The cryptocurrency market has been growing too aggressively and for too long, certain experts believe. Some go as far as to call it a bubble. If truly the case, most cryptocurrencies, including the major ones, will depreciate considerably once it ‘finally’ bursts. How to determine a bubble and how to capitalize on a sudden collapse of prices? Read this brief article to find the answer.

At this point, the majority of regular ‘investors’ and ICO participants have no idea what a cryptocurrency is, how it works and, most importantly, why the market capitalization of all cryptocurrencies has been exploding for over six months already. When even people like Paris Hilton, who are not particularly interested in the world of professional finance and do not make an impression of a cryptocurrency enthusiast, join the ICO hysteria, it can be a troubling sign for sound traders.

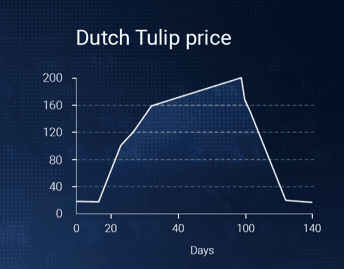

Tulip mania

Two events from the distant past can shed light on the future of the cryptocurrency market. Tulip mania was a period in the Dutch history during which the prices for tulip bulbs first soared dramatically, only to plunge soon after. The crisis was branded the first economic bubble in the early modern history of Europe. Over the course of three months, Tulip Price Index grew 20 times but then collapsed abruptly in a matter of days to the pre-bubble level. At one point, a single tulip bulb would cost ten times the yearly earning of a skilled craftsman. Of course, suchlike market anomalies are possible and they do take place. However, they are not meant to last. Sooner or later the market will turn, obliterating purely speculative gains in a few days.

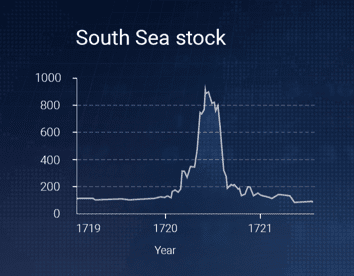

South Sea Company

South Sea Bubble is yet another example of a crowd-driven market behavior and mass hysteria. Founded as a joint-stock company in the 18th century Great Britain, South Sea Company operated as a public-private partnership to consolidate the national debt and enjoy exclusive access to South American trade. Yet, it was never destined to succeed. Failing to report any tangible results, the company still grew at a surprisingly high rate. The stock appreciated ten times its initial price in a matter of five months but then crashed to the original price level. South Sea Company is believed to have severely damaged the British economy and well-being of British citizens of the time.

All bubbles share certain distinctive features, one of them being the discrepancy between the intrinsic value and the market price of a particular good. Tulip bulbs and South Sea Company shares did not offer steady long-term returns, comparable to the purchase price. Yet, their respective prices grew due to enormous buying pressure, sustained by the overly optimistic and utterly uninformed crowd. Once it was clear the good is severely overbought, the price action demonstrated zippy downward movement.

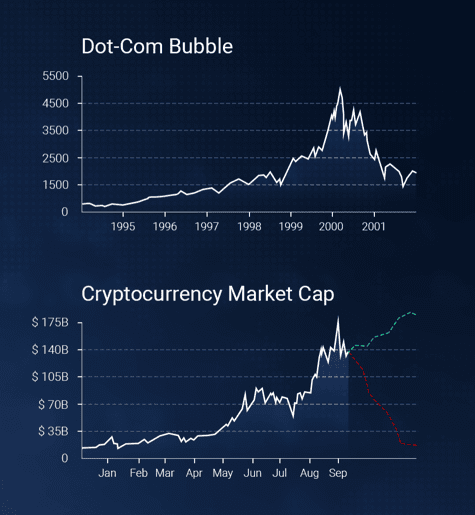

Cryptocurrency market

The cryptocurrency market, certain experts believe, is very reminiscent of the market conditions observed in the 17th century Netherlands and the 18th century Great Britain. The market capitalization of all cryptocurrencies grew from $17 billion on January 1st to $150 billion on September 12th and was even higher on September 2nd, reaching its all-time high of $178 billion. Several industries did manage to demonstrate comparable results in the past, yet none of them did manage to seal the growth.

S&P 500, for example, took six and a half years to grow from 638 to 2481. Explosive appreciation of bitcoin, Ethereum and the rest of altcoins is caused by an unprecedented involvement of ordinary people in cryptocurrency operations. Yet, none of them conceive the concept of intrinsic value, applied to digital currencies. When the notion finally hits the market, the price for most in-demand cryptocurrencies will go down, and fast.

IQ Option platform provides traders with a chance to open both long and short positions when trading cryptocurrencies. It is therefore possible to capitalize on the downfall of the cryptocurrency market. By opening a “Sell” position you try to catch the negative trend and capitalize on the downward movement of the underlying asset. Should the cryptocurrency market be as sick as analysts estimate, short selling may very well become the next most viable strategy for trading bitcoin.