As you probably know, currency pairs are the main assets on the foreign exchange (FX) marketplace. Every trade within the forex market — whether buying or selling — takes place through these pairs. You may think of them as dance partners on a global stage, each with its unique rhythm and sway.

Some stand out as the most popular forex pairs to trade. Others are known for their wild moves — the most volatile forex pairs. So let’s step onto the trading floor and unravel the factors affecting these dynamic duos. This knowledge may help you spot the forex currency pairs that run strong and may be worth including in a trading routine.

If you are new to this topic, you may consider reviewing this article on CFD forex trading first to gain some knowledge of the basics.

🟦 EUR/USD

Being one of the most volatile forex pairs, the EUR/USD is popular among traders worldwide. It is the most widely traded currency pair globally, and for good reason. Here are some key insights into this dynamic duo.

Influencing Factors

Interest rates are among the main factors affecting the EUR/USD forex pair. When the European Central Bank (ECB) adjusts its rates differently from the U.S. Federal Reserve (Fed), it may impact the balance between the two currencies. So it may be worth tracking any news related interest rate changes when trading CFDs on the EUR/USD forex pair.

Additionally, government policies, economic events, and other major news from both the EU and U.S. economies might sway the value of the EUR/USD. Some traders may use fundamental analysis to gather information from these news reports and make informed trading decisions.

High Liquidity

The EUR/USD has high liquidity, making it a favourite among traders. Higher liquidity may allow traders to swiftly enter and exit positions at a market price. However, it is also essential to manage the risks arising too.

Predictable Patterns and Trends

Due to its high trading volume, the EUR/USD might exhibit some repeating patterns and trends. Technical traders may observe these movements to make informed decisions.

However, it might take some time to learn how to spot the right patterns on the price chart with a naked eye. That’s why many traders turn to technical indicators that may assist in identifying trends and patterns on the graphs. Technical tools like the Stochastic Oscillator or Bolllinger Bands may be a good place to start.

Diverse Trading Opportunities

The EUR/USD remains one of the most popular forex pairs to trade among traders who prefer various approaches. Whether you’re a day trader, swing trader, or position trader, this forex pair might offer many opportunities on both short-term and long-term timeframes depending on your trading approach.

🟦 AUD/USD

As one of the most popular forex pairs to trade in the forex market, the AUD/USD attracts attention from traders worldwide. Here are some key facts that may offer valuable insights into this currency pair.

Trading Volumes and Volatility

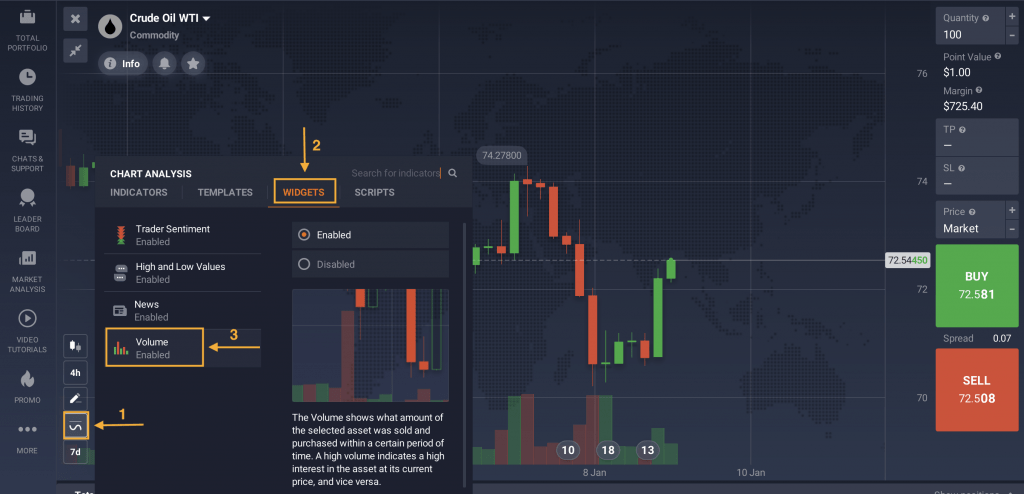

The AUD/USD may be considered one of the forex pairs with the most volume. Why? Because it includes the Australian dollar (AUD) with the mighty U.S. dollar (USD). You may check the trading volume for specific CFD assets in the IQ Option traderoom.

To apply this feature, just go to the ‘Indicators’ tab on the chart (point 1 on the image below). Then click on ‘Widgets’ and enable the ‘Volume’ feature. Trade volume will be indicated below the price chart.

Traders might pick this pair due to its liquidity and frequent price swings. If you’re seeking action, the AUD/USD forex pair may be worth a look. Nonetheless, risk management tools should be used as well.

Australia’s Commodity Influence

Australia is considered one of the largest exporters of commodities, such as coal and iron. Consequently, the country’s economy dances to the rhythm of these markets. When global demand for some commodities shifts, the AUD/USD might respond accordingly. So you may consider keeping an eye on these commodities when considering this forex pair to trade in 2024 based on your trading preferences.

Possible Trading Times

Some traders may view the London session as a possible time to trade the AUD/USD. Why? Because during this window, there’s normally plenty of financial activity across the Tokyo, London, and New York sessions.

🟦 USD/JPY

The list of the most popular currency pairs to trade continues with the USD/JPY. Here are some of the key factors to keep in mind about this asset.

Trading Volumes and Liquidity

The USD/JPY stands as one of the most actively traded forex pairs, attracting traders with its liquidity.

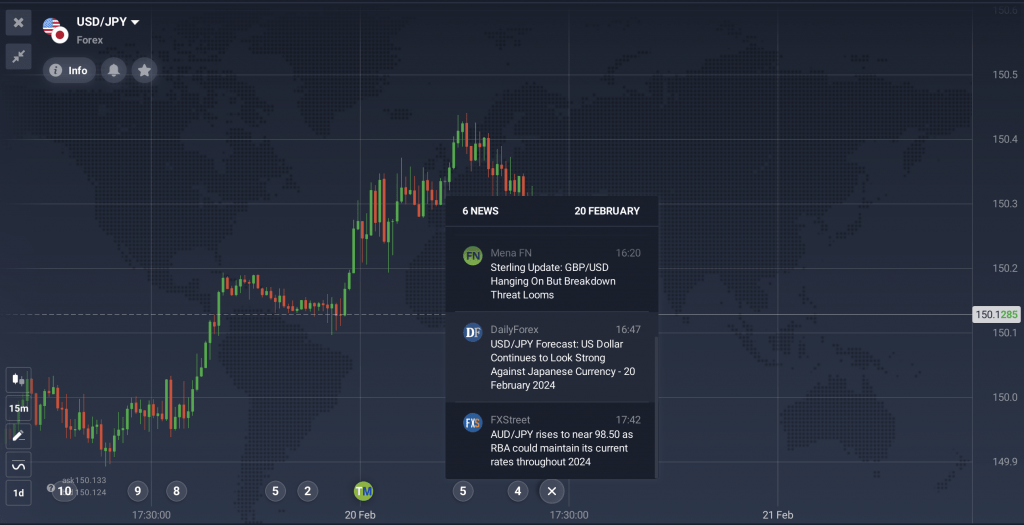

Political Sentiment and Geopolitics

The USD/JPY is no stranger to the winds of political change. It’s a pair that sensitively reacts to the political environment between the United States and the East, mainly Japan. Geopolitical developments, trade negotiations, and diplomatic exchanges may have a significant impact on the USD/JPY exchange rate. So it may be worth keeping an eye on the economic calendar to catch any relevant events that may sway this asset’s price.

🟦 EUR/GBP

As one of the most volatile Forex pairs, the EUR/GBP takes centre stage in the global trading arena. Here are some of the things to keep in mind about this asset when choosing forex pairs to watch in 2024.

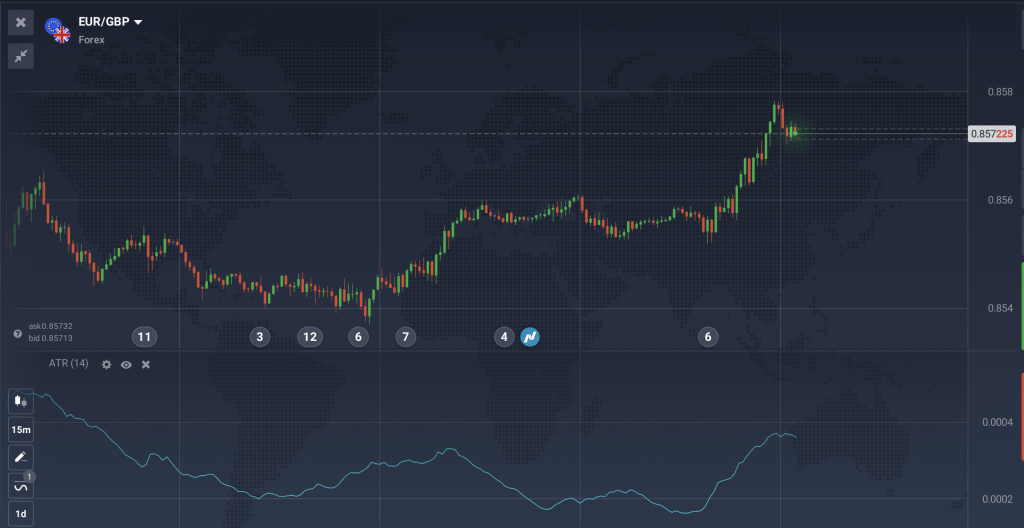

Volatility

The EUR/GBP is also one of the most popular currency pairs among both experienced traders and beginners. Similarly to other forex assets, it is often affected by volatility. For less experienced traders, volatility may be dangerous. However, there are technical tools that might assist in assessing volatility to manage risks. ATR is one of these instruments that may be useful when trading the most volatile CFD forex pairs.

Trading Opportunities and Insights

It may be worth keeping track of the economic and political events in the UK and European countries, as well as announcements from their financial institutions. News like that may have a significant impact on the EUR/GBP currency pair, creating potential trading opportunities.

🟦 USD/CNY

This may be one of the most popular forex pairs to trade lately. Let’s dive in to figure out the main factors that may affect the balance of this exciting pair.

U.S.-China Trade Relationship

The relationship between the United States and China has seen some ups and downs. Trade disputes, geopolitical shifts and economic policies and other factors have left their mark on the USD/CNY. Traders keenly watch for developments in this relationship, as they can significantly impact the pricing of the pair.

Possible Trading Times

The choice of the possible time to trade the USD/CNY may depend on market liquidity and volatility. Some traders may consider the New York and London market overlap (8 a.m. to 12 p.m. EST). This is when the USD/CNY might experience significant price fluctuations, offering potential opportunities for short-term trading.

In Conclusion

When looking for popular currency pairs to trade, you may consider a range of important factors affecting prices. These include volatility, liquidity, trade volume, as well as the optimal trading times. It may be worth keeping an eye on important political and economic events related to your forex assets. They may have a significant impact both on the most volatile assets and forex currency pairs that run strong. Using appropriate technical analysis and risk-management tools might help you manage risks and make informed decisions.