Stock trading is often linked to the idea of “buy and hold”. However, short-term stock trading is also an option — although it’s a whole different game, with its own set of rules and strategies.

Here’s a 4-step plan to help you capitalize on short-term moves and trade stocks for quick results.

Step 1: Stick to Stocks That Actually Move

Imagine two stocks:

- Stock A moves 5% up and down daily.

- Stock B barely moves 0.3% all day.

If you’re into short-term stock trading, you want Stock A — the one that actually moves. These stocks are volatile, have high trading volume, and react quickly to news.

Here are some examples of “fast” and “slow” stocks:

| Fast-Moving Stocks | Slow-Moving Stocks |

| Nvidia (NVDA) – swings wildly, especially after earnings or AI news. | NextEra Energy, Inc. (NEE) – Utility stock = stable, but too slow for day traders. |

| Tesla (TSLA) – one Elon Musk’s tweet can send it flying or crashing. | Procter & Gamble (PG) – Consumer staple giant, moves steadily but not excitingly. |

| AMD (AMD) – Moves fast, especially during semiconductor news cycles. | Johnson & Johnson (JNJ) – Healthcare giant, reliable but not volatile. |

| Meta (META) – Jumps big on earnings, new product launches, or ad revenue reports. | Coca-Cola (KO) – Moves more like a gentle wave than a wild storm. |

How to Spot Fast-Moving Stocks

✅ Look at Average True Range (ATR): High ATR = bigger daily price swings = better for trading.

✅ Check Trading Volume: More volume = more interest from investors.

✅ Watch News & Catalysts: Earnings reports, company announcements, and viral tweets can turn a slow stock into a fast one.

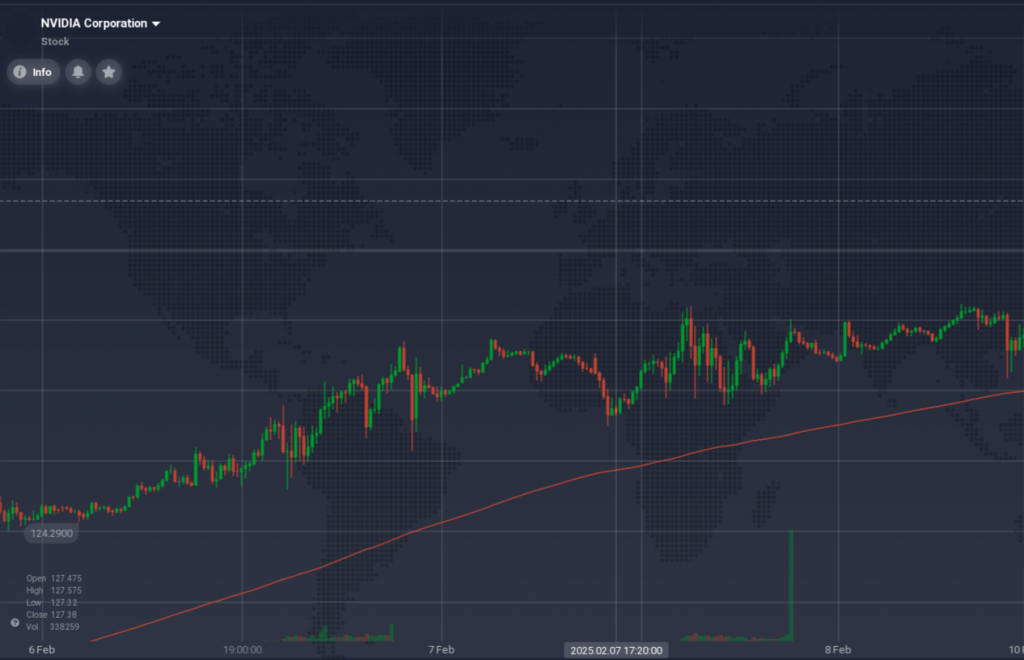

Compare the examples below for the same period:

- Tesla’s stock has an ATR ranging from 2.3 to 2.9 and a trading volume between 340 and 346 — a clear sign of strong volatility.

- Johnson & Johnson’s stock, on the other hand, peaks at an ATR of just 0.53, with volume never exceeding 150 — a much slower mover.

Step 2: Learn to Read the Market’s Mood (Trend Direction)

Before you jump into a trade, you need to figure out where the market is going. Stocks generally do one of three things:

- Go up (uptrend)

- Go down (downtrend)

- Go sideways

So, how to trade with the trend, not against it?

You can try applying these tools to figure out the trend direction and choose the best entry points.

- Moving Averages (50 EMA, 200 EMA): If the price is above the moving averages, the trend is likely up. Below? It’s probably down.

- Trend lines: If you see a stock making higher highs and higher lows, congratulations! You’ve spotted an uptrend.

- Volume Confirmation: Big moves with high volume? The trend has some juice. Low volume? Fake-out city.

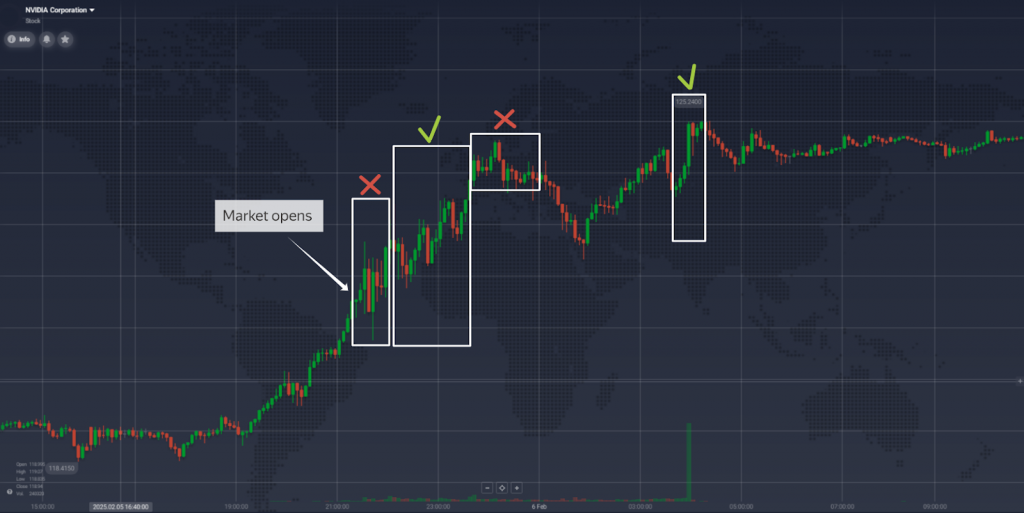

Step 3: Time Your Entries Right

Have you ever opened a bullish stock trade, and two seconds later, it tanks? That’s because entry points matter.

How to Nail Your Entries:

- Wait for a pullback: Stocks don’t move in straight lines. If it’s trending up, wait for a small dip before buying. If it’s trending down, wait for a little bounce before shorting.

- Use Indicators Like RSI: If RSI is above 70, the stock might be overbought (too expensive). If it’s below 30, it might be oversold (cheap).

- Watch Support and Resistance: Prices often bounce off these levels. It may be better to buy near support, sell near resistance.

Step 4: Trading Only at High-Probability Times

Markets are like people — sometimes they’re full of energy (morning and late afternoon), and sometimes they just sit around doing nothing (midday).

Best Times to Trade for Short-Term Stock Trading Strategies (That Work)

- Second And Third Hour of Market Open: This is when the first-hour noise simmers down, and all the overnight news and pent-up energy explode into action. Tons of opportunities.

- Last Hour of the Market: Traders start positioning for the next day, creating big moves.

Worst Times to Trade for Short-Term Stock Trading Strategies

- First Hour of Market Open — it might be very lucrative, but it’s also full of fakeouts.

- Lunchtime: This is when the market takes a nap.

Final Thoughts: Are You Ready for Short-Term Stock Trading?

Short-term stock trading isn’t easy. But if you:

✅ Pick volatile stocks,

✅ Trade with the trend,

✅ Enter at the right time,

✅ Focus on the best trading hours…

… you’ll have a much better shot at closing profitable trades. However, if you decide that short-term trading isn’t for you, there are plenty of other strategy you can use to achieve your goals. Have a look at the 5 Trading Strategies for 2025: Find Your Personality Fit to get some trading ideas and test new approaches.