead of reaching agreements with his European colleagues, is trying to alienate other NATO members by delivering impolite and outright offensive comments on their utility as alliance members. In her recent speech, Angela Merkel mentioned India as a trustworthy partner. The United States, on the contrary, will have to work to reacquire this status.

Political controversies have a potential of influencing economic well-being of all nations involved. Should the negative events unfold, exchange rates of both Euro and USD can witness a steep decline.

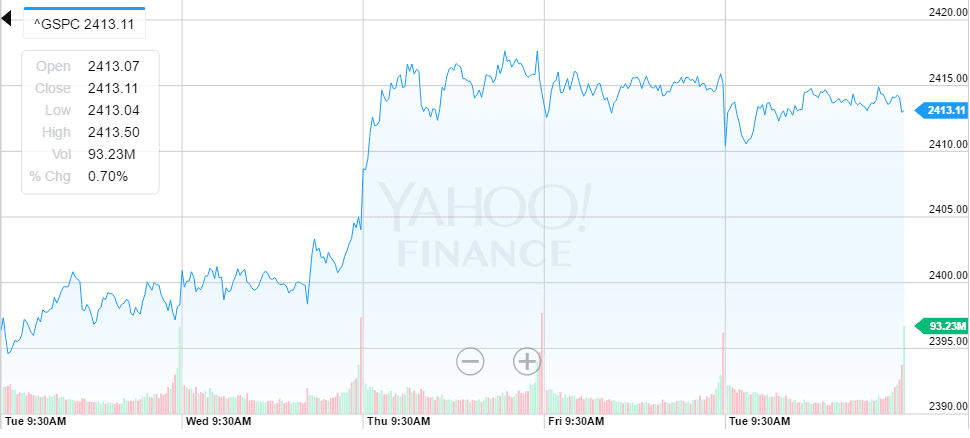

S&P 500 halts its seven-day advance

With a whole number of US-based corporations in the energy industry showing a considerable decline in their market capitalization, the S&P 500 halted its victorious rally to all-time high levels. Europe followed the example of the American market with Stoxx Europe 600 declining for four consecutive days. Tech companies, however, show steady growth, pushing the Nasdaq 100 to a new record.

Many investors still feel optimistic about market growth opportunities but macroeconomic and political risks, including European elections and Trump’s newly proposed initiatives, pose a serious threat to their expectations.

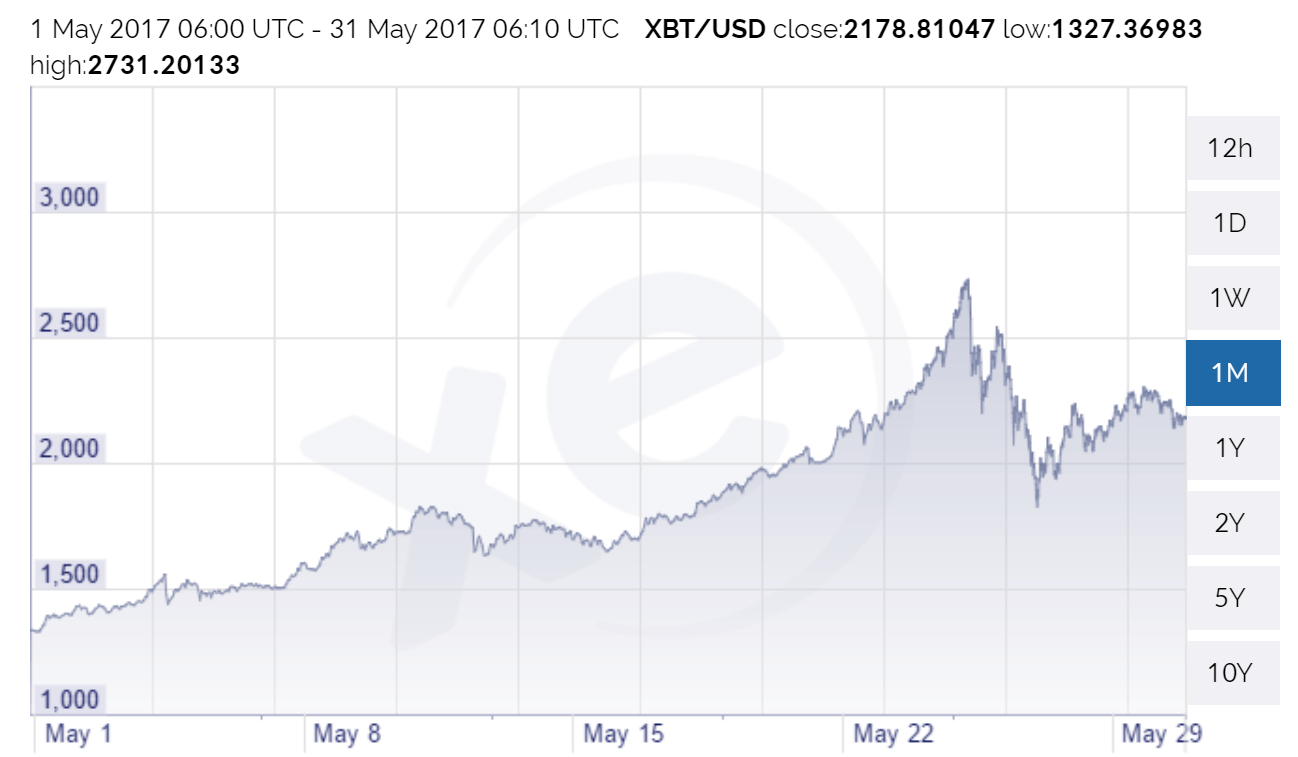

Bitcoin bubble bursting

What was expected has finally happened. Bitcoin, deemed to start a new era of financial operations (which it did) and replace fiat currencies (which it didn’t), lost 20% of its value over the last week dropping from $2717 to $2179. Cryptocurrencies are here to stay and not going anywhere but the status of ultimate investment potential, associated with them, has been lost as the bubble burst.

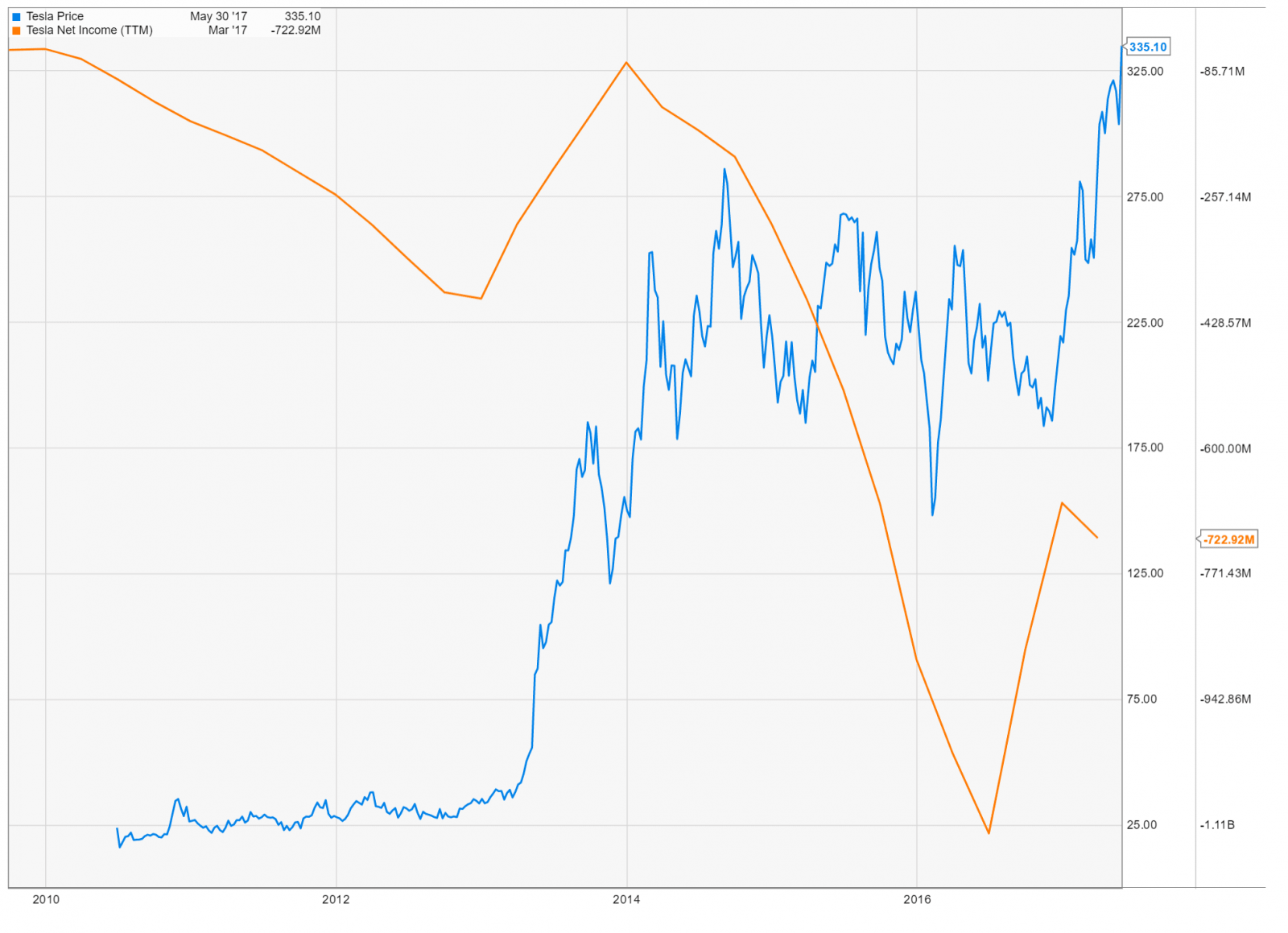

Tesla stock broke another record

TSLA stock jumped 3.06% on Tuesday, closing at $335.1 thus breaking another record. Whether the biggest automotive startup of the 21st century would be able to provide its investors with positive net income is still an open question. Tesla’s shares witnessed an unprecedented growth in the last six months. The company however never managed to return a profit. The intrinsic value of Tesla shares is considerably lower that the market is ready to offer. Hedge fund manager David Einhorn believes Tesla is ‘reminiscent of the March 2000 dotcom bubble’.

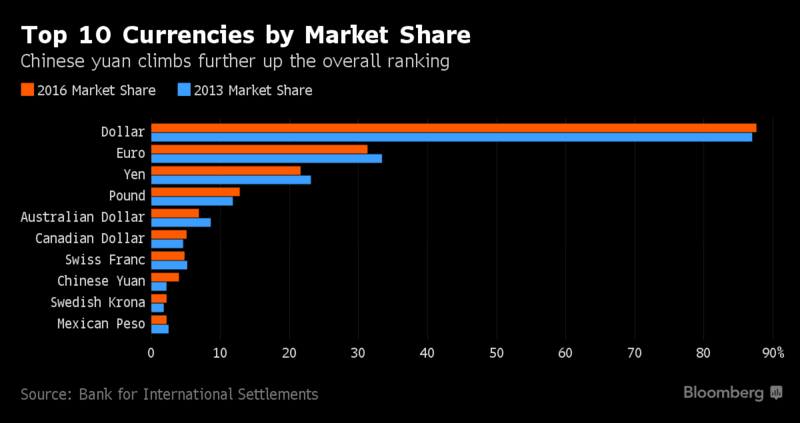

Domestic threats to the global dominance of dollar

Two pieces of legislation are being worked on in the depth of the US state machine right now: the Federal Reserve Transparency Act (FRTA) and the Financial Choice Act (FCA). The former will allow the Government Accountability Office to audit Fed’s decisions and provide their recommendations. The latter would restrict Fed’s financial help opportunities and empower a special commission to influence Fed’s decisions.

Both pieces of legislations are aimed at providing the Congress with means of oversight and intervention and will abruptly end the period of Fed’s independence. With these measures initiated the USD can be expected to slip into the control of the US government, which is a red flag for many potential investors.