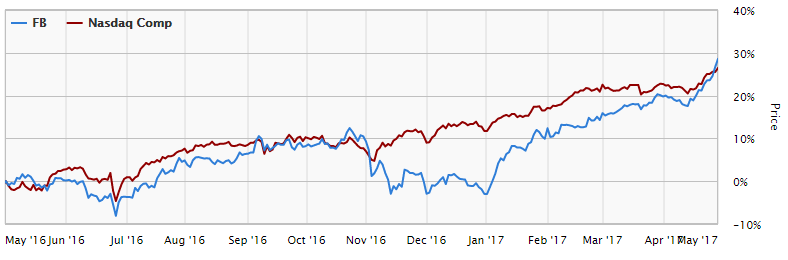

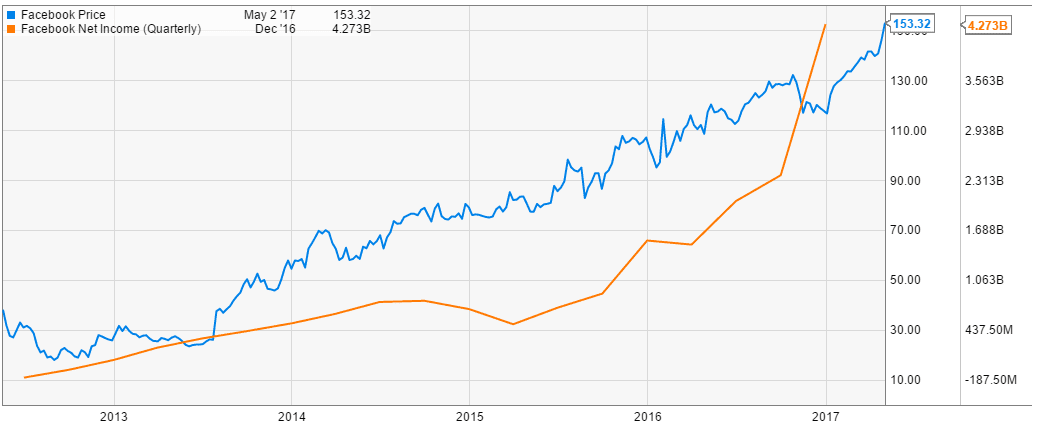

The California-based Internet giant is expected to report earnings on 5 May 2017 after the closing bell. What the future hold for the world’s fifth largest company? Facebook (FB) Stock showed record high financial results in the year 2016. However, as noted by the top management, it would be hard to maintain the momentum. The consensus EPS forecast for the quarter is $0.88. The reported EPS for the same quarter last year was $0.57.

Performance indicators

| 52 Week High-Low | $152.57 – $108.23 |

| Dividend / Div Yld | $0.00 / 0.00% |

| EV/EBITDA Annual | 27.24 |

| Consensus EPS forecast Q1/17 | $0.88 |

| Reported EPS Q1/16 | $0.57 |

| Forward PE | 34.15 |

Reasons to buy

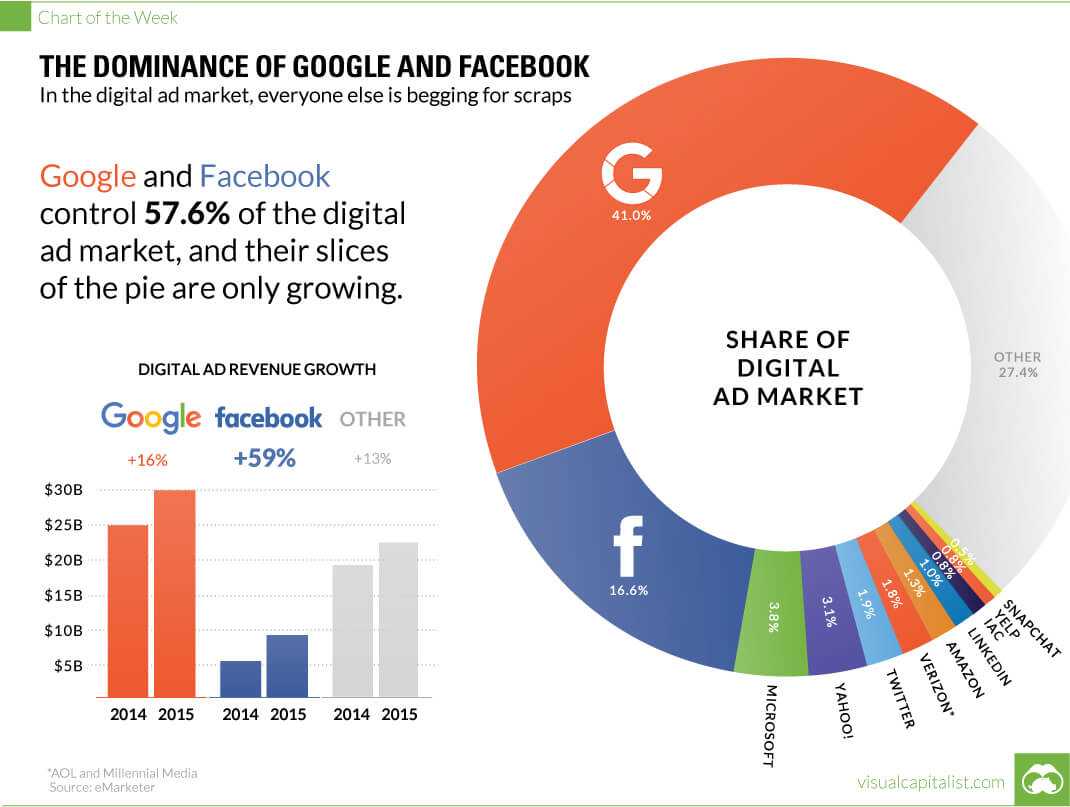

Mobile ads show outstanding results. Financial performance of Facebook is out of the question with ad revenues up 53% YoY and mobile ad revenues up 61% YoY in the last quarter of 2016. The average price of a single ad went up 3% compared to the same quarter last year. Ad impressions grew 49%. While the market is actively shifting towards mobile advertisement, Facebook is actively monetizing on this shift.

Cashing the Instagram. One billion worth acquisition of Instagram back in 2012 seems to bear fruits. During the last one year, 500 000 advertisers have joined the platform. Over 500 million users check their Instagram feed at least once a month. Though the exact figures are undisclosed it is safe to admit Instagram is a smooth-running cash generating machine.

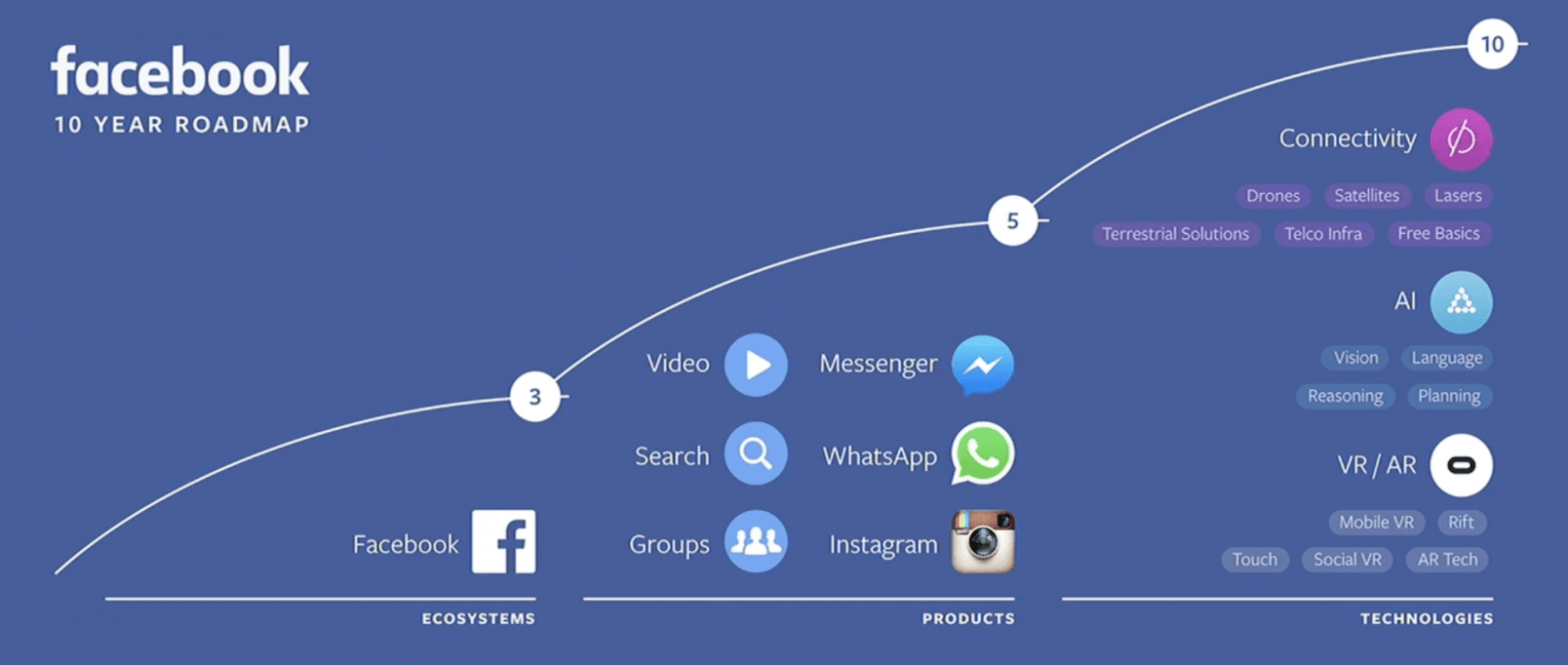

Messenger, WhatsApp, Oculus. Facebook knows the success of the conventional social media is not forever and actively invests in technological start-ups with tremendous growth potential. Online user activities are slowly turning from well-known social networks to messengers and “ecosystems”. And the company is eager to ride on the trend. Chatbots are the new buzz words in the world of technology. Messenger and WhatsApp — subsidiaries of Facebook — are perfectly suited to capitalize on the new technology. Virtual reality, though not a global trend yet, is very likely to generate some returns in the long run.

Strong balance sheet. Facebook generates high and stable cash flow. It makes FB stocks a lucrative option for potential investors and opens the gates for further investments in technological startups. Company’s cash and cash equivalents are equal to $29.4 billion. In 2016, a record high cash flow of $16.1 billion was recorded.

Reasons to sell

Facebook declines in popularity. According to the Internet gurus, the social media as we know it is slowly dying out. What seemed to be a field of endless opportunities is transforming to something different. Snapchat is becoming the most popular socializing tool among teenagers. People no longer want to dedicate hours to browsing Facebook feed. Facebook still has more users than any other social network but its future is foggy. It is up to the company to decide should Facebook make a successful transition into the future of social media.

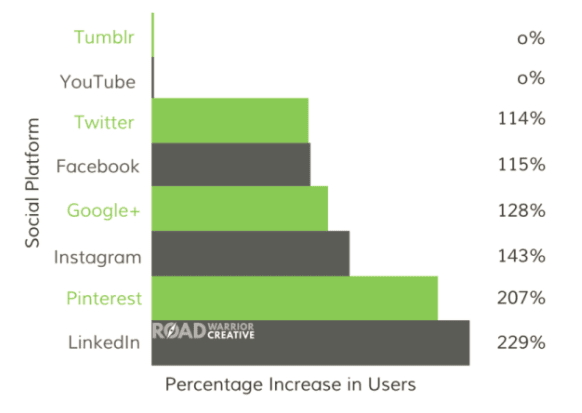

Intense competition. The company faces severe competition from social media applications and other online services. Being the pioneer of the social media industry Facebook cemented its leading position and is not likely to lose in the near future. However, such companies as Google (due to its scale and extensive product portfolio), Snapchat and Pinterest continue to bite off Facebook’s share of users and revenues. For younger generations, FB is neither different nor new. They, therefore, prefer emerging innovative services.

Banned from China. Facebook has been banned in China following the Urumqi riots, during which the platform has been used by rioters for coordination and mass agitation. Taking into account China’s 1.3 billion population, this decision by the CCP became a serious blow to the company’s growth prospects in the region. Asia is the fastest growing region of Facebook’s presence. However, due to low Internet penetration, it is not always possible to engage as many users as the Mark Zuckerberg would want to.

Personal data controversies. Facebook does not only connect people from all over the globe with each other, it saves the history of their “connection” and stores it on privately-owned host servers. This fact has drawn the attention of privacy-concerned activists and governmental structures. Should the security breach take place an Internet giant may lose a substantial portion of its market value.

Conclusion

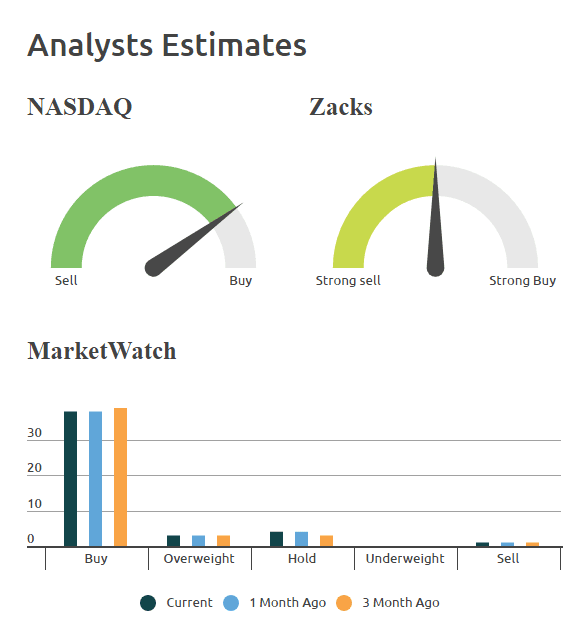

Facebook is an interesting position right now. On the one hand, the company is going through a period of unwitnessed growth and provides the investors with outstanding financial results. On the other hand, the future of Facebook itself is foggy. As in any innovative business sphere, the success of the company as a whole will depend on its founder’s ability to predict the future and spot lucrative investing opportunities.

The overall outlook for the company in the Q1/17 is moderate to positive with a good chance of Facebook beating the estimates. Stock prices can appreciate should Facebook report higher than expected top and bottom lines.