Amazon sold $16 billion of unsecured bonds in seven parts to fund its $13.7 billion acquisition of Whole Foods Market and in a sign of market interest, the longest portion of the offering, a 40-year security, was sold at a yield of 1.45 percentage points above Treasuries, down from initial talk of 1.6 percentage points to 1.65 percentage points, according to a person with knowledge of the matter. Amazon is expected to reduce prices at the iconic yet struggling high-end supermarket chain, which is trying to lure more low- and middle-income shoppers. The deal, which rattled the grocery world when announced in June, could intensify a price war in an industry beset by razor-thin margins and persistent deflation. The debt sale marks Amazon’s first bond-market foray since 2014.

The company has more than $21 billion stashed away in cash and other short-term investments that could have been deployed as a bigger allocation in the acquisition financing. But Amazon needs to preserve cash, and now is an opportune time for issuers to take advantage of low interest rates, said Bloomberg. “This route is cheaper and gives them flexibility,” Waral said. “The expansion plan Amazon has gotten on with buying Whole Foods is just the beginning, not the end.” The bonds may be attractive to investors who want exposure to Amazon, but are reluctant to buy the stock, which has more than quadrupled in value over the past five years, while the S&P 500 hasn’t even doubled.

The share price can be volatile with investors balancing their excitement over Amazon’s sales growth and dominance in e-commerce with the company’s slim profits and Bezos’s big spending ways.

Bitcoin in Space

Space-like adjectives are often used to describe bitcoin’s stratospheric price rise. Now there may be some truth in those analogies. Blockstream Inc. plans to make the digital ledger underpinning the cryptocurrency accessible via satellite signal so people without Internet access, or in places where bandwidth is expensive, can trade and mine bitcoin. The company also touts the service as additional layer of reliability for bitcoin’s blockchain data in the event of a network disruption.

Bitcoin has soared more than 50 percent since the start of the month. A plan to move some data off the main network was activated last week in an effort to quicken trade execution and broaden access, helping to fuel the optimism. The price climbed to a record $4,449.90 Tuesday before retreating. “With more users accessing the bitcoin blockchain with the free broadcast from Blockstream Satellite, we expect the global reach to drive more adoption and use cases for bitcoin, while strengthening the overall robustness of the network,” a Blockstream co-founder wrote.

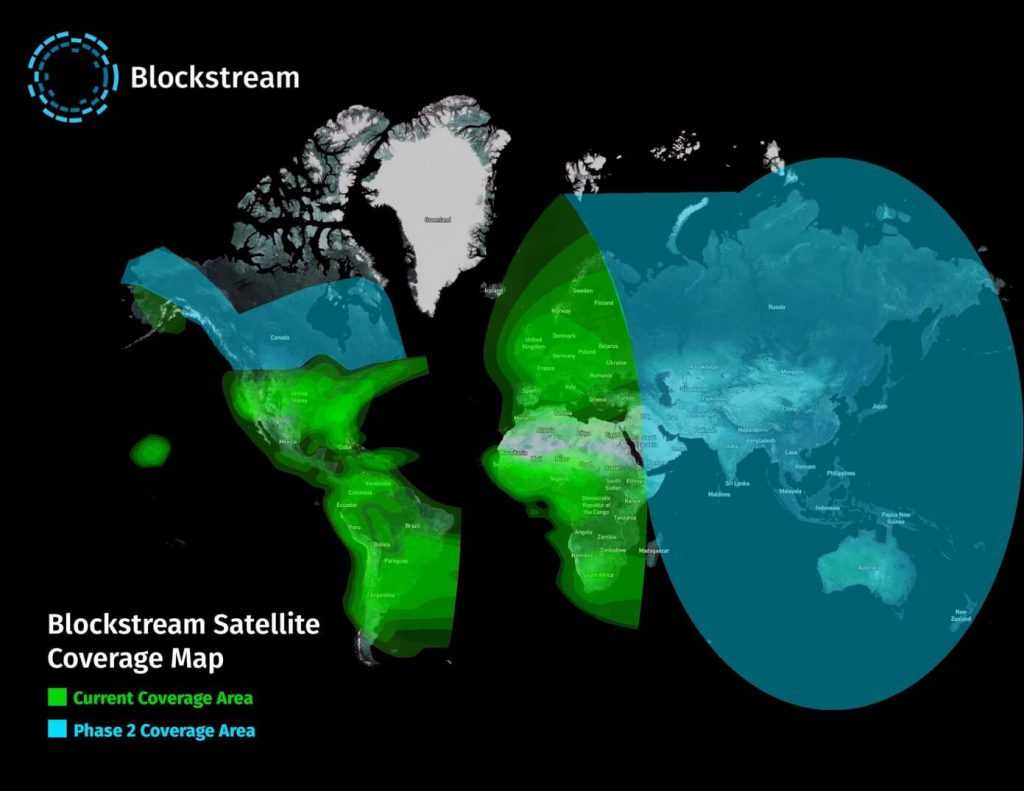

Ground stations, called teleports, will uplink the public bitcoin blockchain data to the satellites in the network, which then broadcast the data to large areas across the globe, the company said. The network currently consists of three satellites that cover Africa, Europe, South America, and North America. By the end of 2017, Blockstream said it plans to “reach almost every person on the planet.” A further indicator of the upside potential in BTC.

Norway’s Wealth Fund Is Getting Worried

After a market rally that lasted years, big active bets have lost their luster for Norway’s domestic wealth fund. The 220 billion-krone ($28 billion) Government Pension Fund Norway, the domestic counterpart of Norway’s sovereign wealth fund, is cutting risk. “It’s been a long cycle. We’ve had good results in both our stock and bond portfolio with our long-term view,” CEO Olaug Svarva said in an interview. “Pricing makes us think that it’s natural to realize some profits.” “To be counter-cyclical is part of our investment strategy,” a manager said. “To go against the market is a big reason for our excess returns. Buying more when risk premiums are higher in the market.”

Equities with little range

Wall Street followed the current rally with a rather dull, range-bound session on Tuesday that left the major averages little changed. The Dow eked out a narrow victory while the S&P 500 (-0.1%) and the Nasdaq (-0.1%) each settled just a tick below their unchanged marks. Small caps underperformed, sending the Russell 2000 lower by 0.8%. Investors rolled into pre-market action on Tuesday with a boost of confidence following news that North Korea’s Supreme leader Kim Jong-un has decided against launching missiles towards the U.S. territory of Guam, which he threatened to do last week.

However, he did warn that he could change his mind “if the Yankees persist in their extremely dangerous reckless actions.” A hotter than expected July Retail Sales Report tempered the upbeat sentiment, though, forcing investors to rethink their rate-hike expectations. At the closing bell, the fed funds futures market assigned an implied probability of 55.2% to a December rate hike, up from 37.4% on Monday. U.S. Treasuries slid to new lows following the retail sales release, pushing the benchmark 10-yr yield as high as 2.28%. In the end, the 10-yr yield finished five basis points higher at 2.27% and the 2-yr yield finished four basis points higher at 1.35%.

Underpinned by the increase in interest rates, the U.S. Dollar Index (93.72, +0.38) advanced 0.4%. The most influential sectors–technology (+0.2%) and financials (+0.2%)–exhibited relative strength throughout the session, helping to keep losses in check. The financial space opened with a gain of around 1.0%, but began fading almost immediately. The technology group was underpinned by yet another positive performance from Apple (AAPL 161.60, +1.75), which climbed 1.1% to a new all-time high.

Imporant economic events today:

19.00 pm – FOMC minutes: Markets will get further clues about when the Federal Reserve’s policy makers will continue on their tightening path and how rapidly they intend to act. Markets to watch: USD crosses, precious metals, global indices