A newbie trader thinks the key is making big wins; the mature trader knows it’s about not losing your shirt on a bad day. That’s where risk management in trading comes into play.

Let’s dive into five essential risk management tools for trading that every trader should have in their toolkit.

1. Stop-Loss: Your Safety Net

A stop-loss order automatically closes a trade at a predetermined price level, protecting you from excessive losses. Essentially, stop-loss is your autopilot that takes over when the market starts going against you.

However, some beginners believe that they can make it without stop-loss. If you’re one of them, guess what is the most popular risk management tool on IQ Option? Right, no smart trader works without a stop-loss — and here’s why.

1. Hands-free trading: With the stop-loss enabled, you don’t need to constantly monitor the chart. The system will keep an eye on the price for you and take action if things go south.

2. Eliminating emotions: If you’re an emotional type, stop-loss is your saviour. Just calculate your acceptable loss according to your strategy and leave the rest to automation. This way, you won’t make emotional moves too fast, too soon.

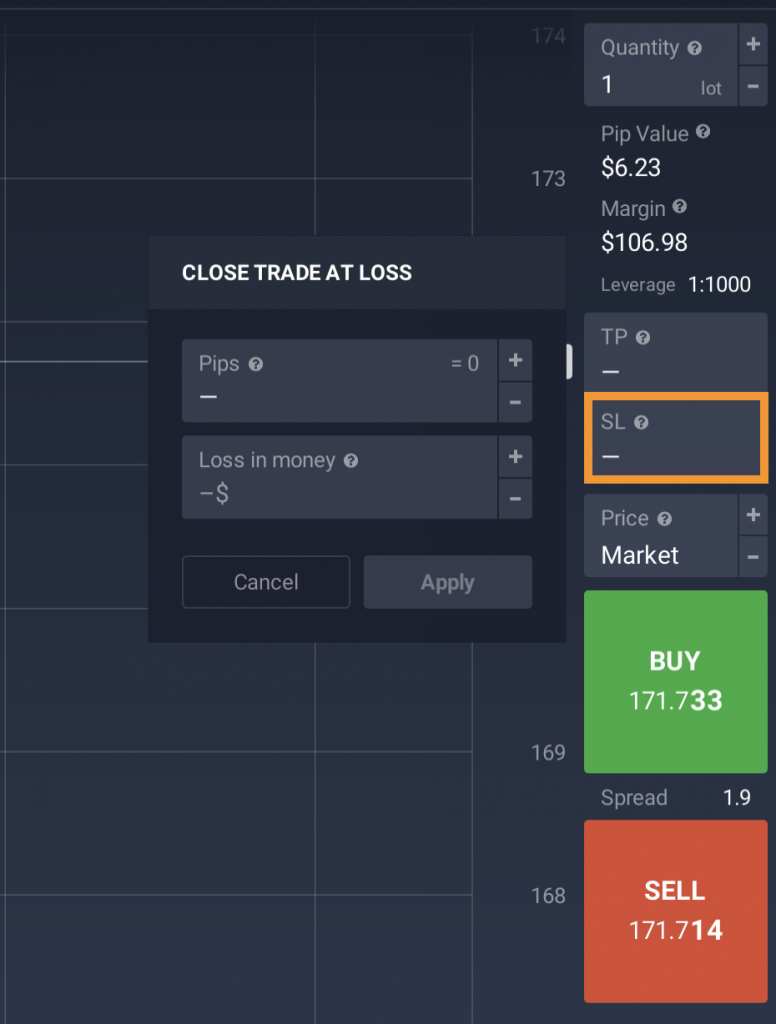

3. Simple setup: Setting a stop-loss is literally the easiest risk management step you can take. Just find it on the right side panel of the IQ Option platform and choose the amount of loss you’re ready to take on that trade.

Keep in mind that this feature might look different for various types of trading accounts. If in doubt, reach out to the support team via the traderoom chat to get assistance.

2. Hedging: The Art of Balancing

Speaking of risk management techniques in trading, we can’t overlook hedging. Hedging involves opening new positions to offset potential losses in existing ones. For example, if you’re heavily invested in a particular stock, you might hedge your bets by investing in a related asset that moves in the opposite direction.

This technique is all about balance. By hedging, you’re not just sitting back and hoping for the best; you’re actively managing your risk and ensuring that one bad trade doesn’t wipe you out completely.

3. The 2% Rule: Keeping It Small

Another tip on how to manage risk in intraday trading is the 2% rule. This rule is a risk management technique where you never risk more than 2% of your trading capital on a single trade. It’s a simple yet powerful way to ensure that no single trade can blow up your account.

Example: Let’s say you have $10,000 in your trading account. According to the 2% rule, you should not risk more than $200 on any given trade. This means that if your Stop Loss is set at 2% of your trading capital, you should only take a position size where a 2% move against you would result in a $200 loss.

This approach helps you stay calm and collected. Instead of panicking over every little market move, you can rest easy knowing that even a loss won’t be catastrophic. For more details on this rule, check out our article on the 2% rule.

4. Risk-Reward Ratio: Weighing the Odds

The risk-reward ratio is all about evaluating the potential gains against the possible losses of a trade. Ideally, you want to aim for a ratio where the reward is at least twice the risk. So, if you’re risking $50 on a trade, you should aim for a potential reward of $100.

This approach for risk management in trading helps you make more strategic decisions. Instead of jumping into every trade that looks promising, you’re more selective, focusing on those with the best potential payoff. To dive deeper into this concept, have a look at our article on the risk-reward ratio.

5. Diversification: Don’t Put All Your Eggs in One Basket

Diversification means spreading your investments across different assets, sectors, or even geographic regions. The idea is to minimize the impact of a poor-performing investment by balancing it with better-performing ones.

IQ Option provides extensive diversification opportunities across various asset classes including Forex, stocks, crypto, commodities, and more. If you’re seeking diversification, you might want to explore ETFs (exchange-traded funds). ETFs represent a basket of different stocks, where the ETF’s price reflects the combined value of its underlying assets. Essentially, investing in an ETF allows you to access a pre-diversified investment option, simplifying exposure to multiple stocks through a single investment.

Conclusion

Effective risk management in trading can potentially yield as much, if not more, profit than a series of successful trades. Whether you’re using stop-loss orders, hedging, adhering to the 2% rule, focusing on a favourable risk-reward ratio, or diversifying your portfolio, these tools and techniques are your best bet for staying afloat in the unpredictable waters of trading.