Bitcoin prices are surging to new highs even as I write this blog post. It looks certain to hit $10,000 within days and may even do so before this post is published. The move is crazy in more ways than one. It was only 2 months ago the coin crashed 40% on China’s ban of ICO and many are wondering if that, or worse, isn’t going to happen again. Sure, it’s possible and even likely Bitcoin will see a major correction but that will only be an entry point for new buyers and opportunity for traders.

In fact, there has been a major correction since the China Crash and it has only helped to strengthen and solidify the market by establishing firm levels of support. This crash occurred only a month ago and resulted in a 30% decline in value followed by a 60% increase in value and new all time highs. The latest rally and surge to new highs is driven in part by new investment and to a larger extent by the inclusion of BTC futures on the Chicago Mercantile Exchange. The volatility in the market, the “wild swings”, are driven by market conditions and technical traders.

Technical traders are dominating the cryptocurrency markets and Bitcoin in particular for 2 reasons:

- The first is that it provides wicked volatility and the opportunity for massive gains in a short period of time.

- The second is that market conditions in Bitcoin create clear and easy to read technical signals.

The conditions I speak of are this; the BTC market is thin but also liquid. By thin I mean there may not be a lot of traders waiting to buy or sell at a certain level, if someone dumps a lot of tokens or news spooks the market moves that result can be large. By liquid I mean there are plenty of people in the market, once support/resistance levels are found rebounds are the norm and not the exception.

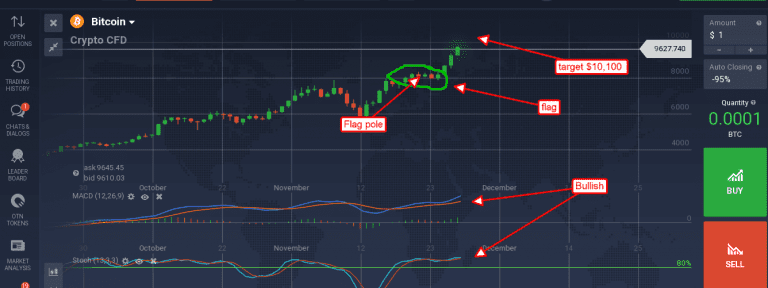

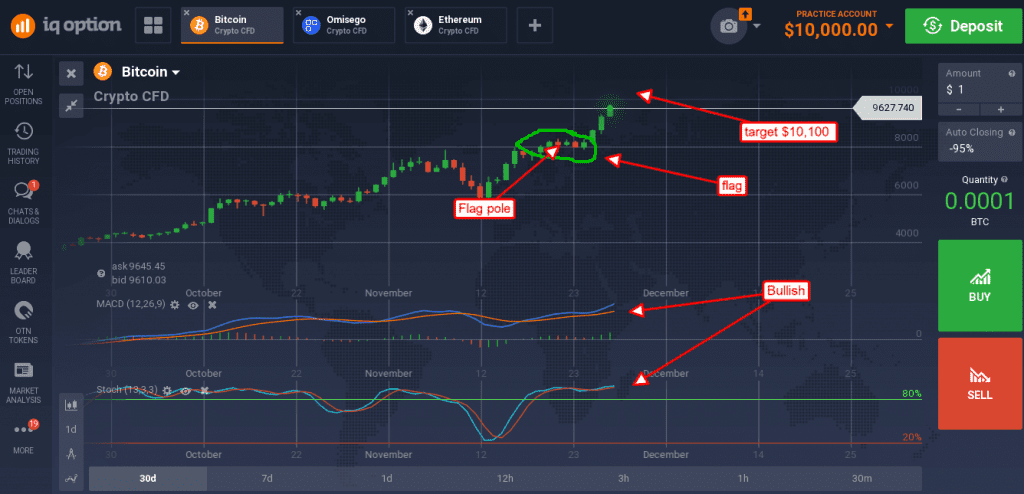

A look to the current chart of BTC/USD shows a text book example of bull market conditions, a rally and a continuation. The pair has been moving up steadily all year but most recently rebounding from lows set in response to the cancellation of Segwit2X. The pattern formed is a flag pattern or sign of continuation within up trend. The flagpole is the first leg of rally, from $5,900 to $8,000, the flag is the consolidation that formed there. Now that BTC has broken out to the upside it is likely it will move an amount equal to or greater than the flagpole or $2,100. A move of $2,100 would put BTC well over $10,000.

Where does Bitcoin go from here? Only higher in this traders’ opinion. On the one hand I can look to past history and see that BTC has doubled or more between each major correction. While past performance is no guarantee of success it does open up the possibility of a move to $12,000. Once BTC surpasses $10,000 another $2,000 won’t be hard because then all of a sudden $20,000 becomes a possibility it can go to $10K there is no reason it can’t go to $20K, right?

Longer term, regardless of corrections, Bitcoin will continue to move higher. All the worlds currency and all of its value is flooding toward blockchain and Bitcoin is the preferred method of storing value. Even if other tokens emerge to overshadow BTC it and the entire cryptocurrency complex are supported by a rising tide of money that won’t end until it’s all logged in a blockchain.