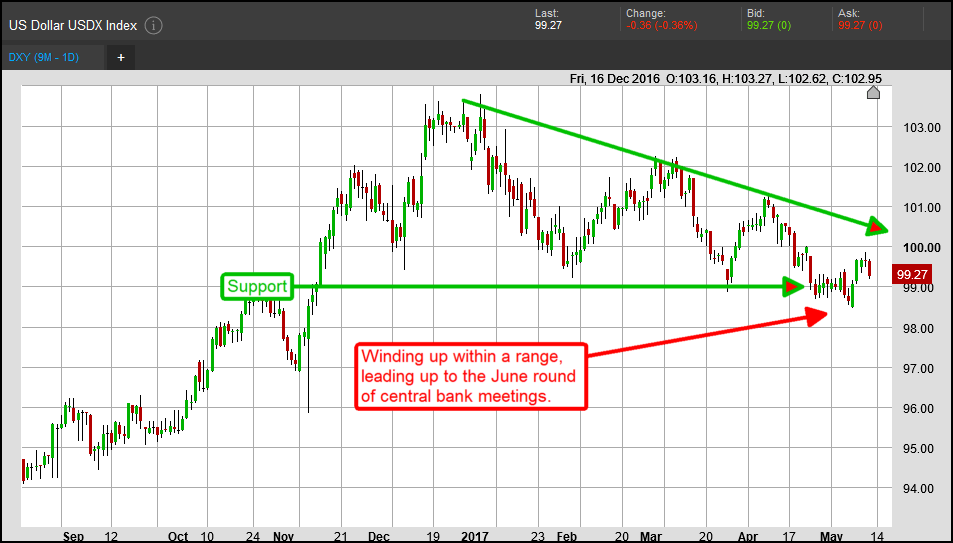

The US Dollar index is trapped in a tug-of-war between the central banks. The time of easy money is coming to an end but not all countries are on the same footing. The FOMC is on track to raise interest rates at least two more times this year but declining sentiment and diverging expectations for the ECB and the BOJ have nixed any positive impact that outlook may have. While positive interest rate outlook supports the dollar, mixed expectations for timing and actions from global central bankers has counterbalanced it, keeping the Dollar Index trending sideways with no indication of breaking out its short-term trading range. The index is winding up within that range, ahead of the June round of central bank meetings and the next possibility of fundamental changes to the market.

Since the last round of central bank meetings the Dollar Index has been trending between the $99 and $100 level struggling for direction. None of the major banks made a move to change policy, and none gave truly clear indication of when they might. Economic data, particularly in the US, continues to strengthen but not at a rate expected to spur the FOMC to more aggressive action. Recently released PPI and CPI data shows that yes, inflation is picking up but no, it is not so hot as to force a rate hike. This outlook has underpinned dollar strength but leaves it susceptible to weakness in the face of improving global economic conditions. The Chicago Mercantile Exchange’s Fed Funds Futures Fedwatch Tool indicates that 2 more rate hikes are likely this year with a 3rd very iffy. The tool shows a near 75% of rate hike at the next meeting, June 14th, with that going up to over 80% by September.

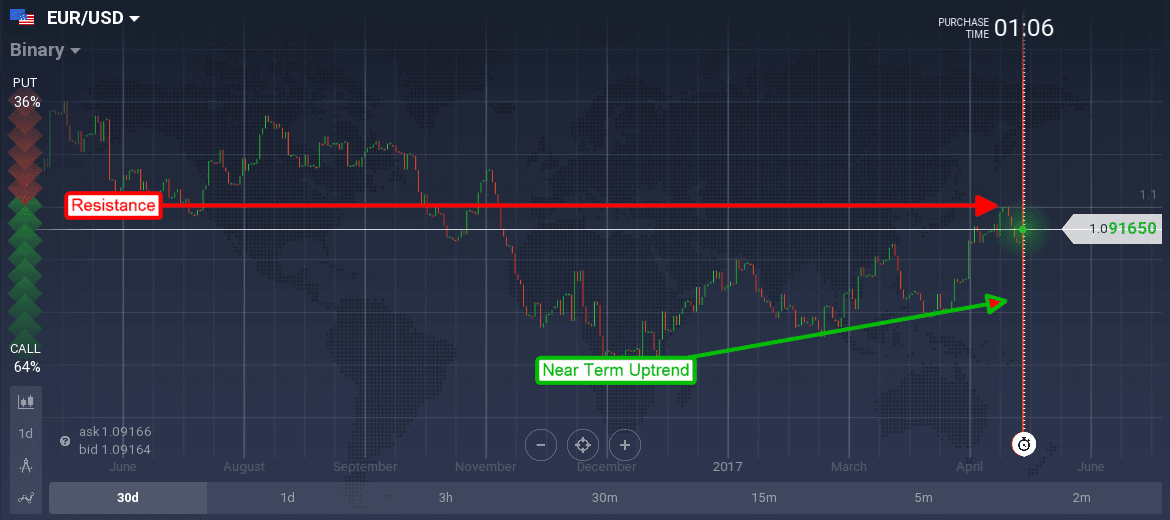

The EUR/USD has been ratcheting higher in the first half of the year as FOMC outlook cooled and EU outlook began to heat up. The pair is approaching potentially strong resistance at the 1.1000 level where it is likely to be halted until the June ECB and FOMC meetings. Economic data will provide day to day volatility until then, the decisions of the bankers longer-term direction in the forex markets. The ECB is not expected to raise interest rates this year but is on track to tighten policy. They’ve already begun to curb bond buying programs and in light of recent data expected to further reduce these programs at their next policy meeting scheduled for June 6th. If they remain on track for tightening with no pick up in expectation for the FOMC we could see the dollar weaken versus the euro and send the EUR/USD above 1.1000 with targets near 1.1100.

Dollar bears can expect to receive little help from the BOJ. The bank recently lowered their inflation outlook even as they increased growth targets which reduces the need to raise rates or tighten policy I the near-term. The recent policy statement even hinted that additional easing may be forthcoming statig the bank would “adjust policy if needed to maintain momentum.” Risk-on sentiment had already weakened the yen, this news weakened it further with the possibility of revisiting recent lows. The USD/JPY has been in uptrend since mid-April and poised to move higher. Current resistance is just above 114.000, a break above which would be bullish.