Tech stocks have been struggling to stay afloat these past few weeks, and it looks like the worst is yet to come. According to a note released by Bank of America Merrill Lynch, increased regulation in the tech industry sector could lead to a market crash in the near future.

Why tech resembles a bubble

In a report published on Sunday, Bank of America chief investment strategist Michael Hartnett listed the key trends contributing to current market volatility in tech. Drawing from previous market crashes, Hartnett details why tech stocks could be in risk of a collapse. The reasons are as follows:

- S. tech market cap is $6.4 trillion, surpassing the Eurozone’s $5.0 trillion market cap.

- S. internet commerce stocks surged 624% in 7 years, making this the 3rd largest bubble in the past 40 years.

- Earnings hubris: tech and e-commerce companies account for a quarter of U.S. earnings per share (EPS), which is a level that is “rarely exceeded and often associated with bubble peaks.”

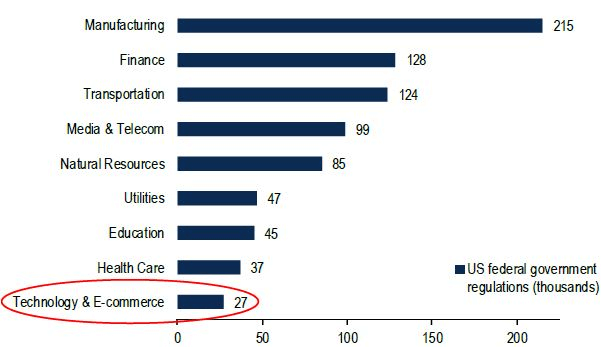

- Tech has benefitted from lack of regulation. It is the most lightly regulated sector, as shown in the chart below.

For Hartnett, one of the main indicators of a potential crash is regulation. “Tobacco (1992), financial (2010), biotech (2015) industries illustrate how waves of regulation can lead to investment underperformance,” Harnett notes. Due to these factors, Harnett urges investors to reduce their tech stock holdings.

Increased regulation in tech

Regulation in the technology sector was a major point of discussion at the World Economic Forum in Davos, Switzerland this past January. For the most part, tech giants have been operating outside of regulatory oversight, resulting in a lack of both transparency and trust. While some tech leaders have publicly called for more regulation, others view it as something that could stifle innovation in the industry. However, in wake of Facebook’s data scandal, arguments in favor of more regulation seem to be outweighing those against increased scrutiny in tech.

With tech stock already struggling, more regulation could drive the market down even further. If history is any indiciation, the tech market could find itself in serious trouble in the coming months.