The 1st semester of the year is over and also the month of June 2017, with the US Dollar showing weakness against its major counterparts, the only exception being the Japanese Yen. On a weekly basis the same observation applies, so the main question is whether the US Dollar weakness can reverse its trend in the second semester of the year with at least one more interest rate hike from the Fed.

Japanese Yen

The Japanese Housing Starts for the month of May were better than expected with a reading of -0.3% versus the estimate of -0.7% but much worse than its previous reading of 1.9%. This Housing Starts figure is hard to tell yet if it reflects strong economic growth, as also the Construction Orders reading for the month of May was -0.5%, worse than its previous reading of -0.2%.

The Japanese Housing Starts for the month of May were better than expected with a reading of -0.3% versus the estimate of -0.7% but much worse than its previous reading of 1.9%. This Housing Starts figure is hard to tell yet if it reflects strong economic growth, as also the Construction Orders reading for the month of May was -0.5%, worse than its previous reading of -0.2%.

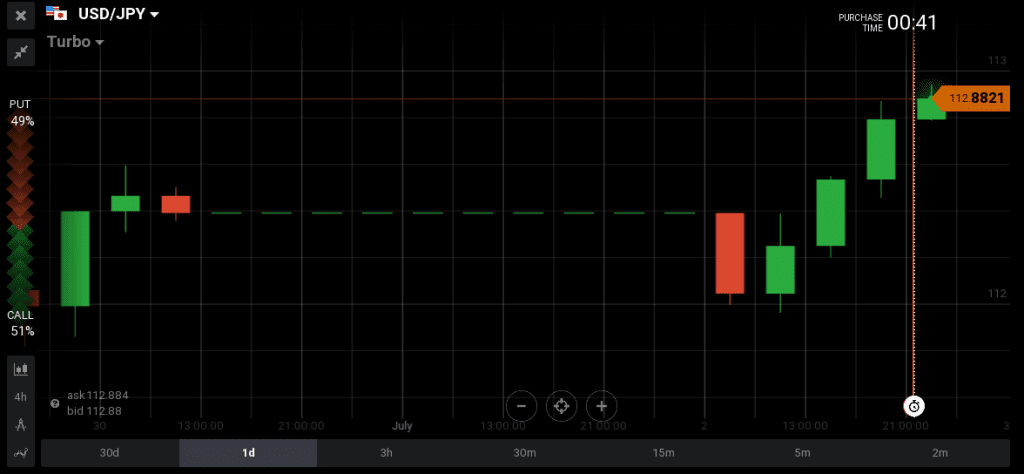

The Japanese Yen depreciated against the US Dollar with these mostly negative economic data, and USD/JPY moved up 0.18% from 111.71 to 112.62.

Euro

The German Unemployment Rate reading for the month of June was 5.7%, exactly as the estimated forecast, and remained at an all-time low, while the German Unemployment Change reading was much better than expected, at 7k versus the estimate of -10K, being positive for the Euro.

The German Unemployment Rate reading for the month of June was 5.7%, exactly as the estimated forecast, and remained at an all-time low, while the German Unemployment Change reading was much better than expected, at 7k versus the estimate of -10K, being positive for the Euro.

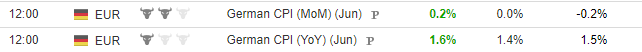

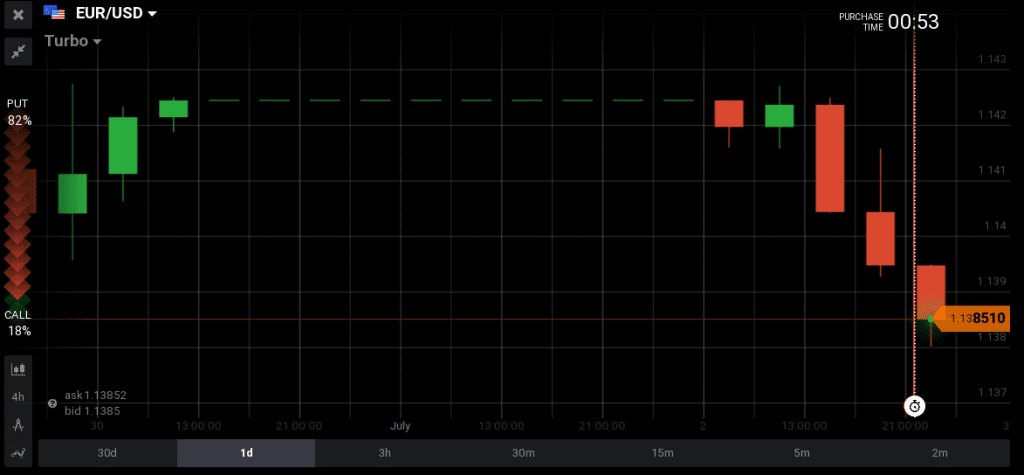

The Euro-Zone Consumer Price Index Estimate for the month of June was 1.3% higher than the estimate of 1.2%, while the Euro-Zone Consumer Price Index – Core for the month of June was 1.2% versus the estimate of 1.0%. These both readings although a bit higher than the expectations should be supportive for the Euro, indicating marginally higher inflationary pressures for the Eurozone, but it is still early to focus on a possible ECB interest rate increase. Despite the good news the EUR/USD was little changed, and it moved lower 0.13% from 1.1448 to 1.1390.

The huge rally in the past week due to the ECB policy shift rumors is a trend to pay close attention this week.

British Pound

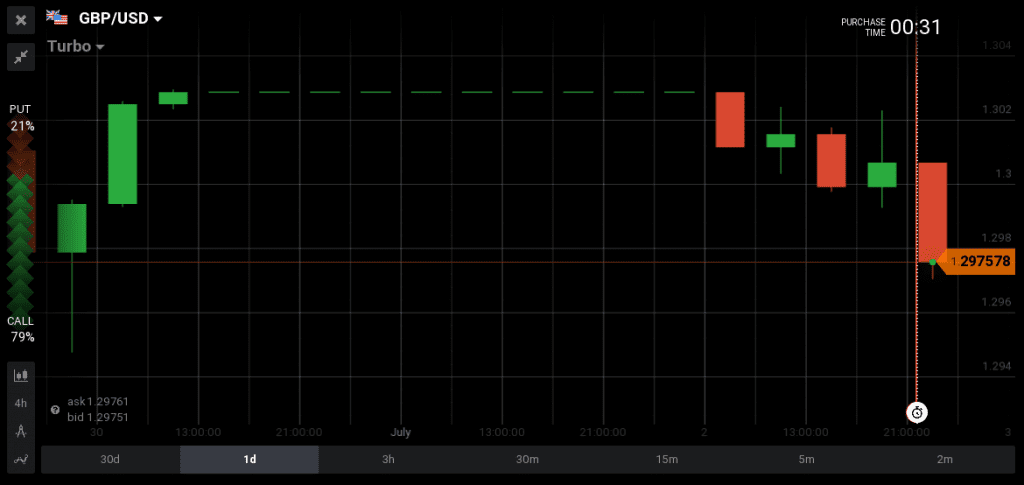

Plenty of economic data for the UK economy, with the most important one being the Gross Domestic Product for the 1st quarter of the year and a reading of 2.0% on a yearly basis, exactly as the forecast.

Plenty of economic data for the UK economy, with the most important one being the Gross Domestic Product for the 1st quarter of the year and a reading of 2.0% on a yearly basis, exactly as the forecast.

Showing a stable economic growth and not any significant economic expansion makes difficult to tell if the recent comments from the Governor of the Bank of England will lead to monetary policy tightening soon.

But the forex market still evaluated these neutral economic data as a bit positive and GBP/USD moved a bit up, 0.16% from 1.2946 to 1.3032.

Canadian Dollar

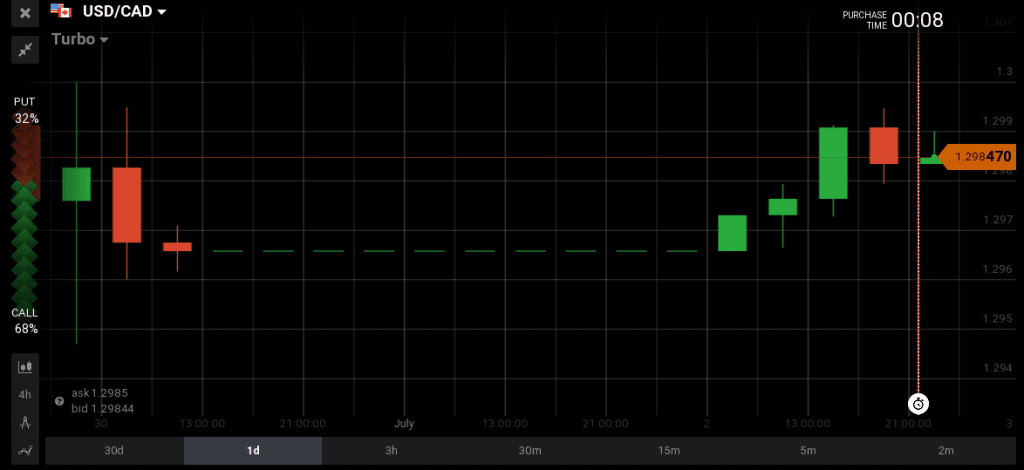

The Canadian Gross Domestic Product for the month of April was less than expected on a yearly basis with a reading of 3.3% versus the estimate of 3.4% and exactly as the estimate with a reading of 0.2% on a monthly basis. These readings can be considered neutral, reflecting economic growth, but the higher oil prices were positive for the Canadian Dollar as the USD/CAD moved lower 0.30% from 1.3014 to 1.2945.

The Canadian Gross Domestic Product for the month of April was less than expected on a yearly basis with a reading of 3.3% versus the estimate of 3.4% and exactly as the estimate with a reading of 0.2% on a monthly basis. These readings can be considered neutral, reflecting economic growth, but the higher oil prices were positive for the Canadian Dollar as the USD/CAD moved lower 0.30% from 1.3014 to 1.2945.

UD Dollar

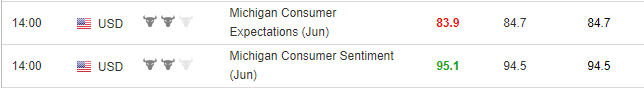

The US Personal Consumption Expenditure Core reading for the month of May was 1.4% exactly as the estimate, and the University of Michigan Confidence reading beat expectations with a reading of 95.1 versus the estimate of 94.5.

Also the US Personal Income reading of 0.4% for the month of May was higher than the expectation of 0.3%. With these positive economic data the US had a mixed trading session.

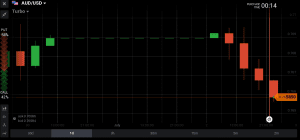

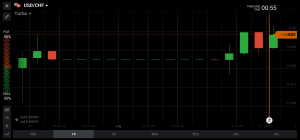

AUD/USD moved 0.09% higher from 0.7664 to 0.7716, and USD/CHF moved up 0.26% from 0.9550 to 0.96.

This week with the US Bank Holiday on 4th of July there will be lower liquidity at least for one day, and this important as lower liquidity can cause new short-term trends or spikes in price action.

Economic calendar for Monday 3rd July 2017

Today the forex market traders will focus on the Australian Building Approvals for the month of May, the Japanese Consumer Confidence Index for June, and the US ISM Manufacturing reading and the ISM Employment reading.