Here it is, a new day, the beginning of a new trading session and an opportunity for a fresh start. But wait – what is the start? What is the first thing to do at the beginning of a new trading day? Everyone needs a good, practical trader’s checklist to get them through the day with maximum productivity. You may save this checklist in your bookmarks or write it down in your daily planner and see if you can apply it in your daily routine. Let’s go!

1. Fresh cup of coffee & daily news

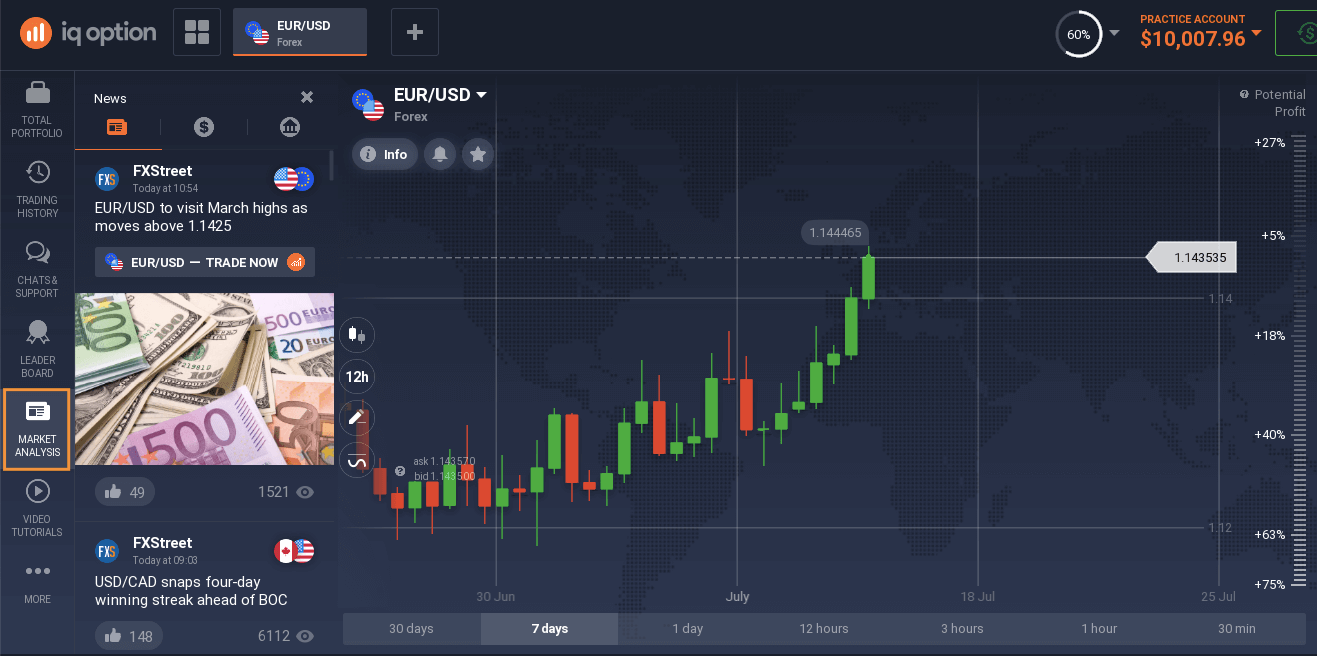

You may start slow. Why not turn your breakfast into something productive? Depending on the assets you prefer to trade, you may check the news and see if there is anything influential going on. If you are not sure where to look – there is an economic calendar right in the traderoom.

You may look through the news, check the Forex or Earnings calendar: it may be helpful regardless of the trading approach you exercise, but it could be especially useful for news traders, as it is a part of their strategy.

2. Market assessment

Now that you have checked the news, it is time to check what is happening on the specific assets you normally trade. It can be done with fundamental analysis. However, many traders prefer using indicators to evaluate the asset’s past performance.

What are the points that may be important to check? It may be helpful to assess the market’s direction, see if it is trending or flat, check the volatility and the strength of the trend. Keep in mind though that past performance is not an indicator of future performance.

All of these points might make it simpler to decide on a trading plan that may be applied later. It is better to write the information down in your trader’s checklist. The information can be as concise or as broad as you wish. What matters is that by the end of the assessment, you clearly understand what is going on with the asset and what your actions might be in accordance with it.

3. Trading plan

Once it is clear what the market is up to, it is time to plan the trades. Trading experts rightfully consider a trading plan to be one of the most important components of a trading routine. The trading plan may be beneficial for every trader, and it is essential to spend extra time on developing it.

The main points here may be the asset, investment amount, total balance that will be used in a trading strategy/sequence, Stop Loss and Take Profit levels, the timeframe of the deal and the timeframe of the market.

The plan may also include the information about the indicators one may be using in the process, support and resistance lines and graphical tools. Sticking strictly to the plan during the day is a way to have a better control of the deals and manage your losses.

Successful people are simply those with successful habits.

Brian Tracy

4. Risk management

An important part of the trader’s checklist is the risk management strategy. What a trader may write down in this part of the plan is the conditions under which they may exit the trades, the acceptable amount of loss and the planned Stop Loss levels.

Writing these things down may seem excessive, but it is a good way to control the trading activity and manage the emotions that inevitably occur during trading. Another advantage of sticking with this checklist is that it might help one feel more productive, organized and accomplished. Just remember that consistency is key.