Bitcoin’s price evolution doesn’t need any introduction – it had an incredible journey in 2017, gaining about 1,400% for the year. But what about Bitcoin’s trading volume? Is the relationship between the volume and price direct? We’ll try to figure out the answers in the following lines.

On September 15, Bitcoin started a long-term and sharp bullish rally from the initial point at $2,991 to a peak of $20,078 recorded on December 17. During this rally, BTC quotation increased almost seven-fold, generating a return of about 590%.

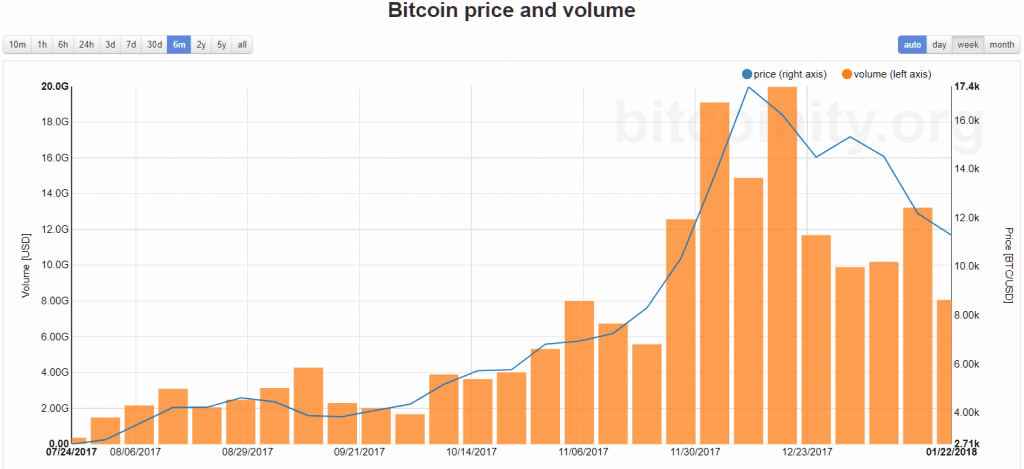

But when we look at the volume figures, the uptrend gets a bit steeper. When Bitcoin started its rally at $2,991, the daily trading volume on all exchanges monitored by Coinmarketcap was about $3 billion. It went beyond $23 billion on two occasions: on December 18, when the BTC quotation was fluctuating at around $16,000, and on January 6, when Bitcoin hit the highest level in 2018, at $17,578.

Thus, we can see that there is more or less a direct relationship between the BTC quotation and Bitcoin’s volume expressed in US dollars. The daily volume index as shown on Coinmarket cap rose from about $3 billion to a peak of $24 billion, which translates into a jump by over seven times or 700%, a performance that is quite similar with what the price demonstrated for relatively the same period.

To make sure we have a somewhat close ratio between the two indicators, we can use data from Bitcoinity:

The chart confirms that the price/volume ratio is actually close.

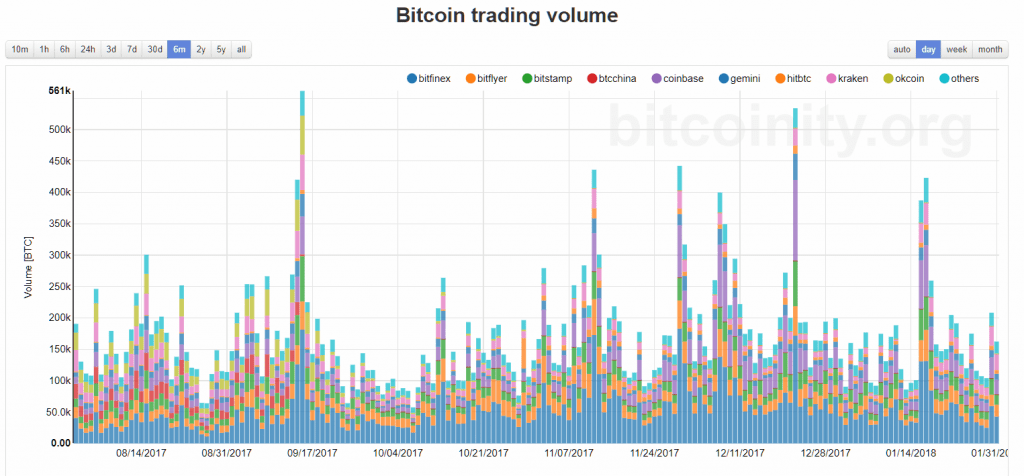

If we talk about the daily volume expressed in the number of Bitcoins traded, then we can see a different picture. Given that there is a close relationship between the Bitcoin price and the volume indicator expressed in US dollars, we can assume that the volume indicator in terms of traded Bitcoins doesn’t show any clear trend at all.

Let’s check data from the same Bitcoinity:

As we can see, in the last six months, the BTC volume actually peaked in September rather than December, when its price hit the record high. There is some volatility in the BTC volume, but the indicator moves in a sideways trend.

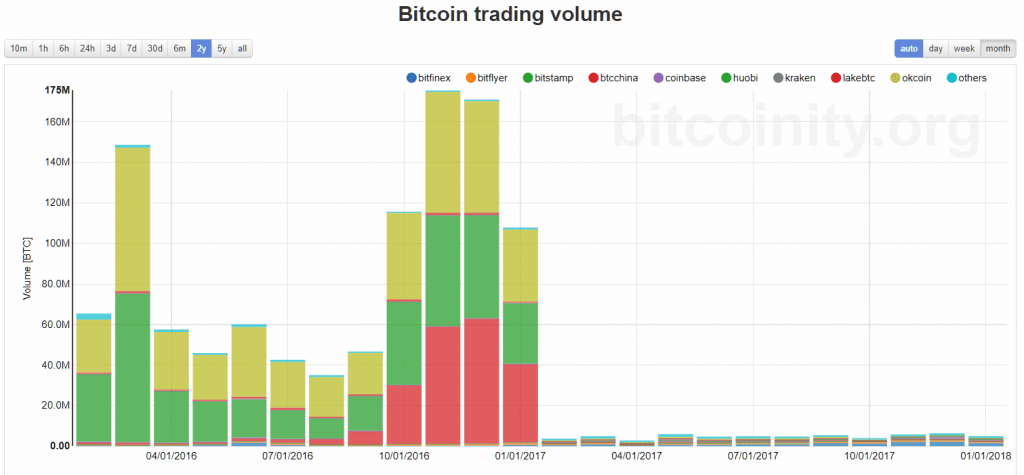

Now here is the surprise, if we check the BTC volume on a two-year chart, then we get something like this:

No – this is not a mistake, the volume in terms of Bitcoins traded was much lower in 2017 than in the previous year. The BTC monthly volume in November 2016 peaked at about 170 million BTC. If we check the same indicator since February 2017, we can see that the number of Bitcoins traded doesn’t even reach 10 million BTC. Why? Because the price for one Bitcoin starts to increase sharply, so fewer and fewer traders can allow spending on it, while the volume expressed in US dollars begins to rise together with the price, as shown in the first chart.

We can also note that China covered about 90% of the whole Bitcoin space, with OKCoin, BTCC, and Huobi being the leading exchanges.

Once the market moved out of China, the BTC volume dramatically fell, but the price showed an astonishing rally, pulling up the volume expressed in USD.

Factors contributing to the growth of volume (USD)

There are several factors that have supported the Bitcoin trading volume in terms of US dollars. Here are a few of them:

- BTC price growth – as I have already mentioned above, the accelerating price of Bitcoin has a direct and logical impact on the volume indicator. This is because people have to spend more fiat money on each Bitcoin. For example, if I sell you one Bitcoin at price of $1,000, then we have a trading volume of $1,000, and if I see you one Bitcoin priced at $10,000, then we have a trading volume of $10,000. So the BTC volume keeps the same at 1 Bitcoin, while the volume expressed in US dollars increases by ten times only because of the price growth.

- Media coverage – Bitcoin became the superstar. There is no single day without Bloomberg, CNBC, Reuters, WSJ, or other huge media name mentioning it from one side or another. As a result, Bitcoin became one of the most searched terms on Google in 2017, and it is clear that it has a direct impact on demand and consequently on the price and volume.

- The launch of Bitcoin futures on the CME and CBOE – in December 2017, Chicago-based futures contract providers CME Group and CBOE launched Bitcoin futures, which supported the BTC price and volume. These events helped Bitcoin get closer to the Wall Street.

The impact of volume growth

A higher Bitcoin price and higher trading volume might be great for crypto investors that are thirsty for profits, but the increasing volume became a burden for several large crypto exchanges. Binance, Bitfinex, and Bittrex are few of the exchanges that were forced to limit and even block the access to new users as the Bitcoin and crypto trading volume hit new highs.

Besides Bitcoin, cryptocoins like Cardano or Tron were demonstrating impressive rallies as well, putting pressure on the exchanges that operated with them.

In January 2018, Bitfinex registered users that could deposit at least $10,000 and were ready to wait from 6 to 8 weeks for the verification process.