It can be noticed that Chinese government is seriously concerned with the growing popularity of Bitcoin and other digital currencies within the country. Initial coin offerings, already ruled illegal, fell the first victim of the national financial authorities. Commercial cryptocurrency exchanges were outlawed soon after. Now, what is supposed to become a new piece of legislation will deem illegal all activities related to Bitcoin exchange. And peer-to-peer digital money transfers are not an exception. Access to foreign cryptocurrency exchanges will be blocked with the help of well-known Great Firewall. In other words, Chinese government is trying to do everything in its power to subdue the local cryptocurrency market and seriously hamper the financial freedom of its citizens.

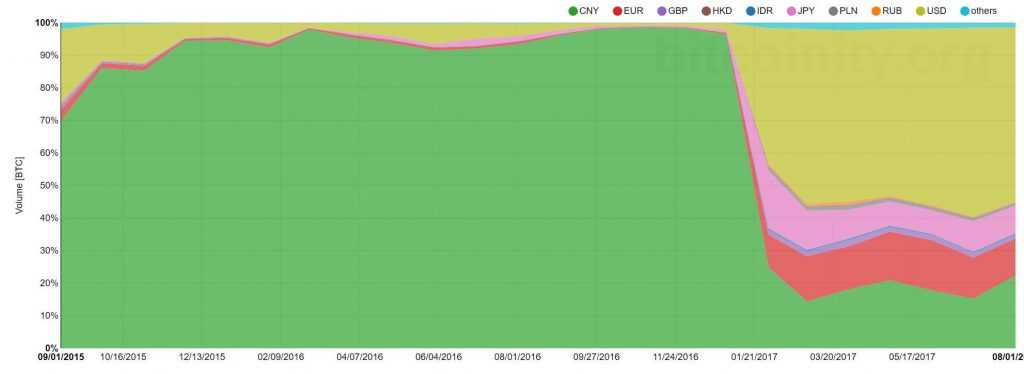

Why is it important and how the BTC price will be affected in the short and long run? China was once the country that accounted for 90% of all cryptocurrency turnover, but no more. The market share of Chinese traders has abruptly plunged to 15% in the beginning of 2017. Still, the influence of the Chinese segment on global cryptocurrency prices should not be underestimated. According to experts, the most recent downfall of the crypto market was partially triggered by the Chinese ICO ban. New legislation, effectively banning all Bitcoin exchange activities within the country, can negatively affect the liquidity of BTC and therefore decrease the price of the world’s first cryptocurrency.

Chinese government is concerned with any alternatives to yuan being used within national borders. Back in 2009, it has already banned the use tokens generated in massive online games in real life. Li Lihui, a NIFA official, has recently stated that the prime goal of the new policy is to track every piece of money and fight money laundering. The measures, however, can lead to opposite results. Should the Chinese cryptocurrency community find a way to bypass the prohibition, Bitcoin will become even more valuable as a tool of independent and unsupervised money transfer. Even if the experiment turns out to be successful China will greatly set itself back in cryptocurrency-related fields, potentially connected to lucrative economic, financial and security opportunities in the future.

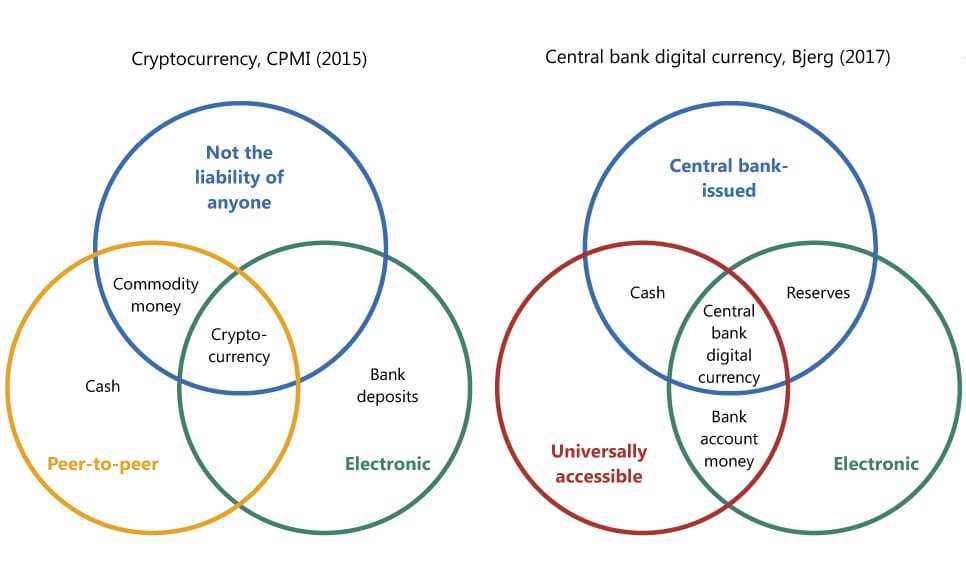

In urge to control the digital currency market and get a better grip on capital flows to and from the country, the Communist Party of China is expected to launch a sovereign cryptocurrency. The same initiative is also contemplated by India. Huang Zhen, a researcher at Central University of Finance and Economics has recently stated that “the People’s Bank of China should start its own sovereign digital currency as soon as possible”. Though only a recommendation to the authorities, this plan may soon become a reality, especially when considering the prospects of independent cryptocurrencies in China. For decades, the CPC has been trying to control the most vital parts of the Chinese society, with finance definitely being one of them. It is hard to believe the communists will let Bitcoin do its things and hand the power over an extremely important economic tool to the regular people.

A government-backed cryptocurrency may sound like a good idea but it doesn’t come without serious concerns. The coin will lack the most important quality of any digital currency: lack of governmental control. Cryptocurrencies exist as autonomous, decentralized and anonymous systems. Should all of the above qualities disappear, what will motivate people to mine and invest in such a project? By crossing this line, Chinese government is simply creating yet another blockchain-based (sub)national currency.

Bitcoin was not seriously affected by the news and is currently traded at around $3950.