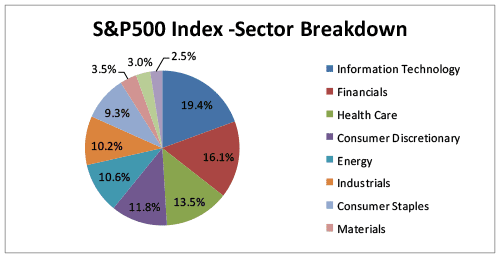

S&P 500 index is composed of 11 sectors and the biggest weightings in this index have the information technology, health care, financial and consumer discretionary sectors and is also a value weighted index. In the following paragraphs follows an analysis of this 11 sectors separately and what reveals the performance of each of them.

The information technology sector has the biggest weighting in S&P 500 index and is responsible for the positive performance of S&P 500 index. Specifically, five stocks of this sector explain the 90% of its performance. The characteristics of these five stocks, which also are called Faang stocks are big amounts of cash, no loans, big innovation, high corporate profitability, huge contribution to the total factor productivity of US economy and big spillover effects in the rest of the world. So, as long as these five stocks do not experience a fall of over 20%, this bull market has legs.

The health care sector is composed of biotechnology companies and medical care companies. The year to date performance of this sector, which is the third best one and is associated with growth investing points to the continuation of US stock market rally.But the biggest part of this outperformance is owed to hopes for mergers and acquisitions in the biotechnology sector and if they do not materialize, the outperformance of this sector will not contribute to the same pace as has already done.

The financial sector has not performed year to date very well and this is not a good sign, because financial stocks outperform in the end of business cycle and when the net interest spread that they earn rises and the economy is in full employment. The main causes for this incident are the historically low interest rates and the big flattening of US yield curve, which does not permit remarkable earnings for financial institutions by borrowing short term and lending long term.

The consumer discretionary sector has outperformed year to date, but its outperformance is owed to Microsoft, Apple and Amazon, which have the biggest weightings in the index of this sector. On the other hand, the performance of the other stocks of the sector is not impressive and that explains that although US economy’s growth rate peaked the second quarter of 2018, retail sales do not perform very well, consumer prices index did not rise as expected in August and finally the US personal saving rate is in declining trend the last 6 months, which indicates that the omens are not so good for long term.

The following 7 sectors do not have big weightings in S&P 500 index and do not contribute to the same degree in its performance.

The industrial sector has not performed as one would expect, because it is considered a cyclical sector and outperforms in the late upswing of the business cycle. This sector is based in exports and given that president Trump has implemented the impose of tariffs in Europe and China and already its big trading partners have responded, the result will be lower exports for industrial companies, lower domestic gains and higher inflation, which will absorb the benefits of the implemented of tax cuts, through higher bond yields and interest rates.

The energy sector has not performed so well until now, given that oil prices are in an uptrend, but this sector usually outperforms during a stagflation period, when the inflation rises, the economy is weak and the US dollar falls, because decreases the opportunity cost of the most commodities. So, this sector reasonably has still a little upside but the low global growth rate is not so supportive for accomplishing this milestone.

US utilities sector has the best performance the last 2,5 months in us stock market and this is not a good omen, because the most times its outperformance is considered a precursor of an economic slowdown and the most utilities companies always charge a price equal to their average variable cost in USA.

The telecommunication services sector in US stock market is considered a defensive sector due to its very high competition, it’s very weak pricing power and its very low profit margins and usually outperforms before and during a recession. This time has the most negative performance year to date, which is consistent with the characteristics of this sector.

The materials sector is still in a negative territory year to date, which reveals how sluggish is the 9,5 years economic recovery and this is a negative factor for the continuation of the bull market ,because typically in the late upswing of the most business cycles this sector had posted positive performance, associated with the fact that materials’ orders rate is higher than sales rate during a strong recovery.

The real estate sector has not performed so well, because although we are in the end of the business cycle the global growth rate is low, the interest rates have started to rise, the US family formation rate is not so great and the supply of homes from a historical point is low, because many US citizens carry big mortgage loans balances and given the low interest rates from a historical perspective, this has as a result the continuous homes’ prices hiking.

Lastly, the consumer staples sector is traditionally a defensive sector due to the fact that its constituents are food and beverage companies that during a recession have a low risk premium and year to date has the second more negative performance, which indicates that is more possible from the whole previous analysis an economic slowdown rather a recession in the short and midterm.