Trading is not only about your knowledge, intuition and hard skills, it is also about noticing the small things and turning them into your own edge. Any professional trader would kill for an instrument that predicts the behavior of the market with 100% accuracy. Unfortunately, no such instrument exists.

Still, there are special tools that can help you. Reversal patterns, as the name suggests, pinpoint trend reversal points. Being able to say when the trend is about to change its direction can be of great value for a trader, no matter what asset he is interested in.

Although not absolutely bulletproof, these three patterns are capable of providing traders with a signal when the trend is about to change its direction. Both novice and experienced traders might benefit from them. You might, therefore, familiarize yourselves with the patterns and possibly apply them in trading, even if just as a supportive tool.

Head and Shoulders

Head and Shoulders is one of the most popular reversal patterns, which is used a lot in real-life trading. Candles on the graph form two shoulders and a head. The trader can also add a neckline using a simple horizontal line. The left shoulder and the head by themselves look like a normal growth pattern but then the right shoulder appears. It can be both above or below the left shoulder but is always below the head formation. The right shoulder is an indicator of diminishing growth potential. When the price action crosses the neckline from above, the trend reversal is considered to be confirmed. When it happens, some traders will consider opening a ‘Sell’ position.

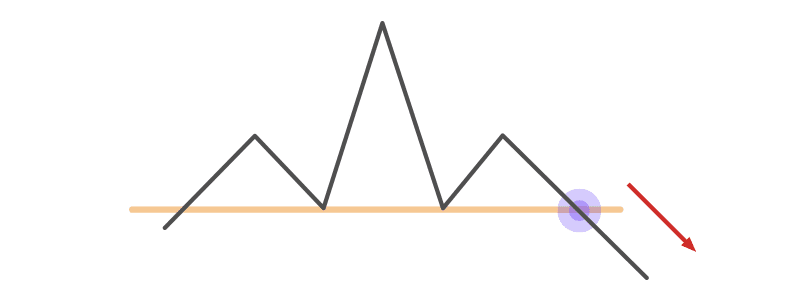

Triple Bottom

Unlike the previous one, Triple Bottom is a bullish reversal pattern. In other words, it is an event some traders might interpret as a ‘Buy’ signal. The pattern is formed by 3 equal lows, followed by a sudden price surge stretching beyond the resistance level. To spot a trend reversal you first need to have a strong negative trend. After trying to break the support line for three consecutive times the price action then goes up, crossing the resistance level from below.

Diamond

This one can get a little bit tricky, as spotting a Diamond pattern on the graph is not always easy. Bearish Diamond top formation is less known than its more popular counterparts, yet it still has the potential to provide great results. This pattern can usually be found at the height of a strong positive trend. It hints at the upcoming trend reversal. Diamond can be reduced to a Head and Shoulder pattern with a V-shaped support line. The breakout — when the price action crosses the bottom right support line — is a confirmation. Traders may consider opening a ‘Sell’ position when they spot it.

Whatever your trading strategy is, always remember that no pattern can be 100% accurate. Use them to spot the possibility of a trend reversal, use additional tools to receive a confirmation.