More now than ever, cryptocurrency regulation has been on the minds of government and regulatory bodies around the world. Before governments can take on the challenge of creating regulation, they must first take the plunge into understanding crypto.

The United States is in the process of doing exactly that. On the morning of March 14, the U.S. House Subcommittee on Capital Markets, Securities, and Investment held a hearing to discuss the current sentiment behind cryptocurrency and initial coin offerings (ICOs). The hearing seemed to echo February’s Senate hearing: regulation should be approached with caution.

How regulation could help crypto

It goes without saying that cryptocurrency is constantly evolving. Moreover, as blockchain and crypto continue to grow, new problems will arise. In order to combat these issues, there needs to be more dialogue not only within the crypto communities but with governments as well. Yesterday’s hearing was a step in establishing dialogue and encouraging understanding.

To better understand crypto, Congress called upon a strong lineup of advisors, each providing special insight into different areas of the industry.

They touched upon a variety of topics:

- ICOs need more transparency: Dr. Chris Brummer, Professor of Law at Georgetown University spoke about the need for ICOs to provide disclosures that would allow investors to make more informed decisions. Disclosures should include the promoter’s location, descriptions of what legal rights token owners would have, potential risks, and a clear description of what problem the ICO’s technology will solve, as well as how.

- Tremendous innovation in crypto: Robert Rosenblum, a partner at one of Palo Alto’s most prestigious law firms, said that it was too early to craft legislation. Nevertheless, the government can follow basic principles to regulate crypto while keeping in mind that it currently has innovative capital raising techniques which could be significant to the U.S. economy.

- Differences between Bitcoin and other crypto: Peter Van Valkenburgh, Coin Center’s director of research, explained how not all coins are created equal. There is a difference between digital commodities, which have value, and ICOs, which are essentially commodities.

While all witnesses emphasized that legislation should not stifle innovation in crypto, Coinbase’s chief legal and risk officer, Mike Lempres, highlighted the negative effect stringent regulation would have on the U.S., risking the country’s potential to reap benefits from the growing industry. The main problem is that regulatory bodies have not come to an agreement on how cryptocurrency should be treated:

“There is so much uncertainty about the definition of security and the scope of regulatory control that the market is being chilled. This is bad for everyone because the technology won’t stop — it will simply move overseas and we will miss out on the opportunity to cultivate benefits in the U.S.”

U.S. based coins struggle to catch up

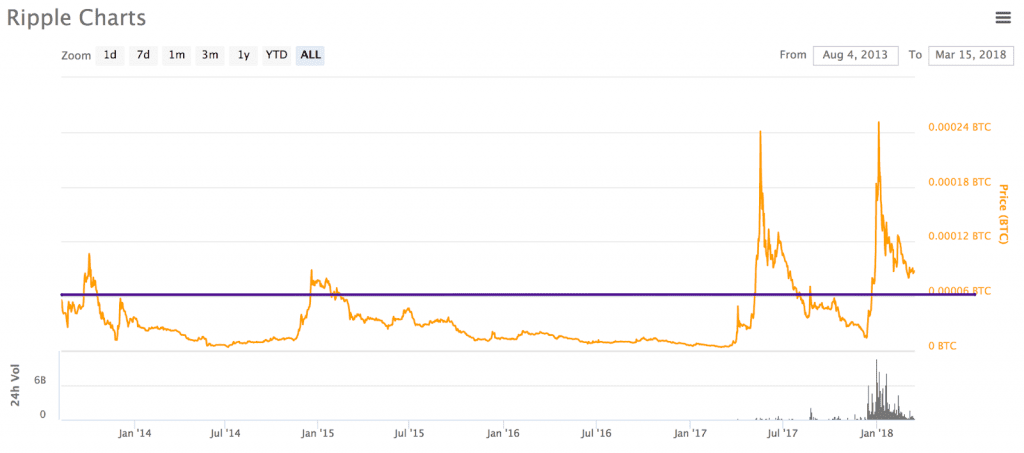

Competition is fierce in the crypto world. While Bitcoin certainly leads the market, other coins compete against each other to catch up. This is where regulation comes into play. If the U.S. fails to clarify regulation, U.S. based coins would mostly likely fall behind. A look at NEO, which is dubbed the Chinese Ethereum, shows that the coin has grown more than Ripple, its U.S. counterpart.

Whereas NEO has managed to recover from market dips, Ripple finds itself spiraling down to initial lows. It is no secret that China is home to some of the most stringent crypto regulations. However, because China has clear policies, crypto and blockchain projects know exactly which rules they must abide by in order to operate successfully. One of NEO’s greatest strengths is its regulatory compliance at a time when crypto faces extreme scrutiny.

If regulatory bodies in the U.S. were to agree on how cryptocurrency should be treated, it would mostly likely help push the market forward.

More education on crypto

When the House subcommittee wrapped up yesterday’s hearing, Representative Bill Huizenga hinted that the conversation on crypto has a long way to go before any regulation is drawn up. Addressing the witnesses who presented on crypto, Huizenga stated: “I believe that this is probably hello and not a goodbye.” It appears the U.S. is attempting to understand not only the risks but also the benefits associated with crypto, which should be a good sign for the market. Overall, Congress’s willingness to learn more about cryptocurrency can be counted as a major step forward for crypto.