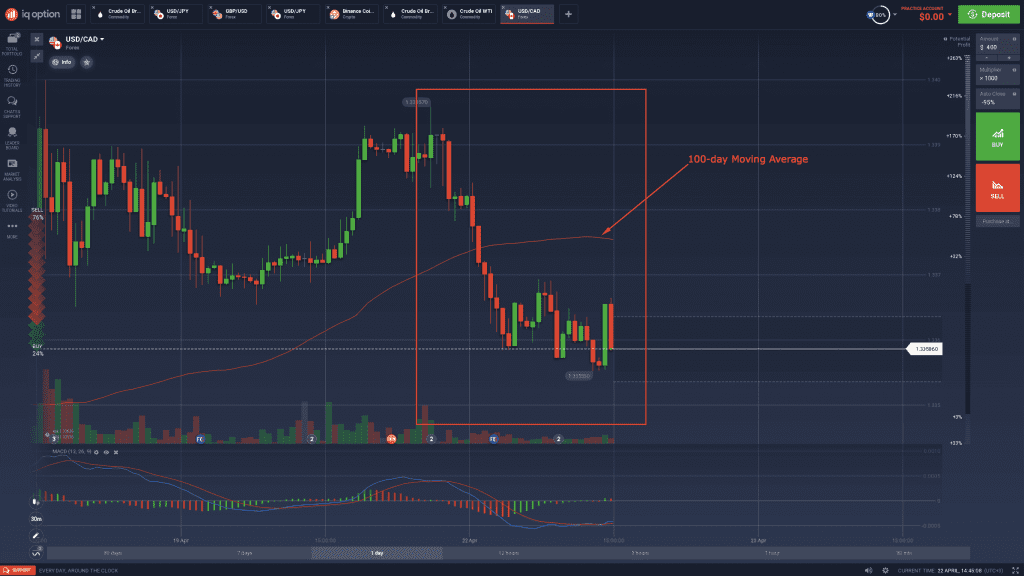

In the midst of the festive Easter season, the USDCAD currency pair experienced a recent plummet, trading around 1.3370. At the same time, crude oil sees surge, reaching new five-month highs as the WTI breaks the $65.00 mark and stabilises, gaining around 2.33%.

The U.S. is preparing to announce on Monday, as analysts predict, that Washington will no longer supply sanction waivers for oil exports coming from Iran. Donald Trump, in an attempt to pull out of a nuclear accord between Iran and six other world powers, reimposed sanctions on exports of Iranian oil back in November, 2018 and now hopes to cut the nation’s oil supplies down to zero.

Following the announcement this morning, oil rally came as no surprise, in addition to the recent OPEC supply cuts to stimulate demand and price growth. How does the Canadian dollar fare within such developments?

Canada was the 4th biggest crude oil exporter in the world in 2018. Their main source of income from the U.S., therefore, comes from exporting oil into the U.S. and effectively establishes a positive correlation between the CAD and Crude Oil. More oil exports means more profit made for the Canadian economy. Based on this, the USDCAD exhibits a depreciation, reaching 1.3370 and traded in a range.

At the same time, the U.S. is preparing to announce Existing Home Sales for March, at a forecast lower than the previous one posted, as analysts predict a result of 5.30M against a previous of 5.51M. Such news might throw the USDCAD further down, increasing the power of the CAD over the U.S. Dollar possibly breaking the 1.3250 psychological support level. On the flip side, if the 1.3400 resistance is broken and the pair trades higher, buyers might come into play and feel inclined to buy into the pair again.

Washington’s radical move, as expected, has experienced disproving arguments as news reports claims an unnamed Iranian oil ministry source argues that the U.S. will fail to cut Iranian oil exports to zero as the attempt to end waivers on oil exports will not be implemented.

The incognito source says: “whether the waivers continue or not, Iran’s oil exports will not be zero under any circumstances unless Iranian authorities decide to stop oil exports… and this is not relevant now.” Should this be the case, oil prices along with CAD and USD might exhibit more uncertainty that will only be extinguished when solid developments inform the markets of how the issue will be handled.

Information regarding past performance is not a reliable indicator of future performance.