Kenneth Rogoff, a well-known Harvard professor and economist, mentioned in his statement the inevitable downfall of Bitcoin. According to Rogoff, BTC “will collapse” not being able to withstand the regulatory pressure it will soon face in a number of countries all over the world. The professor, however, does not undermine the technology behind Bitcoin. Rogoff goes as far as saying the blockchain will thrive and provide great results in the future.

The price of Bitcoin has demonstrated a 1,600% surge during the last 24 months but this is not the prime reason for Bitcoin popularity. BTC is not the most technically savvy cryptocurrency out there. However, being the first and by far the largest coin, it has already accumulated an impressive portfolio of related applications. The existing ecosystem and enviable credibility make Bitcoin the impregnable crypto market leader, at least for some time.

According to Rogoff, central banks can be expected to initiate cryptocurrencies of their own and provide their creations with extensive legislative support. The expert says, “The long history of currency tells us that what the private sector innovates, the state eventually regulates and appropriates. I have no idea where bitcoin’s price will go over the next couple years, but there is no reason to expect virtual currency to avoid a similar fate.”

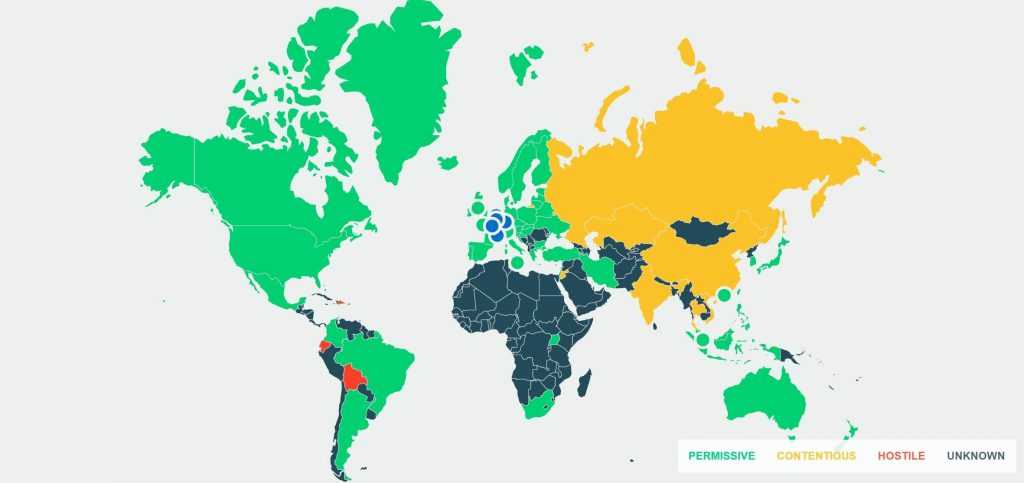

Central governments, therefore, can be the main driver behind the downfall of Bitcoin. Different approaches to BTC regulation can be observed worldwide. While Japan has embraced Bitcoin and recognized almost a dozen of registered exchanges, Russia and China took a more conservative stance, banning all Bitcoin exchanges. Taiwan and the United States may follow the example of Japan, thus driving the BTC price up.