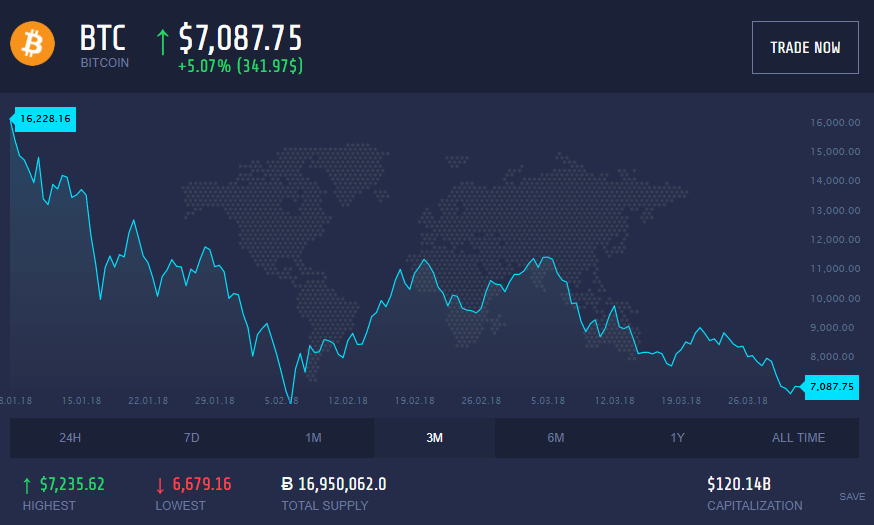

Bitcoin is on its way for its worst first quarter ever with over $114 billions of its value gone. The price of the digital currency has gone down from $13,412.44 on January 1 to $7,087.07 on March 31, marking a more than 47 percent decline. So far this quarter, $114.9 billions of market capitalization or value has been wiped off of bitcoin.

The price of the cryptocurrency has fallen from $13,412.44 on January 1 to $7,087.07 on March 31 (more than 47%).

The previous biggest decline was a near 38% fall in the price in the first quarter of 2014. The biggest price rise was a 599% surge in the price of bitcoin in the first quarter of 2013.

At the G-20 meeting, Argentina’s central bank governor outlined a summer deadline for members to have “specific recommendations on what to do” and said task forces are working to submit proposals by July. Italy’s central bank leader told reporters after the meeting in Buenos Aires, Argentina, that cryptocurrencies pose risks but should not be banned.