A day with light economic calendar may or may not present trading opportunities. The most important economic news were about the continued weakness of the Australian Dollar and some weak number about German Industrial Production.

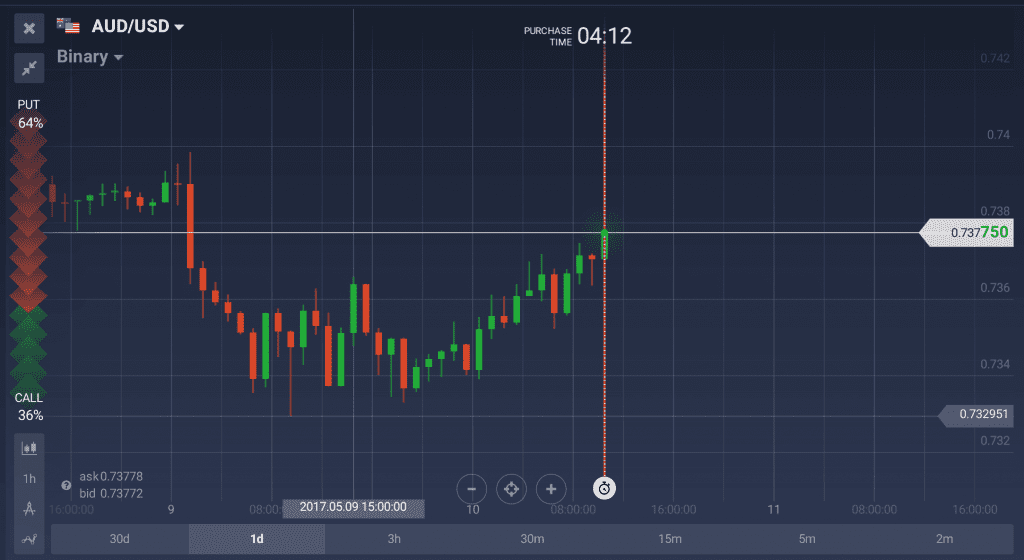

Australian Dollar

Lower than expected Retail Sales for the Australian economy for the month of April 2017 and 1st quarter of the year had as a result a continuation of weakness for the Australian Dollar.

Swiss Franc

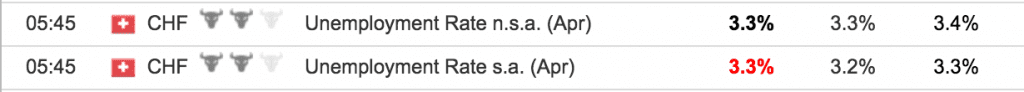

The Unemployment Rate for the month of April 2017 for the Swiss economy came at 3.3%, exactly as the estimate, at a rather very low level and lower than the Unemployment Rate of the US economy:

The Unemployment Rate for the month of April 2017 for the Swiss economy came at 3.3%, exactly as the estimate, at a rather very low level and lower than the Unemployment Rate of the US economy:

Still the USD/CHF strengthened significantly as the pair moved higher from the low price of 0.9978 to the high price of 1.0089:

The weakness of the Swiss Franc can be also partly attributed to falling gold prices yesterday.

Euro

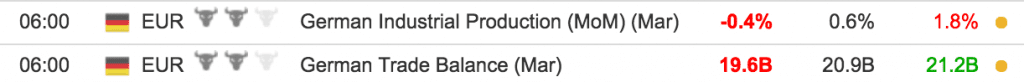

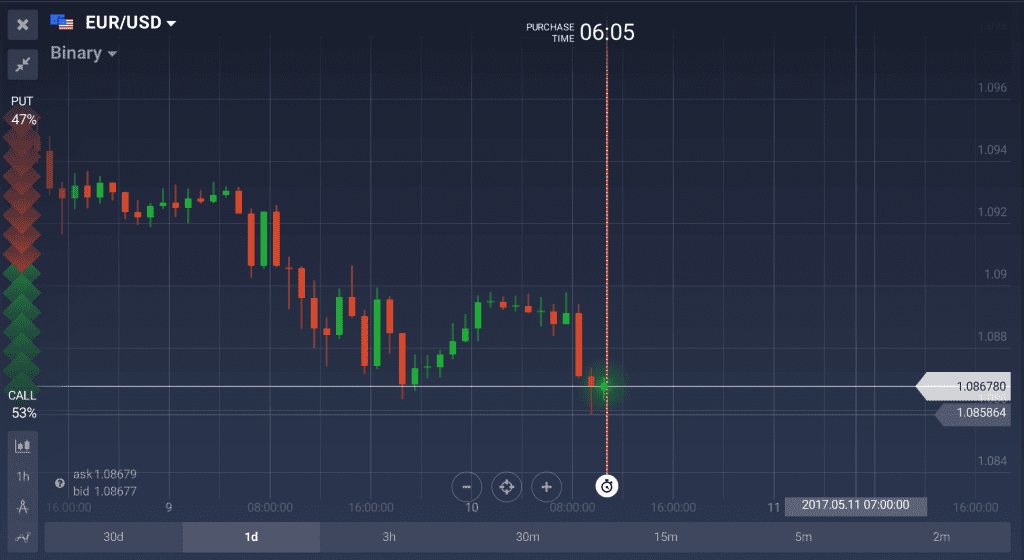

Lower than expected German Industrial Production for the month of March 2017 did not help the Euro hold its recent gains and it continued depreciating against the US Dollar for second consecutive day.

Lower than expected German Industrial Production for the month of March 2017 did not help the Euro hold its recent gains and it continued depreciating against the US Dollar for second consecutive day.

While the German Trade Balance and German Current Account showed better than expected readings, in the long term this is positive for the Euro as capital flows into the German economy and demand for the Euro is rising:

However despite these news the EUR/USD fell to 1.0862 from 1.0932.

US Dollar

With not any important economic news for the day the US Dollar shows increased strength against major currencies, but not versus the British Pound.

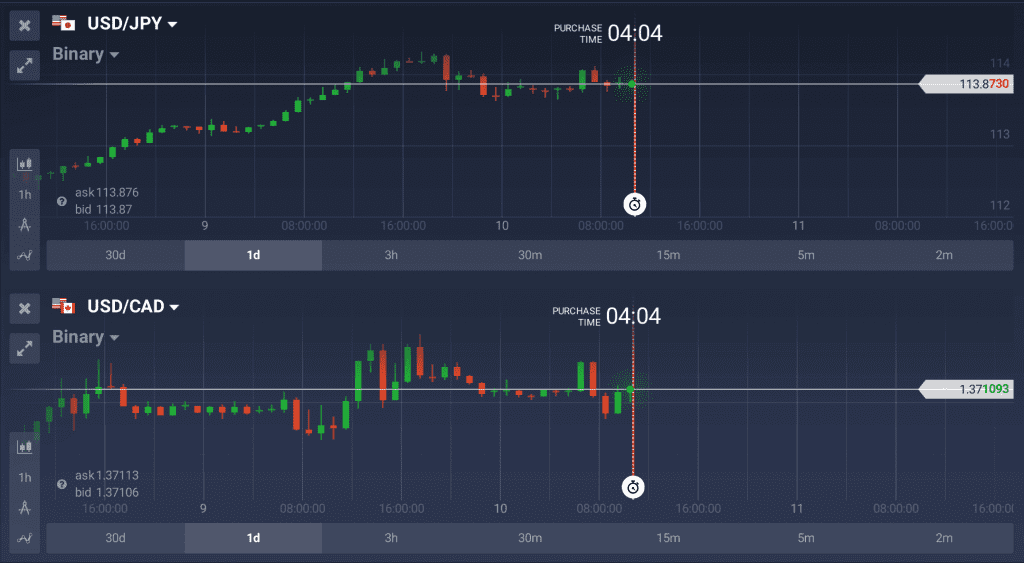

The US Dollar gained versus the Japanese Yen as the USD/JPY  moved higher to 114.31 from 113.12, and versus the Canadian Dollar as the USD/CAD moved higher to 1.3751 from 1.3670:

moved higher to 114.31 from 113.12, and versus the Canadian Dollar as the USD/CAD moved higher to 1.3751 from 1.3670:

The number of new Building Permits for the Canadian economy for the month of March 2017 was less than expected, so the weak building activity did not help support the Canadian Dollar much. However the British Pound in the lack of any important news holds strong enough as the GBP/USD moved higher from 1.2909 to 1.2959.

The number of new Building Permits for the Canadian economy for the month of March 2017 was less than expected, so the weak building activity did not help support the Canadian Dollar much. However the British Pound in the lack of any important news holds strong enough as the GBP/USD moved higher from 1.2909 to 1.2959.

The British Pound was the only currency which did not contribute to the US Dollar strength yesterday, and this is interesting as on Thursday 11th May 2017 the Bank of England will announce its monetary policy decision, a very important fundamental announcement which can cause volatility for the British Pound.

The British Pound was the only currency which did not contribute to the US Dollar strength yesterday, and this is interesting as on Thursday 11th May 2017 the Bank of England will announce its monetary policy decision, a very important fundamental announcement which can cause volatility for the British Pound.

The dominant trend yesterday was a rally for the US Dollar even without important economic news. The Euro at the moment, shows a short-term shift in trend as it continued to move lower despite some positive news from the German economy.

NOTE: This article is not an investment advice

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.