While traders like myself were anticipating a move based on EU CPI and US PCE data it was a twelfth-hour vote at the EU Leaders Summit that spurred the euro to move. The vote, on immigration, was feared to fail but concessions from several nations paved the way for a unanimous outcome. Not only does the result mean tighter controls on immigration to and movement through the EU, it strengthens Angela Merkel’s tenuous coalition government and appeases hard-liners in Italy.

The most obvious impact will be in the Mediterranean where migrants from North Africa have been caused a humanitarian crisis. Fleeing adverse political conditions at home, the migrants have been flooding across the Med in homemade boats endangering themselves and legitimate traffic. The EU vote will force aid ships, which have become an unwitting bridge across the Med, to cede patrol zones to official control.

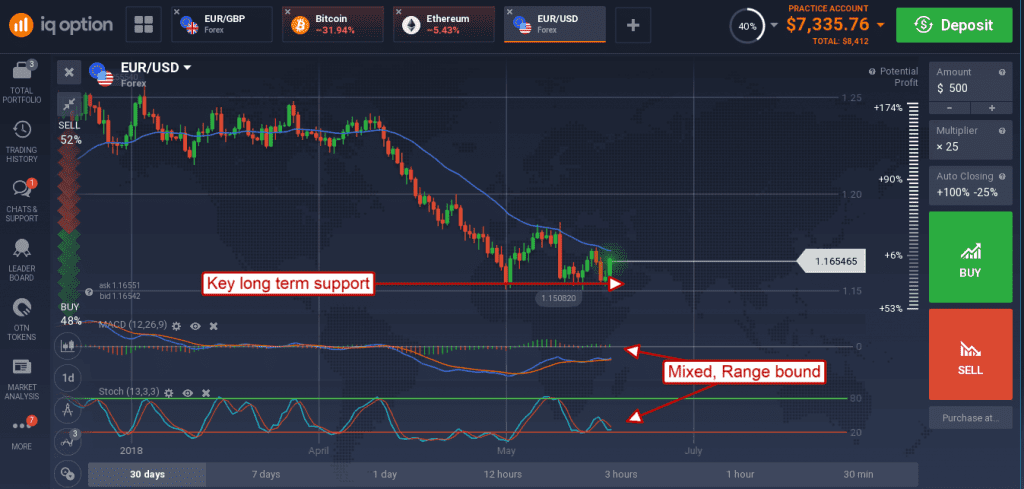

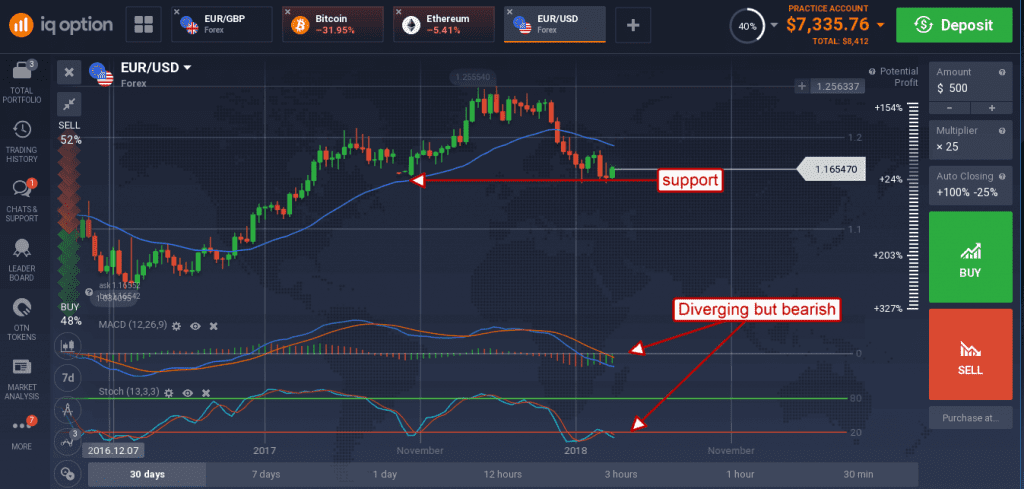

Meanwhile, EU CPI came in as expected adding further support to the EUR/USD rally. The headline and core CPI readings were as expected, the headline holding steady from last month and the core gaining a tenth. The news sent the EUR/USD up by nearly a full percent in the late hours of Thursday evening, but the gains were capped by strength in US inflation. Support is near 1.1500, resistance is at the downward sloping 30 day moving average.

The US Personal Income and Spending figures show solid gains in both income and spending although the spending was light compared to expectations. The key data within the report is the PCE price index which came in as expected at the headline and core. The shocking news is the YOY read which puts the headline PCE price index at 2.3%, up 0.3% from the previous, and the core reading at 2.0% and the Fed’s favored target.

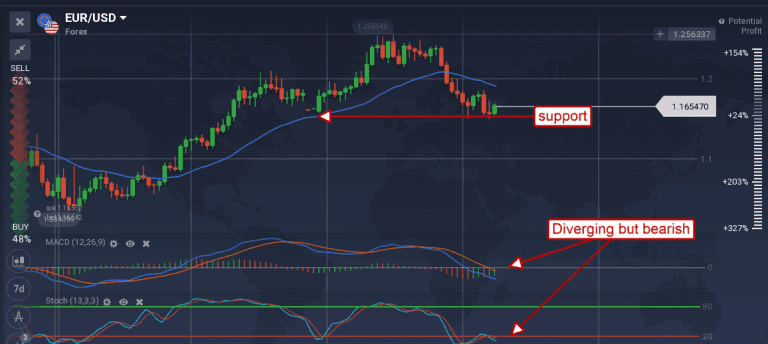

Looking at the longer term weekly chart the EUR/USD is forming a bottom that could spell reversal for the pair. The indicators are still bearish but both consistent with support at the 1.1500 level and showing signs of mounting bullishness.

This move is likely to be driven by data as EU economics improve and US economics cool off under the pressure of FOMC rate hikes. Adding to the bullish outlook is accord within the EU strengthening its borders and by default the union itself.