When it comes to Commodities, Crude Oil may be considered one of the most popular options for trading. But there are different grades of Crude Oil depending on a number of factors, which may affect the value of the asset. So having a grasp of important concepts like Brent vs. WTI correlation might prove to be quite useful when making trading decisions. To get a better understanding of the facts and enhance your trading knowledge in this respect, let us take a look at the most actively traded Crude Oil versions.

Types of Crude Oil

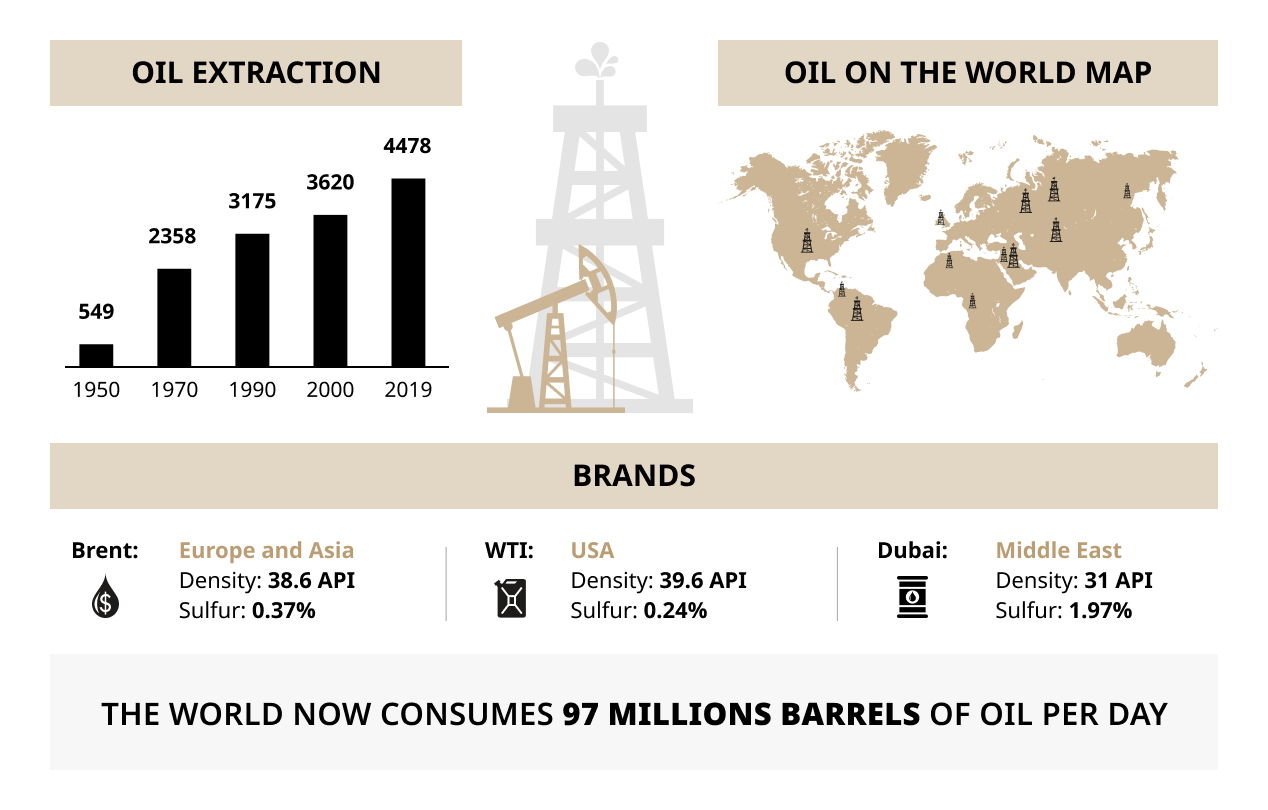

There are different types (also called grades) of Crude Oil, each one is distinguished based on its properties that determine the processing requirements. One of the key characteristics is the percentage of sulfur in its composition. Crude Oil containing less than 1% of sulfur is called “sweet” and may be considered better for production.

Density is another important parameter to keep in mind: it is measured in degrees of API gravity (an index created by the American Petroleum Institute) and ranges from light to heavy. Light oil needs less processing and therefore is generally more valued. Light “sweet” Crude Oil is the most preferred type among producers as it offers better opportunities for oil refining than other versions.

Benchmarks

Because there is a variety of Crude Oil grades available, having a pricing standard to value this commodity is essential. Nowadays there are several benchmarks used in different parts of the world: the most common are Brent, WTI and Dubai.

Brent Crude

This benchmark usually refers to Crude Oil extracted from the North Sea region. It is light, “sweet” and considerably easy to transport to remote locations, which is another important factor for the oil industry. About two-thirds of global Crude contracts are based on the price of Brent, which makes it the most widely used benchmark (particularly in European, Middle Eastern and African countries).

WTI

WTI stands for West Texas Intermediate and it is extensively used for Crude Oil produced in the United States, Canada, Mexico, South America. It is extracted from wells in the United States and distributed via pipeline, which makes transportation more expensive than that for oil procured from the sea. WTI Crude Oil is also light and “sweet” and highly valued on the global market.

Dubai

This benchmark is used in reference to oil produced in the Middle East – Dubai, Oman, the UAE. The quality of Dubai Crude Oil is slightly inferior compared to the previous benchmarks: it is heavier and has higher sulfur content.

Other types of Crude Oil are evaluated based on the comparison to these benchmarks. There is a certain differential that helps establish their value based on the above-mentioned characteristics, such as density, sulfur content, production and transportation costs, etc. Different countries can use both benchmarks to determine the prices for the local production.

Brent vs. WTI: what to choose for trading

As these two benchmarks are most commonly used by producers, they also remain considerably popular among traders. Both being almost equally light and “sweet”, they are quite similar in quality and perfectly suited for refining. However, there is some difference when it comes to the location of oil fields, which affects the price of production and transportation.

Over the years, WTI and Brent oil prices have often gone hand-in-hand following global changes, though at times they diverge due to regional political and economic situations. So it is up to the trader to choose between these benchmarks and keep track of events that might cause price changes and create a promising trading opportunity.

Trading Crude Oil

Crude Oil prices are affected by a number of factors and are subject to fluctuations. The main factors influencing price changes are the following:

- Shifts in the supply and demand balance. These are often driven by changes in the global economic conditions. For example, there was a significant drop in both Brent and WTI prices at the beginning of the Covid-19 pandemic in March-April 2020 caused by a sudden decline in demand.

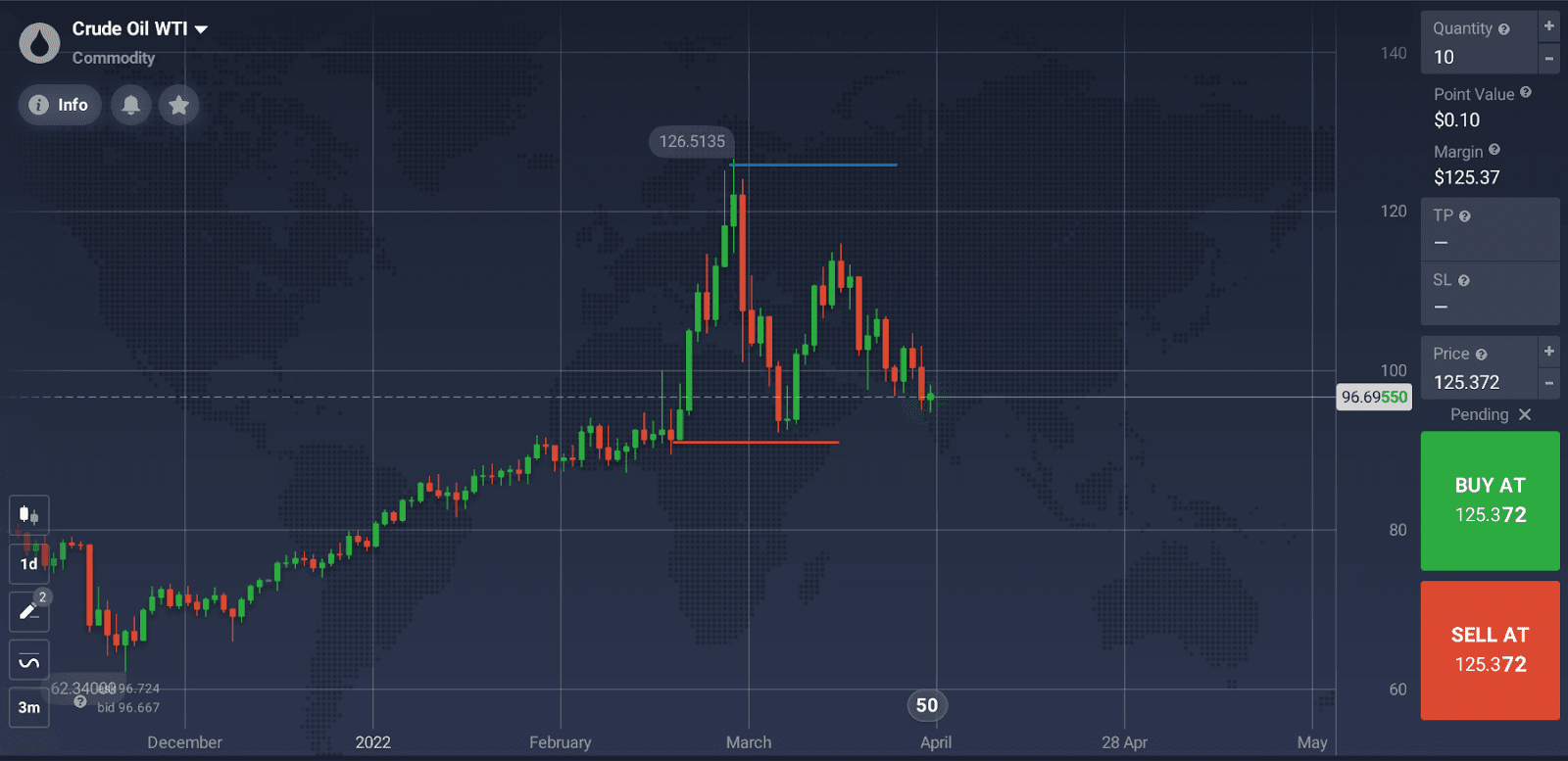

- Political uncertainty. In turbulent times disruptions in oil production and transportation might occur and have a significant effect on oil prices. Take a look at the recent price fluctuations driven by global political uncertainty around the events in Ukraine: you can see that the price of WTI Crude Oil went from $90 to $125 over the course of one week and then returned to the previous level in the same amount of time.

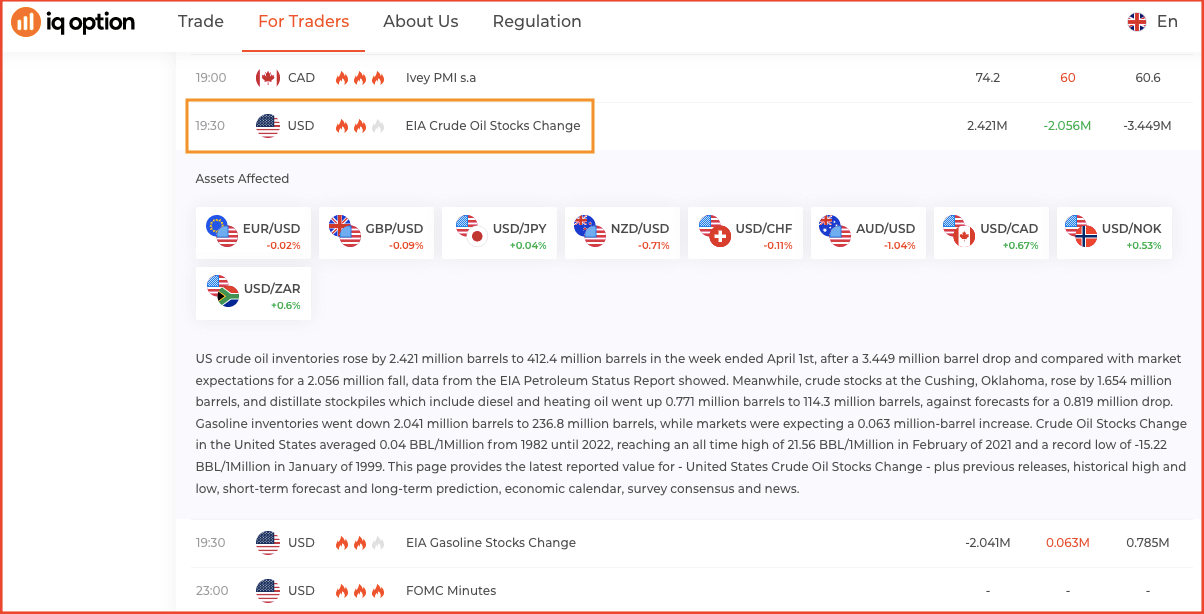

There are also other events that are unlikely to appear on the main pages of news websites, but can nonetheless have an impact on Crude Oil prices. They include reports from organizations involved in oil production and monitoring, such as Organization of the Petroleum Exporting Countries (OPEC), U.S. Energy Information Administration (EIA), American Petroleum Institute (API), etc.

Keep in mind: When trading Crude Oil, it is important to follow global economic and geopolitical news. To stay on point and never miss events that can significantly drive the prices up or down, you may use the economic calendar on the IQ option website. It offers updates on Crude Oil inventories that might affect the supply and demand balance.

If you have not yet used the economic calendar for trading ideas, check out this article with step-by-step instructions on how to make the news work for you here.

Conclusion

If you are interested in Сommodities, you may consider the Crude Oil market that might offer interesting opportunities for traders. To get the most out of them, it is important to keep track of current economic and geopolitical situations in the world and make quick decisions based on the acquired information. With Brent and WTI considered the most common benchmarks for global Crude Oil prices, it falls to the trader to choose between them and keep a keen eye for any news that might drive prices to change and create an opportunity to make a trade.