The world will remember 2024 as many things, but “boring” isn’t one of them. From Bitcoin’s rise to meme stocks redefining market trends, some assets soared while others fizzled out.

Here’s a recap of the worst and the best assets of 2024 — plus a glimpse into what to trade in 2025.

Crypto: Meme Magic and a Trump Card

Some analysts saw crypto as the best assets of 2024 for trading and investment. Let’s have a look at the assets that were worth the attention and those that failed everyone’s expectations.

🏆 Best Performing Assets of 2024

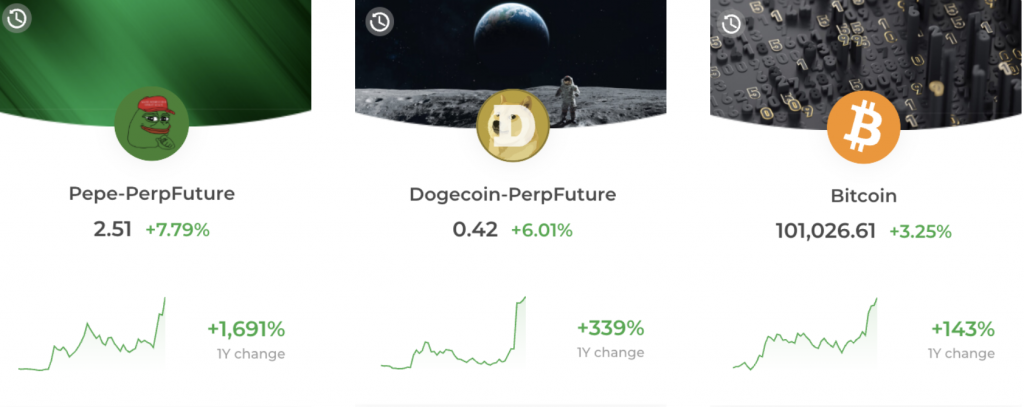

- Bitcoin smashed through the $100,000 barrier, driven by institutional adoption, regulatory clarity, and a major boost from Donald Trump’s election victory. His administration’s pro-crypto policies created a tailwind for the market, with reduced uncertainty and broader acceptance fuelling BTC’s rise. Wall Street may not have loved crypto before, but that has changed in 2024.

- Dogecoin barked its way to a 358% gain, thanks to Elon Musk integrating DOGE tipping into the X platform. Meme traders laughed all the way to the bank as Dogecoin’s loyal fanbase proved the power of internet culture.

- Pepe hopped on the meme wave and didn’t look back. Fuelled by a community of traders who love a good frog joke, Pepe showed that humour and hype can make serious profits.

💔 Worst Performing Assets of 2024

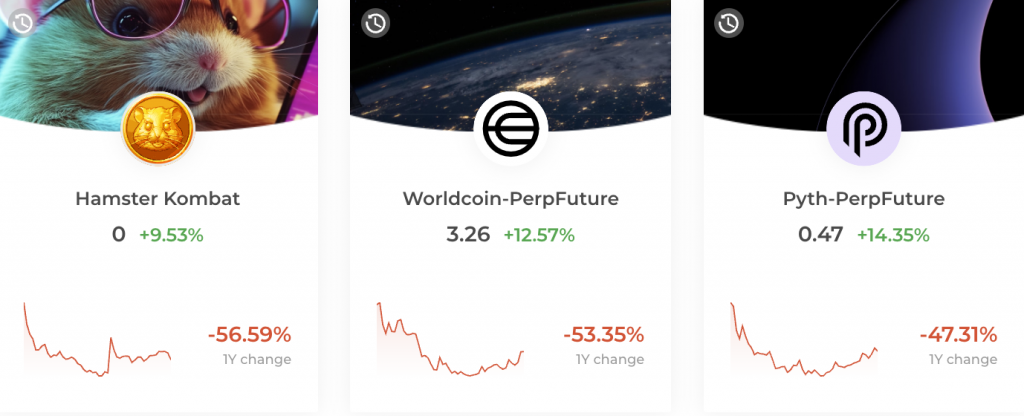

- Hamster Combat was a classic case of hype without substance — it crashed harder than its website on launch day. Turns out, hamster-themed tokens weren’t a sustainable niche.

- Worldcoin had a rough year as its utopian vision of ID-based crypto ran into regulatory roadblocks, causing its adoption and price to stagnate.

- Pyth never gained traction, leaving investors scratching their heads over its purpose. Its price plummeted in a year when use case clarity mattered more than ever.

Throughout the year, our traders found ways to profit even from seemingly hopeless assets like HMSTR. Check out our guide on how to short sell crypto and learn how to ride any market wave — no matter the direction.

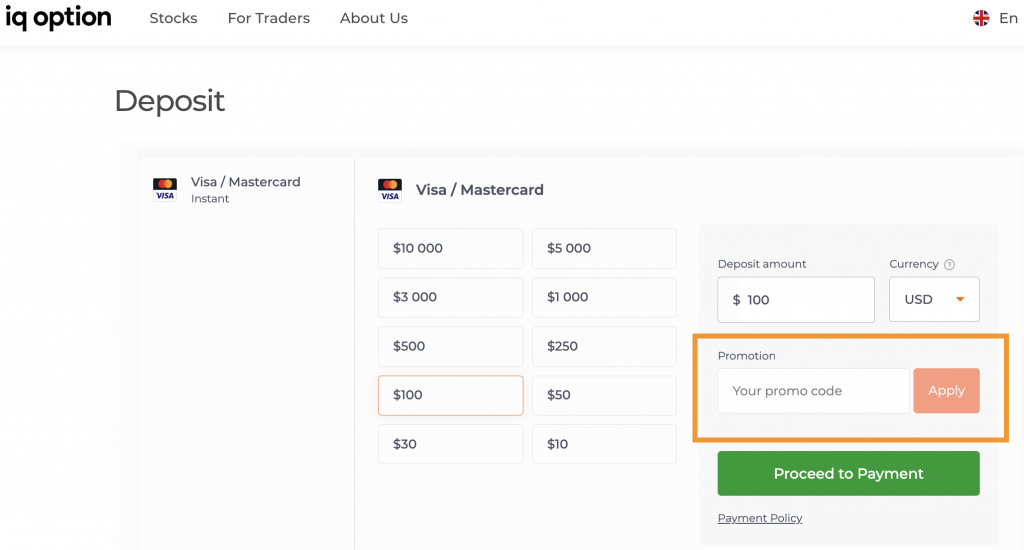

🎁

We’ve got a special surprise for you! Use this promo code when making the next deposit and boost your trading game this holiday season.

NEWYEAR15

Once you activate this “Risk-Free Trade” promo code, your next trade will be insured up to $15. This means that if your next deal closes at a loss, you will get back up to $15 of your investment. Just enter the promo code in the ‘Promotion’ section when making your next deposit and enjoy trading risk-free.

The number of promo codes is limited, so hurry up to claim it before 31.12.2024!

Stocks: Tech Celebs and Fading Stars

🏆 Best Performing Assets of 2024

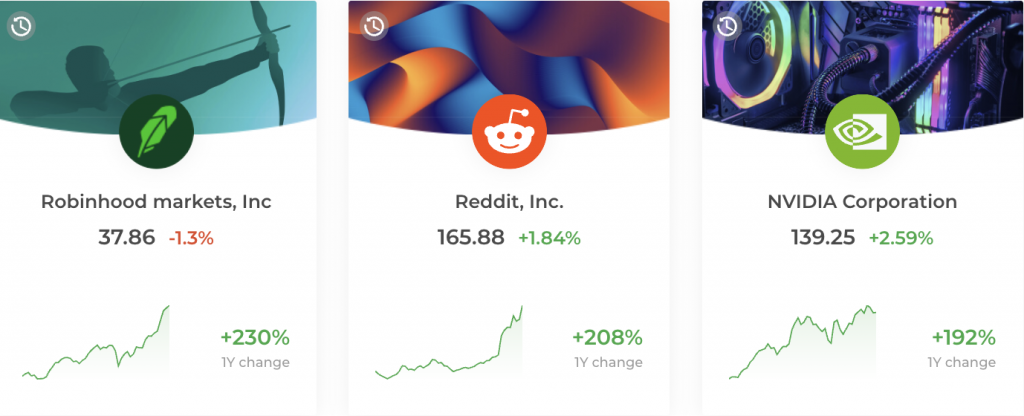

- Robinhood made a comeback with crypto, futures, and AI-powered financial tools. Traders are loving it — finally, a meme stock that delivered!

- Reddit surged after its IPO, proving that millions of subreddits are a financial force to be reckoned with. Pro tip: Meme stocks are now powered by meme sites.

- Nvidia kept printing money, riding the AI boom with no signs of slowing down. With GPUs being the backbone of AI and gaming, it was Nvidia’s world, and we were just living in it.

✍️

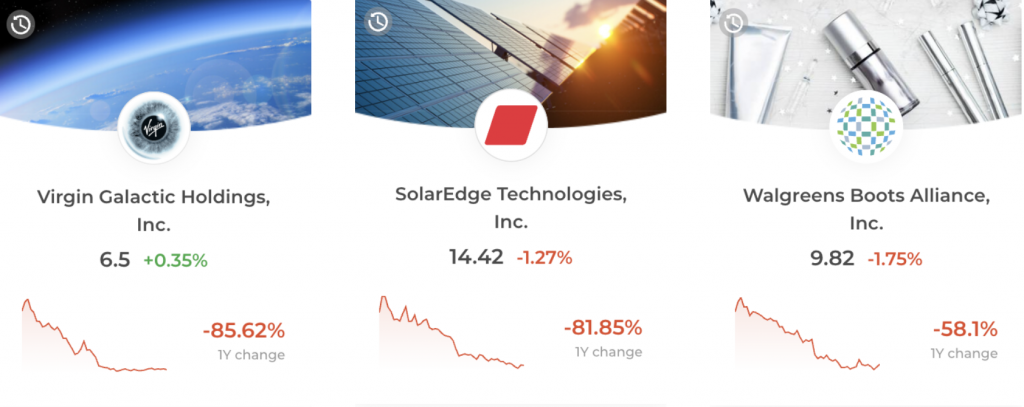

💔 Worst Performing Assets of 2024

- Virgin Galactic once promised trips to space; now it’s just tripping. Operational delays and underwhelming demand clipped its wings.

- Solar Edge Technologies was caught in an energy sector slowdown, proving that even green dreams can wilt.

- Walgreens Boots Alliance faced a tough year, as declining foot traffic and competition from online pharmacies took a toll.

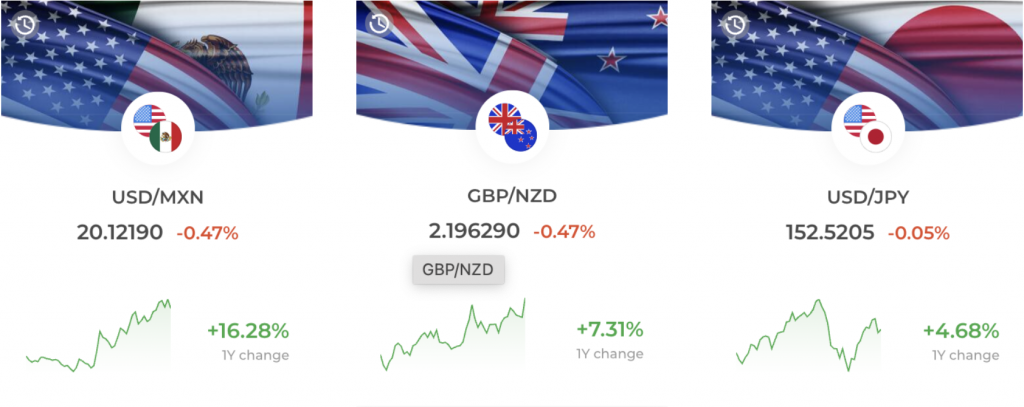

Forex: Dollar Dominance and Kiwi Woes

🏆 Best Performing Assets of 2024

- USD/JPY surged as the yen weakened under Japan’s dovish monetary policy. The dollar called the shots this year.

- USD/MXN shined on strong U.S. demand for Mexican exports and resilient trade ties.

- GBP/NZD rallied as New Zealand’s economic recovery faltered, making room for a stronger pound.

💔 Worst Performing Assets of 2024

- NZD/USD felt the squeeze of weaker global trade and softer commodity prices. Tough year for the kiwi.

- EUR/ZAR dropped as South Africa benefited from stronger commodity exports, leaving the euro in the dust.

- AUD/USD saw declining momentum amid falling commodity demand, as China’s recovery slowed.

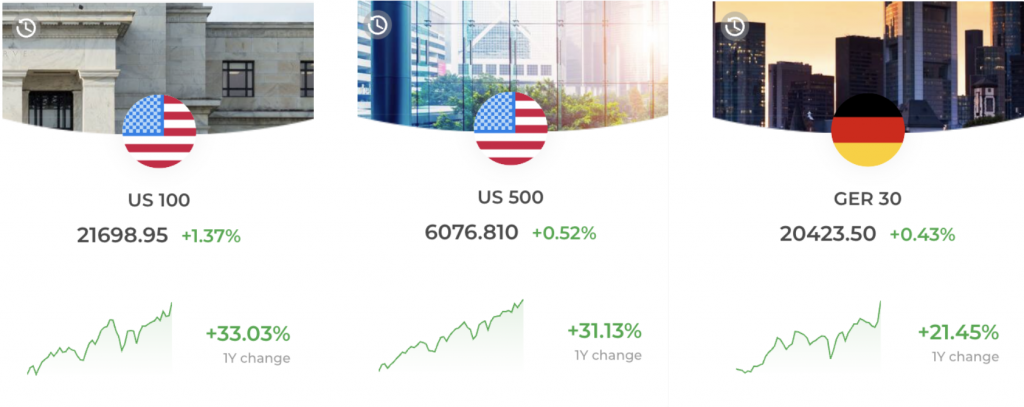

Indices: Tech Rallies and Regional Struggles

While indices may not have been the most popular among the best assets of 2024, many traders took advantage of this ambitious market. When you’re searching for the answer to the question “What to trade in 2025?” you may want to consider indices as a way to diversify your portfolio.

🏆 Best Performing Assets of 2024

- US100 and US500 hit record highs, powered by Big Tech and resilient corporate earnings. AI’s rise fuelled the market, making traders bullish on all things tech.

- GER30 (Germany’s DAX) had an exceptional year, driven by strong performances in the automotive and industrial sectors. A rebound in European markets gave the index a significant boost, making it a favourite for global investors.

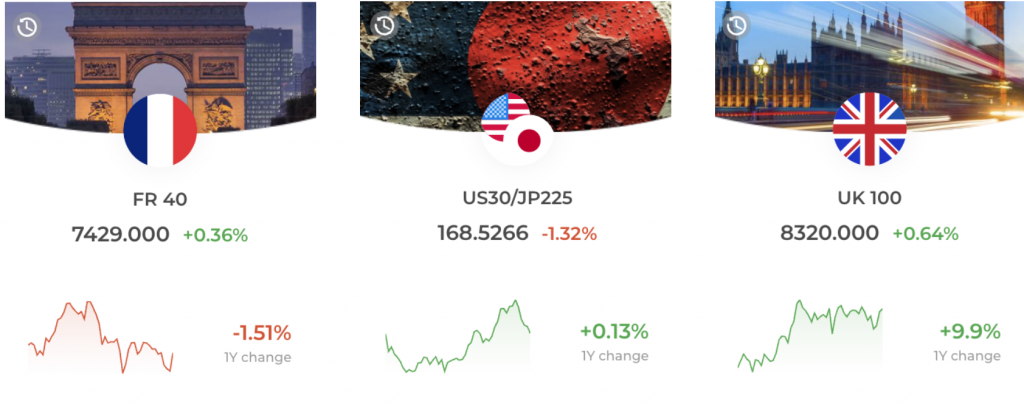

💔 Worst Performing Assets of 2024

- FR40 (France’s CAC 40) faltered as key sectors like luxury goods took a hit from slowing global demand.

- US30/JP225 (Dow Jones/Nikkei 225) suffered as industrials lagged in both economies, proving not every index can keep up with tech’s meteoric rise.

- UK100 (FTSE 100) struggled under inflation and stagnating growth, leaving traders looking elsewhere for gains.

Commodities: Golden Days and Burnt Crops

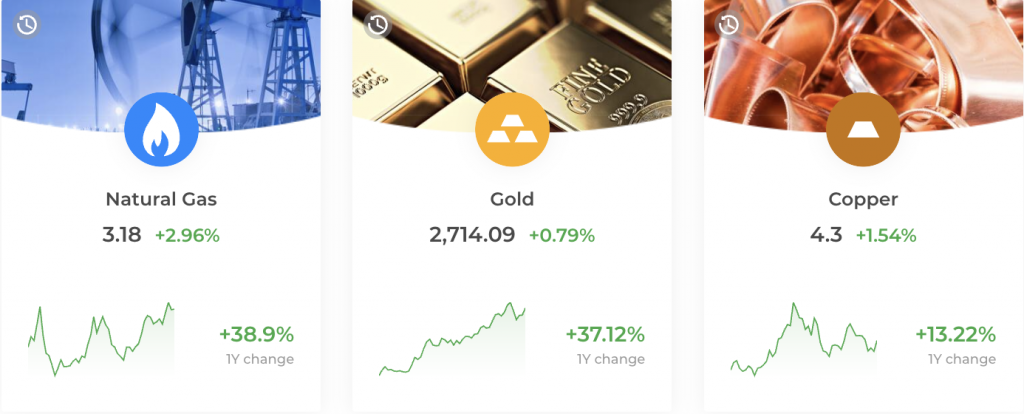

🏆 Best Performing Assets of 2024

- Gold glittered, hitting near-record highs as investors flocked to safety amid market uncertainty.

- Gas prices rallied, driven by supply shortages in Europe and a harsh winter forecast.

- Copper thrived on renewable energy demand, cementing its role as the backbone of green infrastructure.

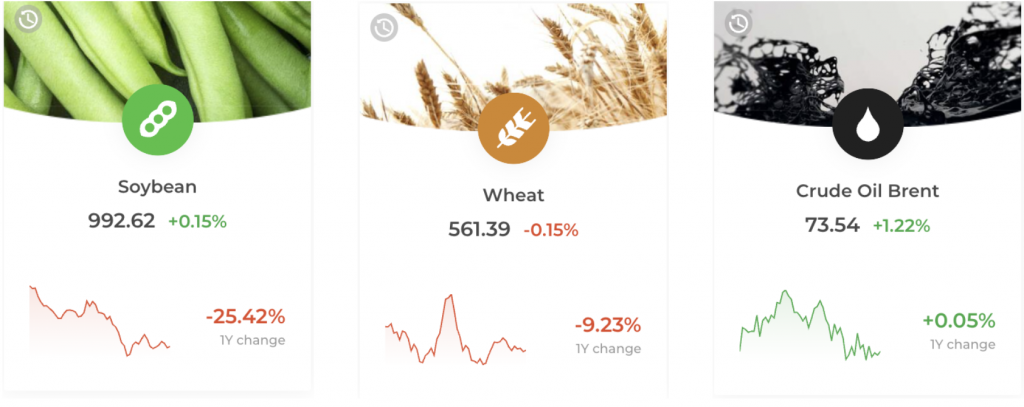

💔 Worst Performing Assets of 2024

- Soybean and wheat crops suffered from oversupply and declining global demand.

- Crude Oil Brent had a tough year, with OPEC cuts failing to counteract waning global demand and rising alternatives.

What to Trade in 2025

Looking ahead, the trends from 2024 provide clues for what to trade in 2025. AI-driven stocks, renewable energy commodities like copper, and Bitcoin’s continued rise are worth watching. Meanwhile, opportunities in undervalued forex pairs like EUR/ZAR and agricultural commodities could offer intriguing entry points for risk-tolerant traders.

Here’s to crushing it in 2025! 🥂