2020 has been a year of unexpected challenges for everyone. Society had to quickly adapt to the new norms and the uncertainty, that was extreme in March and April, still lingers as we are waiting for the vaccine and dread new restrictions.

The trading market is a reflection of the world’s state. The combination of various events caused strong volatility, and the market’s ups and downs not only created opportunity and risks for investors, but also attracted many newcomers to the world of trading and investing. As the year is coming to an end, let’s remember some of the major events that shook the market to the core.

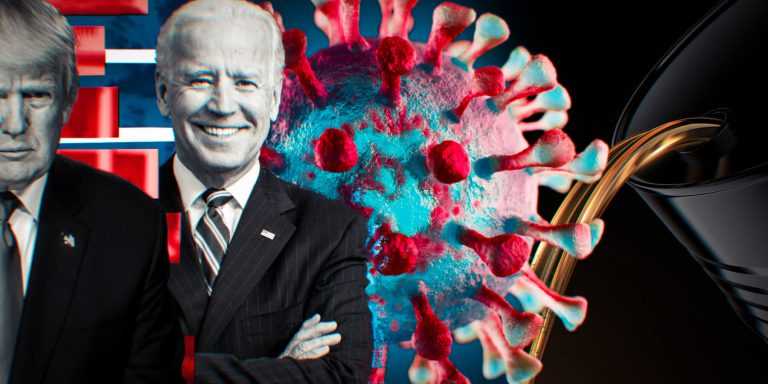

COVID-19

The main event of the year that everyone is struggling to recover from is the raging pandemic that for several months put the whole world on pause. The lockdown and the associated restrictions caused many businesses to close, and most industries continue suffering a serious decrease in profit. In March and April, the tourism industry, the restaurant business as well as the retail and film industries took the brunt of the situation, and continue to bear losses as the restrictions get renewed.

Higher unemployment rates and the supply shortage due to reduced production are some of the long-term consequences that may stick around for the longer term, depending on the measures to be taken in 2021.

For the trading market, the pandemic reflects in the sharp crash of stocks in February-March 2020 and strong volatility in the following months. The uncertainty has not settled yet, as the coronavirus vaccine testing has not been finished, which leaves possibility for further price fluctuations.

OPEC+

Crude oil followed the stocks: the fall of the alliance in April, the fight about production cuts between producers and the low demand for crude oil, resulting from the coronavirus pandemic, caused a sharp decline of its price. In the end of April, Crude Oil WTI hit a record low of -37.63. Since then, producers managed to agree on production cuts in order to maintain a higher price for crude oil.

The oil industry has been struggling through the year and even though oil prices are back on the rise, they haven’t reached their pre-coronavirus levels yet. Currently, Crude Oil WTI is traded at 48.3, while Crude Oil Brent stays around the 51.5 mark.

US presidential election

No other presidential election receives as much media attention as the United States’ one. It is only natural — the political events of the largest economy in the world have their influence on much more than just internal affairs. The winner of the election gets to lead the country, a military superpower, for four years and many things will depend on the new president’s political policy.

The victory of the Democtratic candidate caused a temporary spike in European stocks and stimulated some growth on the Chinese market — the reaction to the new president’s softer international policy. While many agree that Biden’s victory could be a positive influence on Asian stocks, some argue that the trade policy established by president Trump will not be drastically altered.

What’s to come?

2020 has been a year of many changes to the familiar reality. The trading market is a reflection of the events and it is still not clear what 2021 will bring. However, one thing is definite: economic crises create many opportunities for those who follow the market closely; however, the risks that arise due to the economic crisis shall also be taken into account. Traders that might wish to prepare for 2021 may consider following the news closely and improving their technical analysis skills.