Whether you are an experienced or novice trader, it may be hard to avoid common day trading mistakes. While some errors may be obvious and easy to address, others might be harder to notice and manage. Let’s take a look at the 5 most common day trading mistakes, as well as potential ways to manage these errors and enhance your trading knowledge.

Trading Against the Trend

Whenever you open a long or a short position, there is a chance that the market may go in the opposite direction. In this case, you may have to make a decision. Generally, there are 3 main options day traders usually choose from depending on their trading goals and approach.

- Close a losing trade right away to manage losses;

- Hold on to the losing deal hoping for an upcoming trend reversal;

- Open even more similar positions to average down.

The last two approaches are usually used in long-term trading methods, as it might take a while for the price to reverse. However, day trading involves opening and closing trades within a few hours, which is often not enough time for a trend reversal. Consequently, holding on to losing deals may be one of the common day trading mistakes.

How to Fix?

Day traders tend to keep away from trading against the trend even if closing a deal at a loss might seem difficult at the start. However, it may assist in managing the risk. The 2% rule and setting up stop-loss and take-profit orders might also be helpful in addressing this common mistake of day traders.

Emotional Trading

When it comes to trading, emotions can often lead to spontaneous decisions. The results may be unpredictable and hard to manage. This is true for both positive and negative emotions: they tend to cloud the trader’s judgement and decrease the chances of making an informed decision.

How to Fix?

Whenever you are feeling emotional, consider taking a pause and consulting your trading plan. Does the decision you are about to make match your trading goals? Have you used technical analysis tools to confirm your ideas? Answering these questions may help you get back on track and understand how to avoid trading mistakes in the future.

Changing Your Trading Approach Too Often

Every trading method has its ups and downs. So it might take you some time to test a new approach and get used to it. Usually, in order to understand if a trading approach suits a trader’s trading style, they need to study and practice it for a while. That is why quitting too soon may be considered one of the most common day trading mistakes. Since the trader did not have the time to test a new method, they would likely lose time and knowledge.

How to Fix?

Once you decide on a trading method, take some time to see how it works. Then, if you feel that it doesn’t suit you, you can move on to a different approach. There is nothing wrong with making changes to improve results. However, if you do it too soon, you may miss out on opportunities.

Trading Just One Asset

Focusing too much on just one asset may also be considered one of the common day trading mistakes.

✍️

When focusing on just one asset, the number of available opportunities is reduced. And, therefore, the chances of enhancing the results. Nonetheless, the number of assets each trader chooses to trade with depends on their trading approach.

How to Fix?

Diversification is something experienced day traders tend to consider. Moreover, they often search for assets from different economic sectors. Fundamental analysis may also assist in identifying the most suitable assets and spot trading opportunities based on each trader’s preferences.

Ignoring Technical Analysis

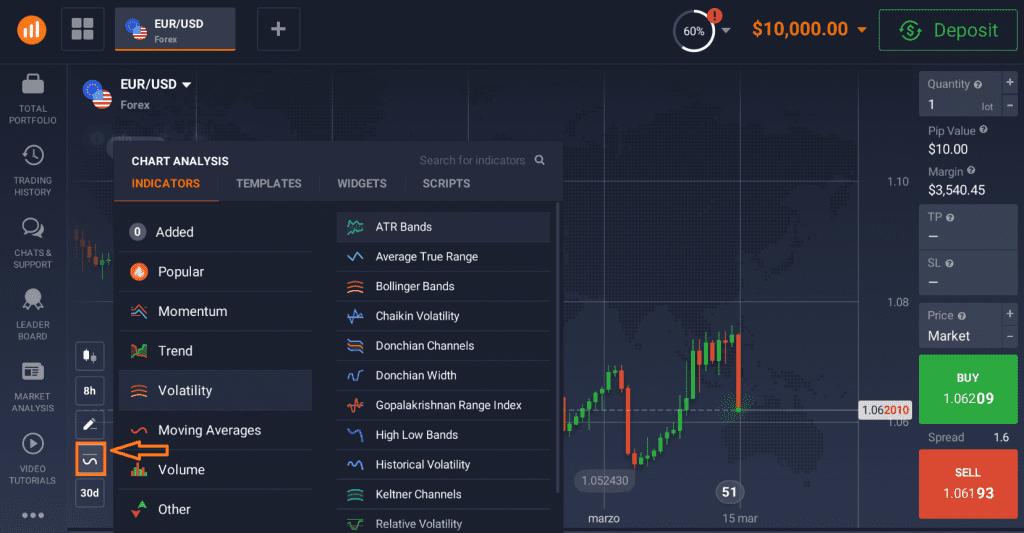

There are many technical analysis tools available to traders, which may be overwhelming. For instance, IQ Option has over 100 technical indicators alone. Moreover, most of them can be used separately or in different combinations.

However, this also means that every trader can find the tools that work for them. By applying technical analysis, the number of common day trading mistakes may be reduced to enhance your trading approach.

How to Fix?

Pick one or two basic technical analysis tools and test them first. There is no need to use every available indicator at once – you may consider focusing on a few and applying them to test your ideas.

To learn more about technical tools, you may turn to the detailed guides with step-by-step instructions on this blog. For instance, the Best Technical Indicators for Forex material may be useful for Forex traders. If you are more of a visual learner, check out the trading video tutorials that you can watch directly from the IQ Option traderoom.

In Conclusion

It may be hard to avoid common day trading mistakes, especially if you are a novice trader. However, there are many ways to manage them and reduce their impact on your trading results. There is no universal solution that fits all, so some methods may work better than others. However, over time, you might feel more confident and realize that you have learned how to successfully manage some of the biggest mistakes day traders make and enhance your trading knowledge and approach.