The US Federal Open Market Committee held their July/August meeting and held rates steady, as expected. What was not expected was a change to the statement which points to strong growth across all segments of the US economy. The FOMC says labor markets continue to strengthen, economic activity is strong, household spending is growing strongly as is fixed investment. Balancing the economic view is a tepid look at inflation which has been holding steady near the Fed’s target rate of 2.0%.

The news is only the latest proof that Trump’s domestic policies are working. The only negative aspect is the possibility trade wars will have a negative impact on US and global growth, yet another reason for the dollar to strengthen. If the global economy does begin to suffer risk-off traders will flood into the dollar as the US economy is the most stable, regardless of Trump antics.

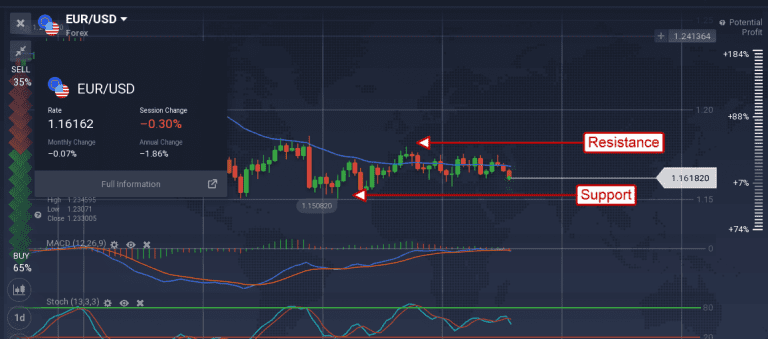

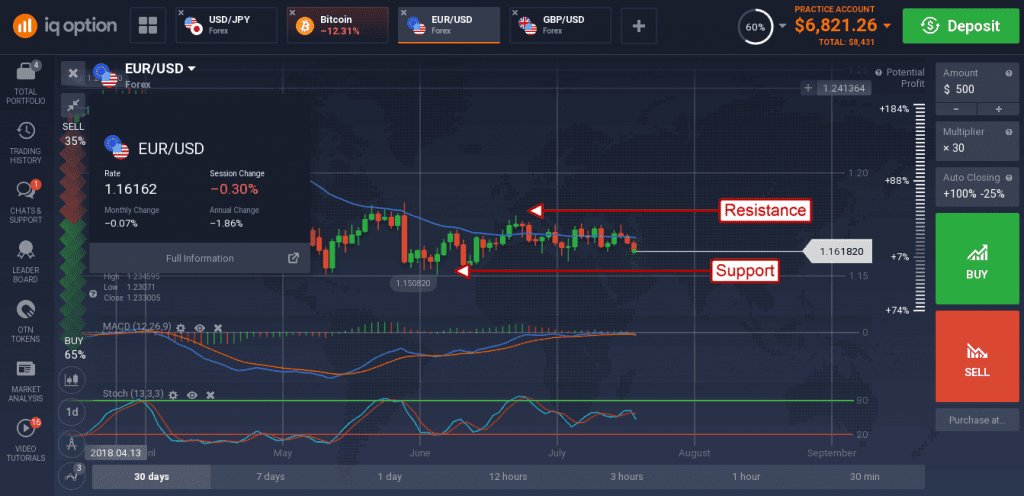

The EUR/USD shed about -0.40% in the wake of the news, moving down toward the bottom of a near term trading range and long-term support near 1.5575. The indicators are rolling into a bearish signal that may lead the pair down to test long term support although the longer-term indications remain consistent with range bound trading. The next hurdle for this pair will be Friday’s NFP data, and more specifically wage gains. If hourly average wages increase substantially it will raise the specter of accelerating inflation and that will increase the chances for additional rate hikes.

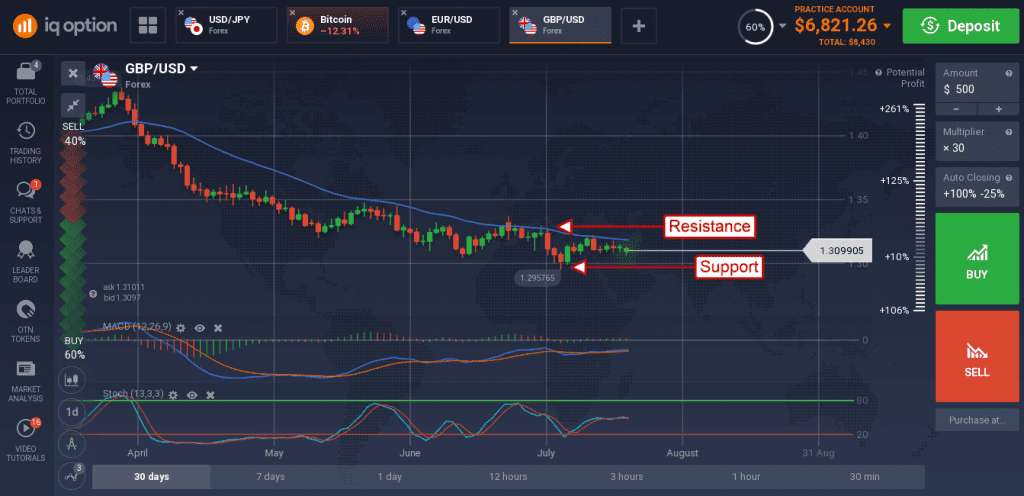

The Bank of England raised rates at their August meeting, as expected. The move is intended to curb acceleration within the UK economy despite the drag on growth provided by Brexit. The vote was unanimous and brings UK rates to 0.75%.

The GBP/USD held steady on the news, neither rising or falling, as traders focus on the next round of data. A move in either direction could be significant although there are near term support and resistance targets that may contain price movement. A move up may find resistance at 1.3200, a move lower may find support at 1.3000.

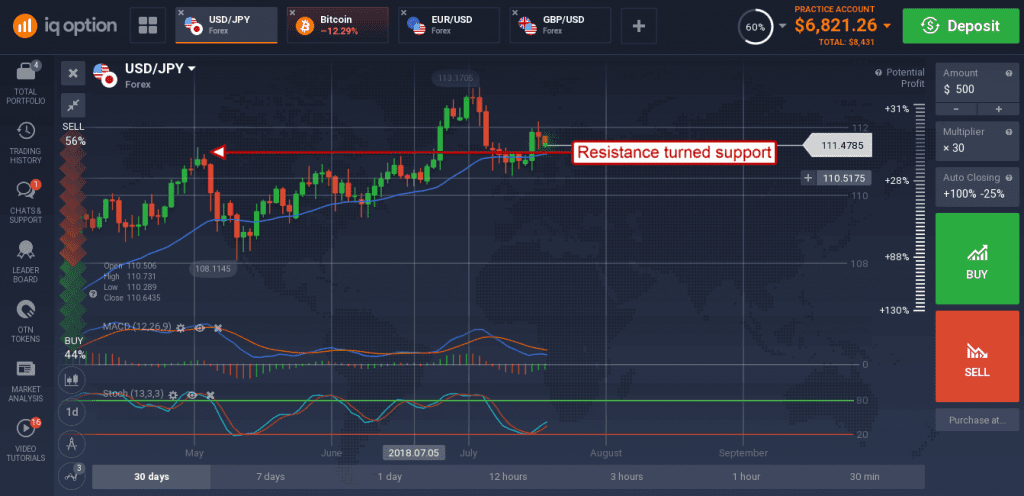

The dollar fell versus the yen as traders turn an eye toward the safe-haven currency. The pair shed about -0.20% following the FOMC policy statement but the outlook remains bullish. The pair is now testing former resistance turned support at the 111.20 level and is likely to bounce higher.

The indicators are mixed but consistent with a test of support within up trenSet featured imaged so a move up to retest the recent high should be expected. One possible catalyst is Friday’s NFP data.