A working strategy, attentiveness, deep knowledge — all of these things are crucial for a good trader. However, being good at using the platform and knowing about all the features that can be applied is just as important. The tools you are using make a huge impact on the outcome of the deals and let you get better control. See how well you know the platform with this checklist!

Let’s have a closer look at the features you might have missed.

1. Use balance…

‘Use balance to keep position open’ is a feature that allows you to keep the deal open even after it goes beyond the autoclose level. If your deal is out of money, but you believe that soon the price will reverse, you may enable this option. Funds from your balance will be used to maintain the deal if it goes in the opposite direction, below the autoclose level. If the price reverses and goes in the chosen direction, the funds deducted from the balance will be returned (gradually, the same way they were deducted).

2. Trailing stop

This feature allows you to secure a certain amount of profit (incur a certain amount of loss), once the deal is in the money. After you set a Stop Loss level, it will follow the price of the asset if it goes in the chosen direction. It will not move, however, if the price goes against your prediction. This means that if you invested in, for instance, EURUSD, predicting that the price will go up and set a Trailing Stop Loss of 50%, if the price of the asset rises, the Stop Loss level will move up accordingly in the desired direction. You may find a detailed explanation of this feature here.

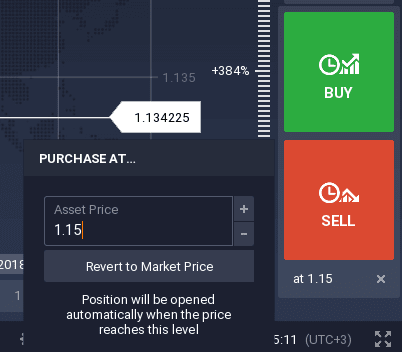

3. Purchase at…

Open a deal at your own conditions with this feature that allows you to create a pending order. To do so, set the investment amount, the multiplier, the Stop Loss and Take Profit levels just like you would do with any deal. Then simply set the price of the asset at which you want your position to be opened. After that decide which position you are opening — Long or Short one and click the corresponding button (Buy or Sell).

You will see a confirmation that your order has been created. Once the price of the asset reaches the indicated level, it will trigger the order and the deal will be opened automatically.

4. Market analysis

Did you know that you do not need to leave the trade room to be on top of the latest market news? This is your chance to get a better understanding of fundamental analysis principles — find all the information on top-performing assets, consult Forex and Crypto calendars and access latest earnings reports. You do not need to have multiple tabs open — all the necessary information is at your disposal. Here you can also choose the desired asset and open a deal for it. Basically, this feature is everything you need for fundamental analysis in one place.

Proceed to the platform to give these features a try. Who knows, maybe they can become a valuable addition to your trading routine.