The Bureau of Labor Statistics will release its Nonfarm employment report for April which is one of the last two obstacles to a rate hike in June. Current, Fed Futures imply a 94% chance of a rate hike in June.

A print above expectations with hourly earnings growth north of 2.5% would unleash a move higher in the US dollar against major currency pairs, especially as it is oversold on a short-term timeframe.

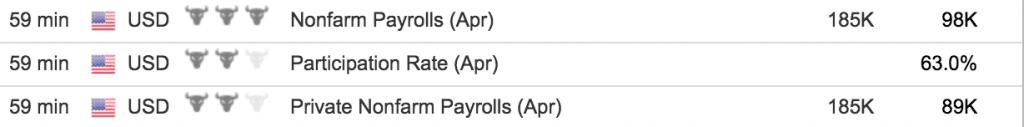

Consensus

Currently, the consensus forecast is for 185K jobs released with a range between 140K and 220K. Anything above these figures would entail a potential acceleration of the Fed’s hiking timetable, and something below 100K would potentially put the Fed on pause.

Another component of the NFP report is average hourly earnings. The absence of wage inflation throughout this recovery has allowed the Fed to take its time in raising interest rates. However, there are signs that wage inflation is beginning to pick up as the labor market tightens. Earnings reports are also showing that employers in low wage industries like restaurants and retailers are having trouble keeping workers.

“Transitory” Weakness

There currently is vigorous debate among traders and economists about the weakness in first quarter economic data. GDP growth was under 1% while a bevy of data releases undermined the narrative that the US economy was on the verge of an acceleration that would lead to a normalization of inflation and interest rates.

The Fed weighed in on this debate on Wednesday in its FOMC statement. It is not too concerned about the softness in first quarter data as it has not adjusted its interest rate path at all. This jobs

report will give some insight into whether the Fed is correct or not.

A weak number would reveal that the pessimists are correct that the weakness in oil, auto sales, retail sales, and manufacturing is a harbinger of a slowing economy.

Case for a Strong Number

However, one can make a compelling case for a strong number given continued strength in the labor market. Unemployment claims have not indicated any sort of stress in the labor market.

Additionally, the quit rate for jobs remains high. This shows that workers are confident in the labor market, if they are quitting their jobs. Basically, employment data shows that so far the broader economic softness has not affected the labor market.