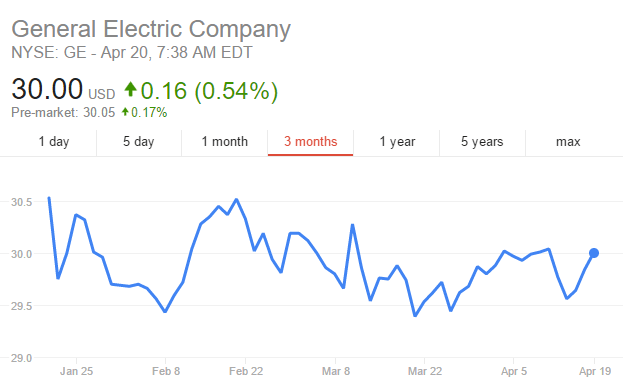

General Electric (NYSE: GE) is a global conglomerate company that operates in the whole galaxy of fields: from aviation and healthcare to pharmaceuticals and software development. GE showed slow yet steady growth during the last five years.

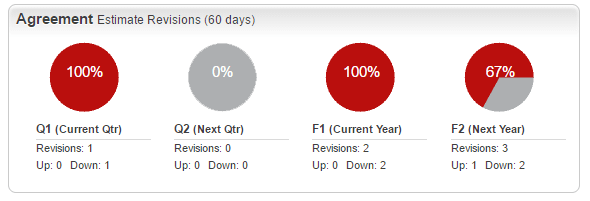

However, there are enough reasons for experts to believe GE stocks are not the best purchase right now. One of them is the upcoming earnings report (will be published on 21 April 2017 before market open). For the last five quarters, General Electric failed to meet experts’ estimates. Each time GE stock depreciated right after the report release.

Performance indicators

| 52 Week High-Low | $33.00 – $28.19 |

| Dividend / Div Yld | $0.96 / 3.22% |

| EV/EBITDA Annual | 14.46 |

| Consensus EPS forecast Q1/17 | $0.17 |

| Reported EPS Q1/16 | $0.21 |

| Forward PE | 18.29 |

What pushes the stock prices down?

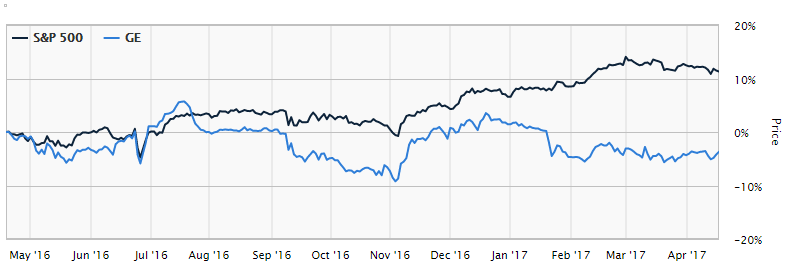

Underperforming the industry. While the Diversified Operations industry lost only 0.1% in the last three months, General Electric witnessed a 7.4% decline.

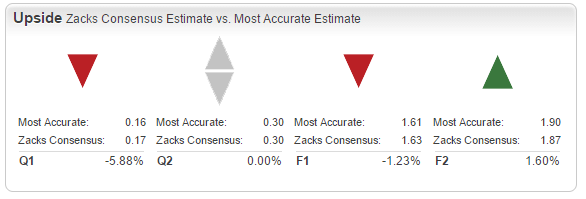

Decreasing EPS. Earnings per share is one of the major factors that determines the behavior of the market. The consensus EPS forecast for the quarter is $0.17, the reported EPS for the same quarter last year was $0.21. A sharp decrease in EPS estimates definitely won’t benefit the stock prices.

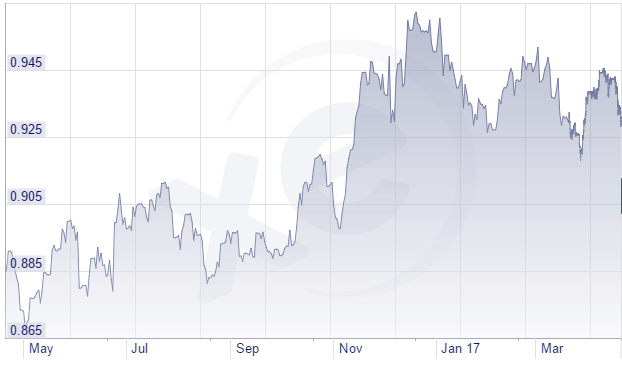

Stronger dollar. With a national currency becoming stronger, GE is very likely to face severe competition from cheaper substitutes. Strong dollar means higher prices for foreign customers. This is particularly important for developing countries, where the price can easily be a primary decision making factor.

Decreased gross margin. The company has performed worse in the fourth quarter of 2016 than it did before. Gross margin declined 10 basis points to 28.7%, non-GAAP operating margin decreased from 18.3% to 17.3%.

History of negative earnings surprises. The most important reason why certain investors prefer to get rid of the GE shares is company’s history of negative earnings surprises. In the last 26 quarters GE has missed only one earnings estimates. At the same time the last five quarters have been marked with negative earnings surprises and 1Q17 is also expected to disappoint investors.

Growth factors

GE — Baker Hughes merger. General Electric has recently reached an agreement with an American-based oil field services company to create a new entity with an impressing mix of products and unmatched equipment capabilities. GE will own 62.5% in the emerging enterprise. By combining expertise and operating assets of two companies, GE is trying to breathe new life into its oil and gas department. The colossus born out of this merger will become the second largest players in the oilfield equipment and services industry. In addition, General Electric acquired Meridium, Inc., a global leader in the field of asset performance management software. GE has already announced its plans to acquire two 3D printing equipment manufacturers — Arcam AB and SLM Solutions Group AG — worth $1.4 billion. Mergers and acquisitions are a sound growth strategy for huge international companies, especially in the industrial and IT spheres.

Focus on core business. Unlike highly diversified conglomerates of the past, GE is trying to divest non-core businesses and focus on core capabilities to provide investors with high-quality long-term growth. The company has almost completed the GE Capital Exit Plan. By exiting the financial sector the company plans to pay closer attention to technology and R&D initiatives. Top management of the company hopes that industrial business will account for more than 90% of total operating earnings in 2018 (compared to 58% in 2014).

Strong international presence. Approximately 50% of the company’s revenue comes from developing countries, China and India in particular. High economic growth rates in emerging economies boost GE sales and help the company keep up with development plans. Moreover, geographic diversification, even in the global world, can be a stabilizing factor, with risks in one region mitigated by opportunities in the other ones.

Solid free cash flow. The company generates substantial positive cash flow, which is used to 1) invest in R&D, other companies and innovations and 2) remunerate shareholders with significant dividends and share repurchases. In 2017 alone GE plans to spend $8 billion on dividends and $11–$13 billion on share repurchases.

Put or Call?

A lot of factors influence stock prices. However, few of them have an impact comparable to that of earnings reports — at least, in the short term. With another earnings report about to be released, GE stock looks vulnerable and is likely to depreciate when investors find out that the company didn’t meet their expectations for the sixth consecutive quarter.

The overall outlook for the company is moderate to negative. General Electric can be expected to lose a portion of its stock price at the beginning of the trading session on 21 April 2017.