The American Express Company will deliver its quarterly earnings report on July 19 after the closing bell. AXP stock prices can be expected to fluctuate in the beginning of the trading session on July 20, moved by the data in the report. The consensus EPS forecast for the quarter is $1.47. The reported EPS for the same quarter last year was $2.1.

What, apart from the earnings per share, are the factors that will define the direction of the price movement? Take a closer look.

1) Stock Performance

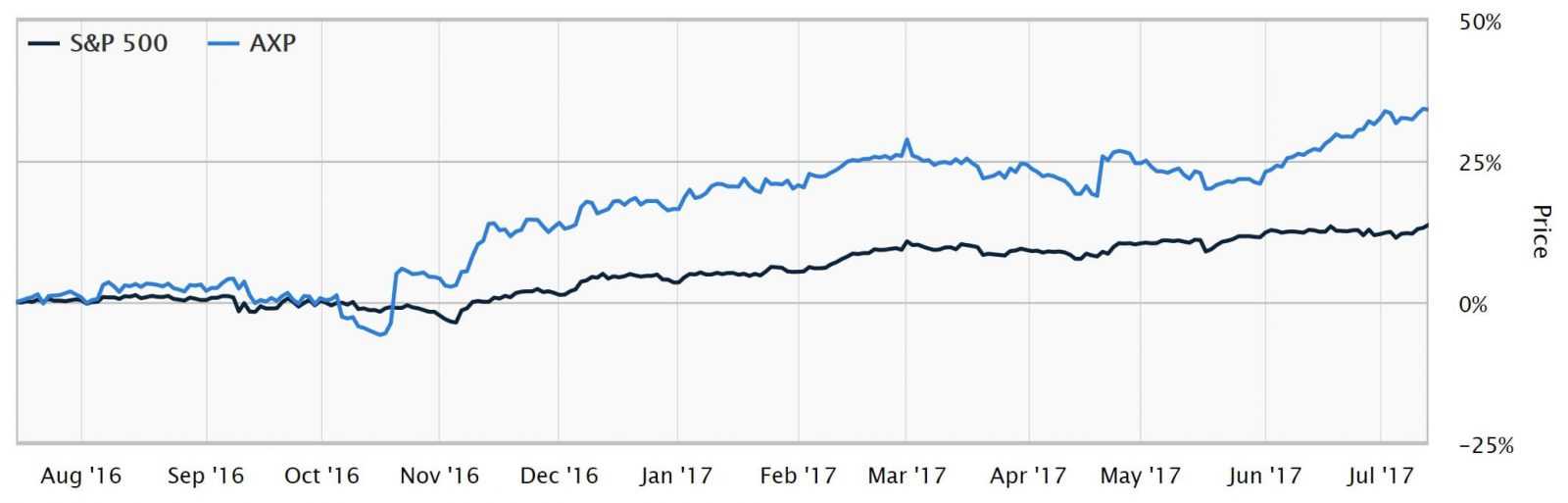

Past performance is in no way an indication of the future one. However, it is much easier for a company that outperformed the market for a substantial period of time to do the same in the future. American Express is one of those high performers. The company grew 36% in the last one year, while the industry demonstrated ‘only’ a 27% growth*. Certain experts believe the AXP stock will continue its victorious ascension.

2) Geographic Diversification

American Express is a global financial company and can therefore enjoy higher stability and rely on geographically diversified revenue streams. China, India, Mexico and Japan are all attractive destinations for the growing AmEx business. Company’s market share in Europe is forecasted to grow, as well. China is expected to grow big enough to steal the first place in terms of card payments from the United States in another 10 years.

3) Negative Currency Translation

The global nature of the AmEx’s business without a doubt makes the company more stable and competitive. It, however, does not come without a price. With over 30% of its revenue coming from the abroad, American Express is exposed to a substantial risk of negative currency translation. Stronger USD, supported by the United States economic growth, can eat up a portion of the company’s top-line.

4) Costco Partnership Termination

Costco used to be a prime source of new customers for the American Express Company and over years became one of its most prominent partners. Termination of the partnership between the two companies has already negatively affected AmEx’s revenues in the first quarter of 2017 and can be expected to do so in the future*. The effect will be felt for at least a couple of quarters.

Costco used to be a prime source of new customers for the American Express Company and over years became one of its most prominent partners. Termination of the partnership between the two companies has already negatively affected AmEx’s revenues in the first quarter of 2017 and can be expected to do so in the future*. The effect will be felt for at least a couple of quarters.

5) Shareholder Value

During the previous quarter the company announced a 9.4 percent increase in dividend payments. The latter will now be equal to $0.35 per share. More than that, the top management of American Express wants to spend up to $4.4 billion by the end of 2018 on stock buybacks. Higher dividends and stock buybacks serve the purpose of increasing shareholder value, which will ultimately drive the stock price up*.

The outlook for the company is moderate. There are enough factors to contribute both to the appreciation and depreciation of the AXP stock. The data revealed in the upcoming report will be key to future price action.