Altcoins are dominating the cryptocurrency market today, recording strong gains against Bitcoin. Total market valuation currently stands at $347 billion, with $400 moving closer within reach as altcoins continue on an upward swing.

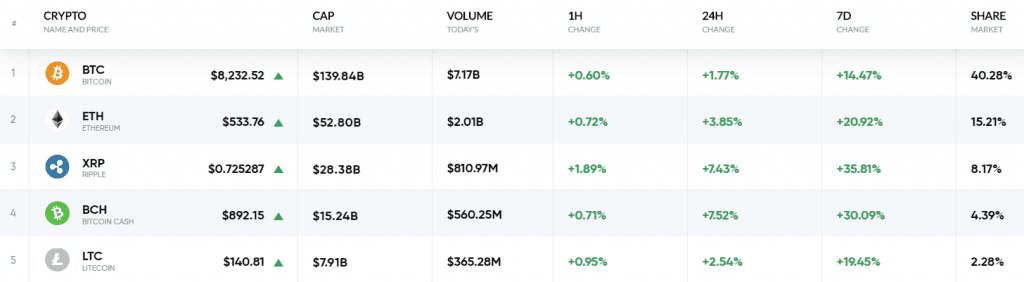

Datos del mercado de criptomonedas por coinrate.com

Earlier this month, Wall Street analyst Tom Lee predicted Bitcoin would see a rally after U.S. tax day. It looks like altcoins have picked up on the positive sentiment as well, following bullish trends that have allowed them to outperform both Bitcoin and Ethereum in the last 24 hours. While Bitcoin saw a boost of 1.77% that brought its trading price above $8,200, coins such as Ripple and Bitcoin Cash witnessed almost 8% gains, bringing their prices to $0.72 and $892.15, respectively. Leading the top 25 coin rally is Stellar, which is currently trading at $0.35 thanks to a 12% price surge. Trailing Stellar is Tron at almost $0.05 after a spike of 8.6%.

It is also worth noting that, throughout the week, a handful of altcoins registered price movements independent of Bitcoin. Coins such as Cardano and Icon saw upward movement of over 8% on days when Bitcoin did not fluctuate significantly. Such activity can be interpreted as signs that market maturity is underway.

Bullish quarter ahead?

Saxo Bank, a Danish fintech bank specializing in online trading and investment, recently published its quarterly outlook for global markets, cryptocurrencies included. According to the report, increased regulatory pressure and the string of social media advertising bans have left the market in a fragile state, but that does not mean cryptocurrencies do not have the potential to make a strong comeback. In fact, there are many events that could spark market rallies in the upcoming quarter. The report painted an optimistic picture of the cryptocurrency market:

“If there is a significant pullback in the equity markets, there will be an inflow of money into uncorrelated assets, or assets that lie outside the reach of the traditional financial system in which cryptocurrencies are a potential alternative. The inflow of institutional capital to the cryptocurrency market due to the increase in regulation and investor protection could lead cryptocurrencies to a positive quarter.”

As described in Saxo Bank’s report, an increasing number of financial institutions are already exploring their options for diving into crypto. This week, British investment bank Barclays revealed it was gauging client interest in the bank possibly launching cryptocurrency trading desks in the future. More interest like this could bode well for the future of the crypto. For now, all eyes are on altcoins as they take command of the market.