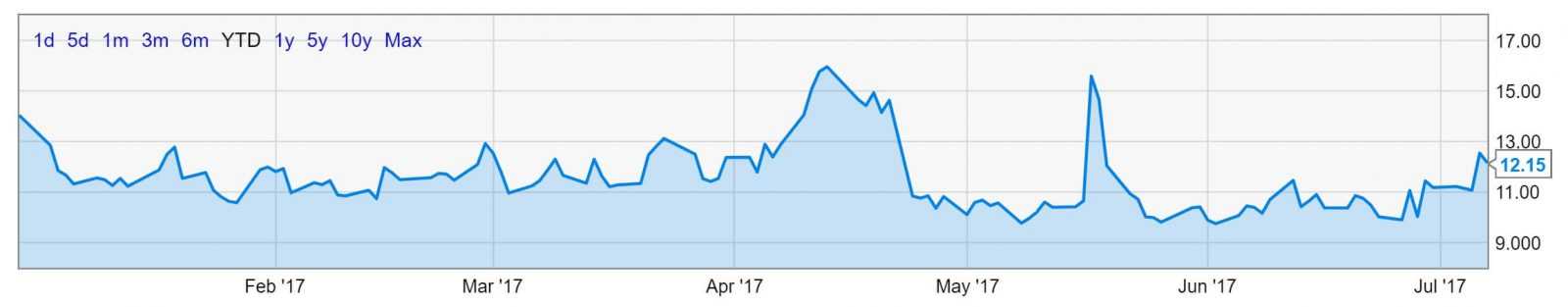

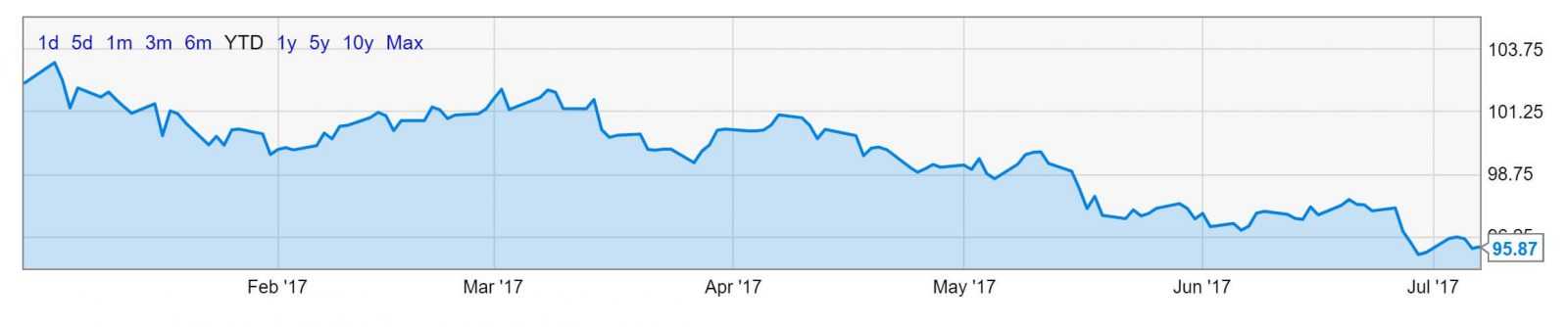

The market expects PepsiCo (NYSE: PEP) shares to be moved by the quarterly earnings report. The latter will be published on July 11 before market open. As of now, the outlook is positive to moderate with a probability of PEP shares going up should the company provide better than expected financial results.

The consensus EPS forecast for the quarter is $1.4. The reported EPS for the same quarter last year was $1.35. EPS growth is one of the major factors that determine the price action. Here are some more factors that can influence the share price along with the data revealed in the earnings report.

Performance indicators*

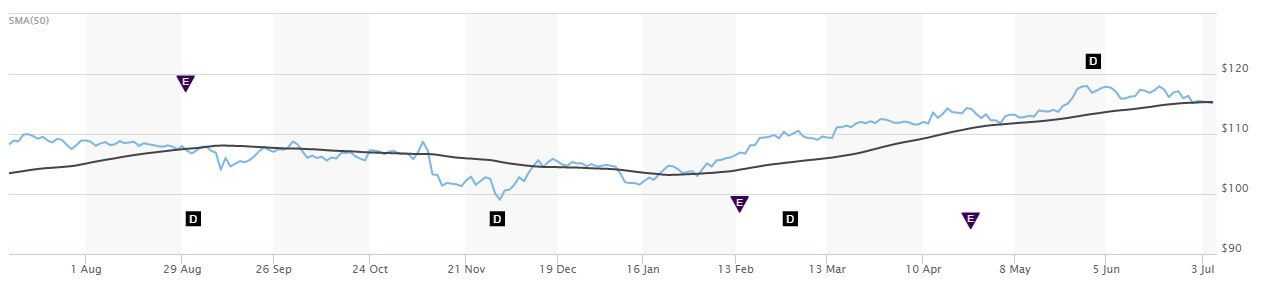

| 52 Week High-Low | $118.24 – $98.50 |

| Dividend / Div Yld | $3.22 / 2.79% |

| EV/EBITDA Annual | 14.58 |

| Consensus EPS forecast Q2 | $1.40 |

| Reported EPS Q2/16 | $1.35 |

| Forward PE | 22.53 |

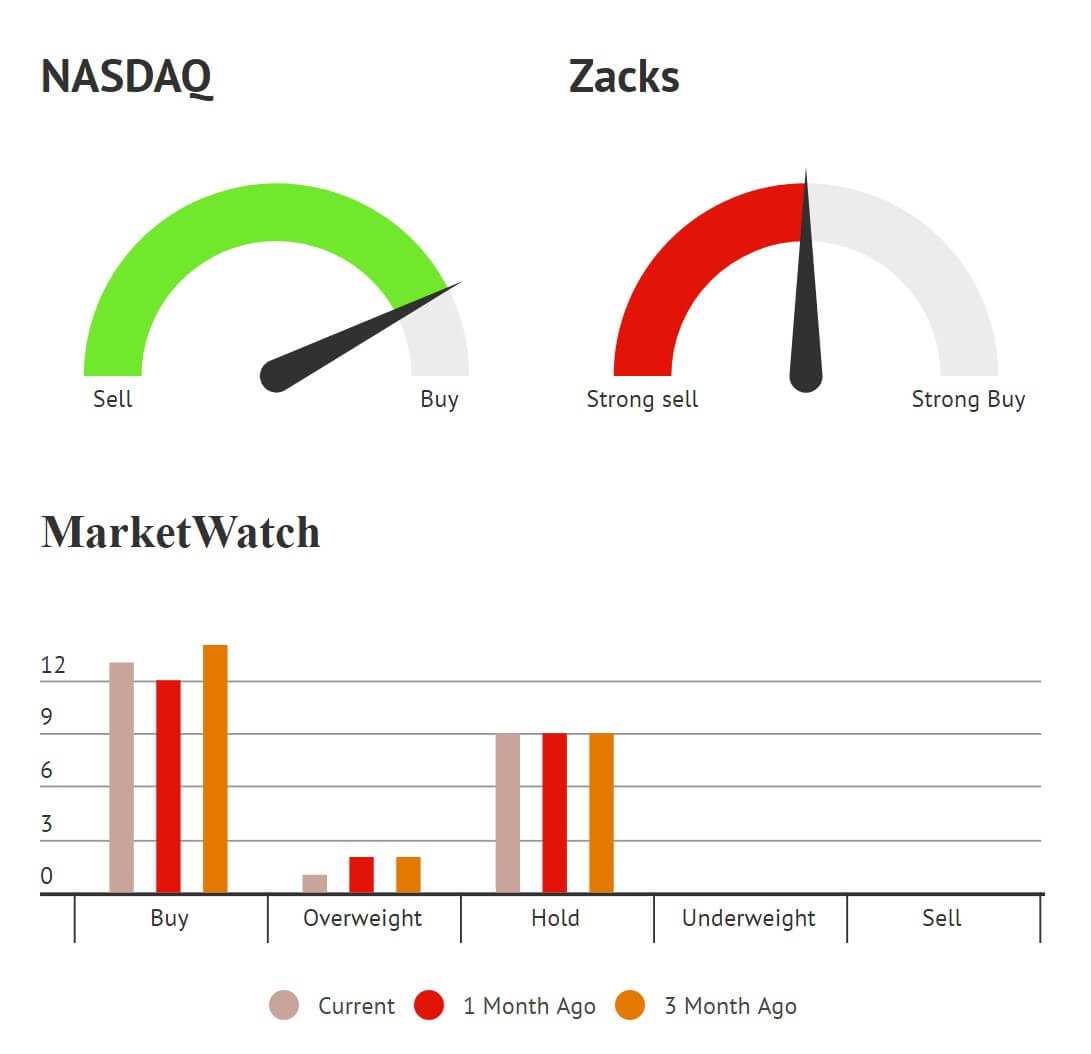

Analyst Estimates

Opportunities and strengths

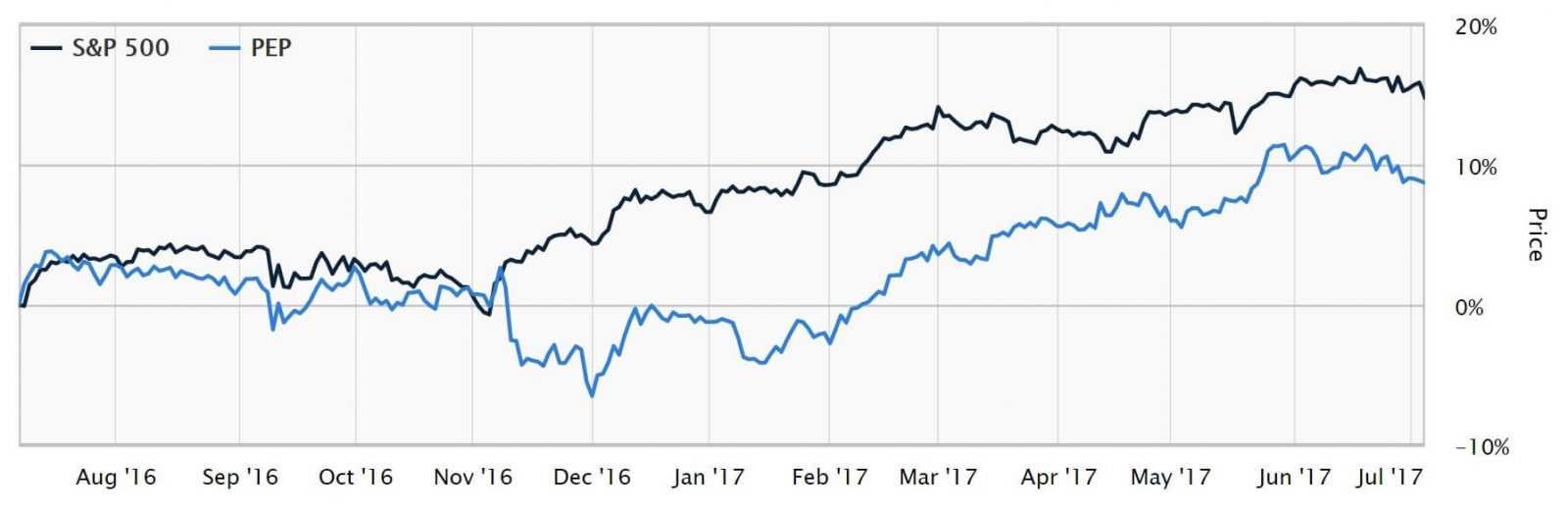

Financial Performance. PepsiCo lagged the S&P 500 index but outperformed the soft drinks industry. In fact, the company added 12.6 percent to its value in the last twelve months, leaving Coca-Cola with 0.6% growth behind. Strong performance in the fast is in no way a guarantee of above the average performance in the future but it lets the investors understand the dynamics and assess the factors that fuel the growth. Despite major challenges the company has been steadily growing for the last four years.

Brand Recognition. With 22 brands that generate $1 billion or more a year in sales, PepsiCo can boast a truly diverse product mix. The company currently holds the position of the world’s second largest beverage manufacturer and a global leader in salty snacks, which tells a lot about the size and complexity of the business it operates. Pepsi, Mountain Dew, Gatorade, Tropicana, Lay’s, Doritos, Cheetos and Quaker are among the company’s most expensive — and most profitable — brands.

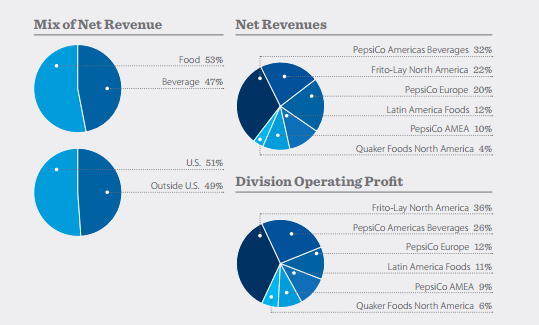

PepsiCo has an advantage of selling both beverages and salty snacks, which have high co-purchase incidence, driving the revenue of the company even higher. Enormous size and high number of brands that it runs lets PepsiCo drive up its return to scales and spend less on R&D, IT, back office etc. Therefore, the company is not only getting more by selling complimenting products, it also spends less by producing all of them in-house.

Snacks Business. PepsiCo and Coca-Cola use different approaches to their business. While the Coca-Cola Company focuses on what it considers to be its core business, sugary drinks, PepsiCo is trying to get a grip on everything that at least remotely reminds people of beverages and salty snacks. Thus, an extensive brand portfolio. There are advantages and disadvantages to both strategies and Pepsi seems to play its cards just right.

Doritos, Cheetos and Lay’s are among the world’s most popular and beloved snacks and Pepsi owns all of them. Over 50% of the company’s revenue came from the snacks business. While the sugary drinks segment’s performance leaves much to be desired (due to changing consumer preferences and unfavorable government regulation), snacks business shows impressive growth.

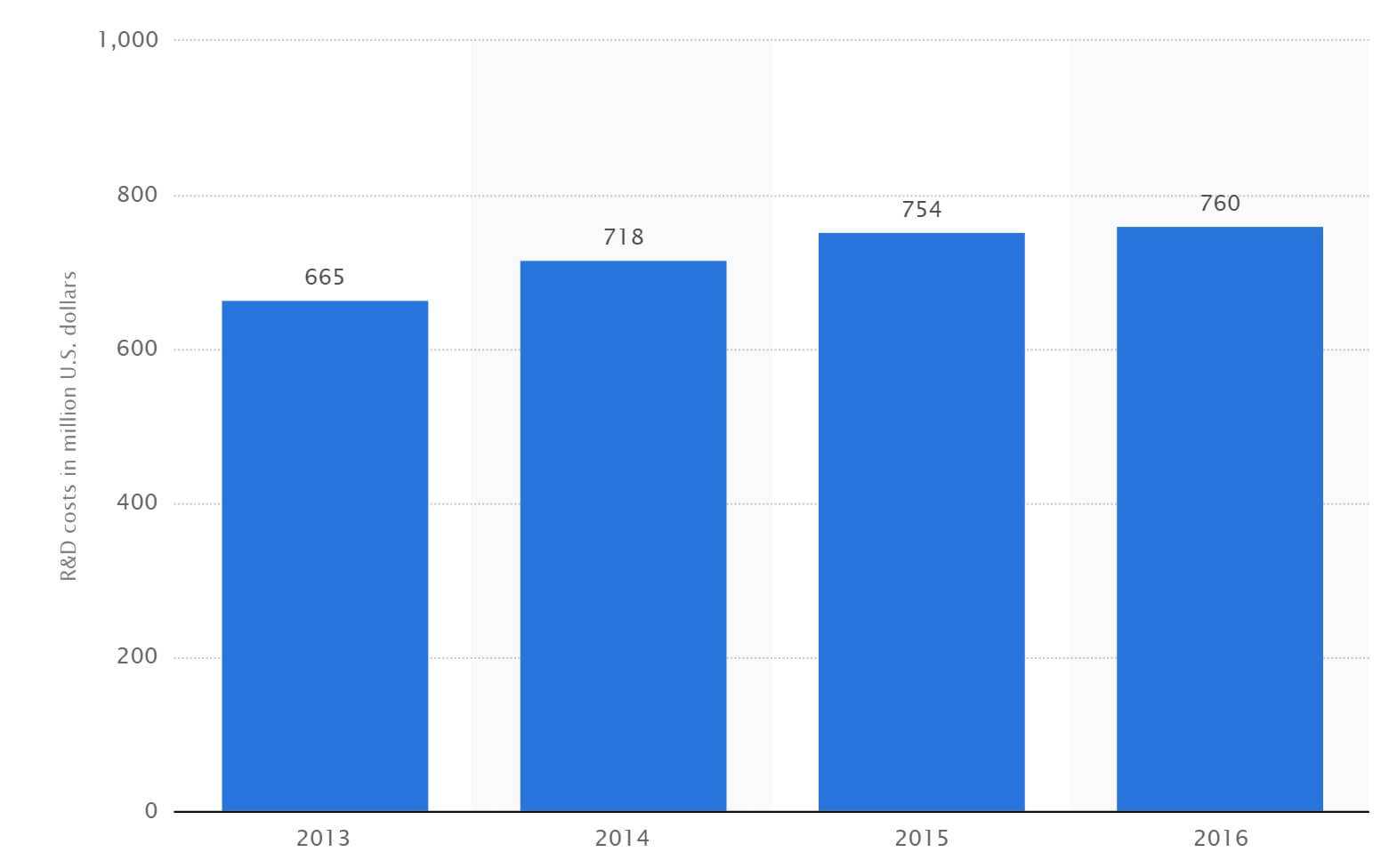

Aggressive Marketing. Pepsi is investing aggressively not only in R&D but also in advertising and marketing, which the company also does in an innovative way. PepsiCo increased its presence in social media, attracting younger audience. Since 2011 R&D spending grew by 45%, investing over $3.5 over the course of the last five years. Increased marketing and R&D spending helped the company achieved stated financial goals even despite hostile business environment in certain areas.

Innovative Products. It may sound surprising but innovation is as important in the FMCG sector as in any other one. PepsiCo is not an exception. The company dedicates a big portion of its resources to innovation, introducing new flavors and new products to the market. Since 2013, new products generated approximately 5$ in sales annually. PepsiCo is shifting its focus to guilt-free products that at least to some extent can be associated with healthier dieting. They contributed 45% of net revenue.

New products are not the only way for the company to innovate. Pepsi buys innovative businesses and brings their ideas to the market under its own brands. KeVita, a probiotic company, is one of those examples.

International Presence. Geographic diversification is always a good way of diminishing risks and getting access to additional markets. Just over a third of the company’s revenue come from abroad. Emerging markets like Russia, Mexico, China, India, Brazil and Africa get extensive attention due to their growth potential and fairly big population numbers. The company is planning to spend over $5 billion in Mexico and India each over the course of several years.

Threats and weaknesses

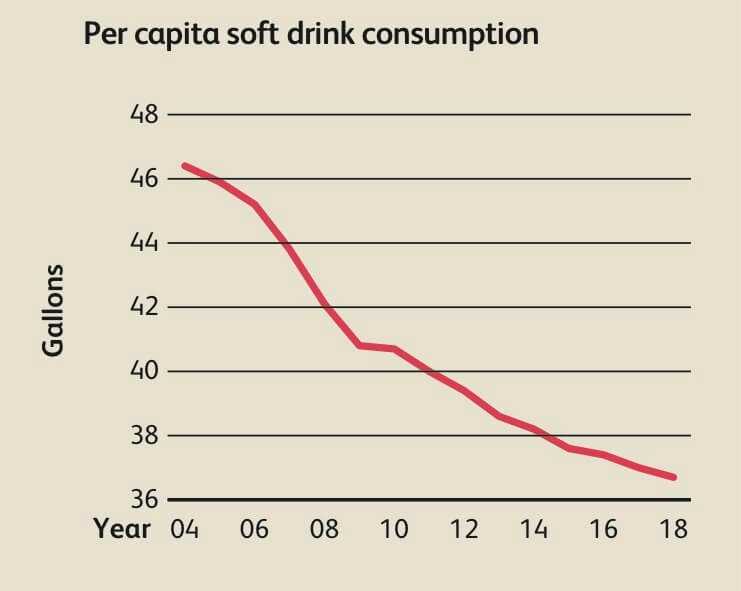

Consumer Consciousness. More and more people, at least in the developed countries, start to believe sugary drinks and salty snacks — two pillars of the Pepsi business — are bad for your health and should be avoided at all costs. Focus on healthy way of living and dieting has already ate up a substantial portion of the company’s top line and can seriously undermine its profitability in the near future. The obesity epidemic triggered many state governments to introduce sugary drinks taxes, driving the consumption even lower due to increasing prices. Sales in the carbonated sugary drinks category declined 2% in 2014 and 2015 and 1% in 2016.

Emerging Markets Volatility. Emerging markets, at which the company is concentrating a lot of attention due to their high growth potential, turn out to be more volatile that the company wants them to be. Exchange rate fluctuations and macroeconomic factors contribute to unstable cash flow coming from markets outside the United States. Business conditions in Venezuela deteriorated to the point where Pepsi no longer includes data from this country in its financial statements. Political instability in the Middle East does not contribute to successful business in the region.

Negative Currency Translation. With a lot of money coming to PepsiCo from abroad negative currency translation can put the top line at risk when being recalculated into the USD. American economy now seems to be fully recovered from the consequences of the 2008 financial crisis and even shows moderate growth. The United State dollar can be expected to react with a firm appreciation, which will decrease the amount of money the company gets from its overseas operations.

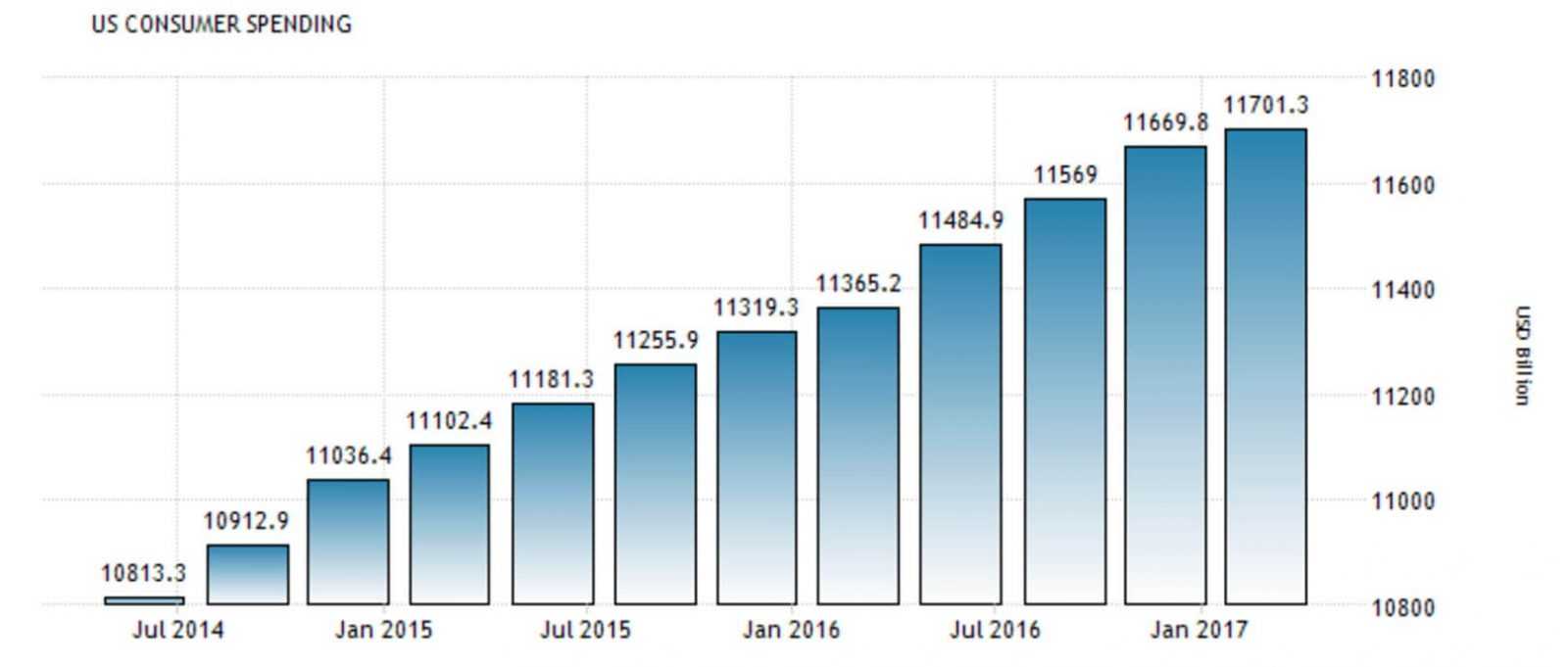

Consumer Spending. Despite lucrative business conditions in the United States consumers are still cautious in their spending. Sugary drinks and snacks are not something people can’t leave without — at least, the majority of them. Most consumers therefore prefer to spend on essential foods and drinks and avoid spending money on something that is not their basic necessity.

Conclusion

PepsiCo is not only one of the most expensive companies in the world, it is also a company with good growing potential and solid financial results. The outlook for its shares is currently moderate to positive. PEP stock price will most probably be affected by the earnings report that the company will release on July 11 before the opening bell. Traders can expect stock to appreciate should the company report better than expected results and depreciate should the company demonstrate relatively weak performance.