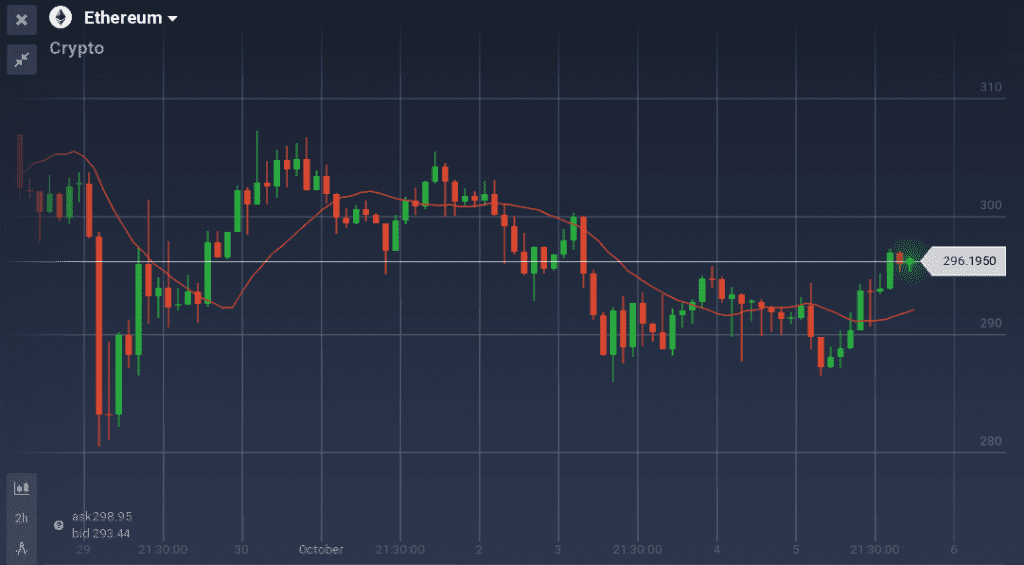

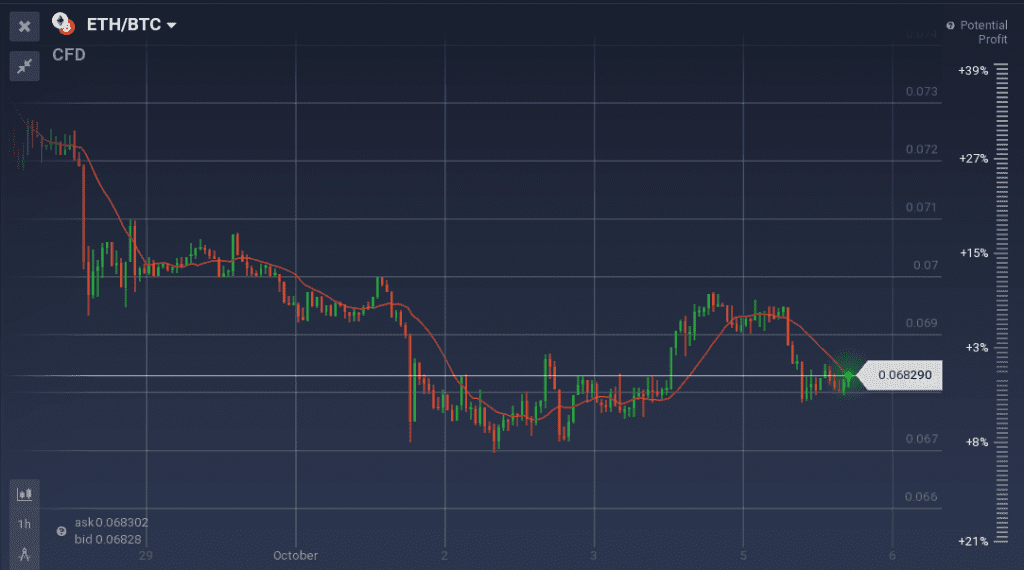

The past week was dull for the Ether traders as the price fluctuated around the $295 mark. But for ETH/BTH buyers, it was a really bad week.

Key Highlights

- Ether is finding it hard to hold bullish ground above $300.00 against the US Dollar.

- ETH/USD is testing a flat trendline around $295.00.

- ETH/BTC is poised to extend declines below the 0.070BTC level.

Starting with the daily chart of ETH/USD, the pair is trading near a key support area at $300.00-295.00. After a sudden dip, the price rallied above $305, but then it gradually started to decline. The trend line support at $295.00 recently held the upside move and protected buyers from taking control.

The $295.00 support zone is clearly very significant and acted as a major pivot area many a times. A significant current rally looks promising and could take the value beyond $300.00.

Alternatively, if Ether buyers succeed in defending the trendline support, the price would once again attempt a test of the $305.00 resistance.

On the upside, there is a bearish trendline with resistance at $292.00, which can be considered as a pivot zone for the current bias.

Earlier during the week, the ETH/BTC pair started to dip and eventually failed to remain above 0.072 BTC and is currently trading below the 0.069 BTC support. Resistance was seen around 0.067 BTC which prevented further dip.

Overall, today’s close is very important and Ether must stay above $295.00. A strong reversal through the recent lows at $292.00-285.00 would negate further losses in ETH/USD.