With the top crypto assets reaching new heights, traders may be looking into potential opportunities in this sector. While Bitcoin (BTC) is currently attracting the most attention, it would be unwise to ignore other crypto assets, such as Ethereum (ETH). Each digital asset brings its unique features and opportunities for traders and investors. In this article, we’ll explore the main factors and key events affecting these two top crypto assets in 2024. Additionally, we will look at the Bitcoin vs. Ethereum correlation and its potential development in the near future. However, keep in mind that forecasts are not a reliable indicator of future performance.

Bitcoin: key facts and figures

Bitcoin, the pioneer of cryptocurrencies, boasts a current market cap of over $1 trillion, maintaining its status as a cornerstone of the crypto world. Launched in 2009, Bitcoin has experienced remarkable growth over the years, becoming the key player in the digital currency space. It has gained over 50% so far this year, and there may be more potential growth ahead in the near future.

If you aren’t familiar with the concept of crypto trading, especially when it comes to trading CFDs, have a look at this video tutorial to learn the basics.

Now let’s have a look at the main points to consider when analysing the Bitcoin price and looking for potential opportunities.

Bitcoin halving in April 2024

One key aspect that sets Bitcoin apart is its limited supply. The total number of Bitcoin to be mined is set at 21 million, with 19 million already in circulation. The original protocol requires regular halvings, which reduce the reward issued for each new mined block. This in turn decreases the production volume, limiting the supply of new bitcoins to the market.

☝️

Bitcoin halving events occur approximately every four years, when the number of mined blocks reaches a certain amount. The upcoming Bitcoin halving in April 2024 will reduce mining rewards from 6.25 BTC to 3.12 BTC. This means that there will be fewer Bitcoins released on the market for each mined block, reducing supply and potentially driving prices higher.

There is no exact date for the upcoming Bitcoin halving in April 2024. It will occur as soon as the number of mined blocks reaches 840 000. It may be useful to keep an eye on the news to prepare for the event and make informed decisions.

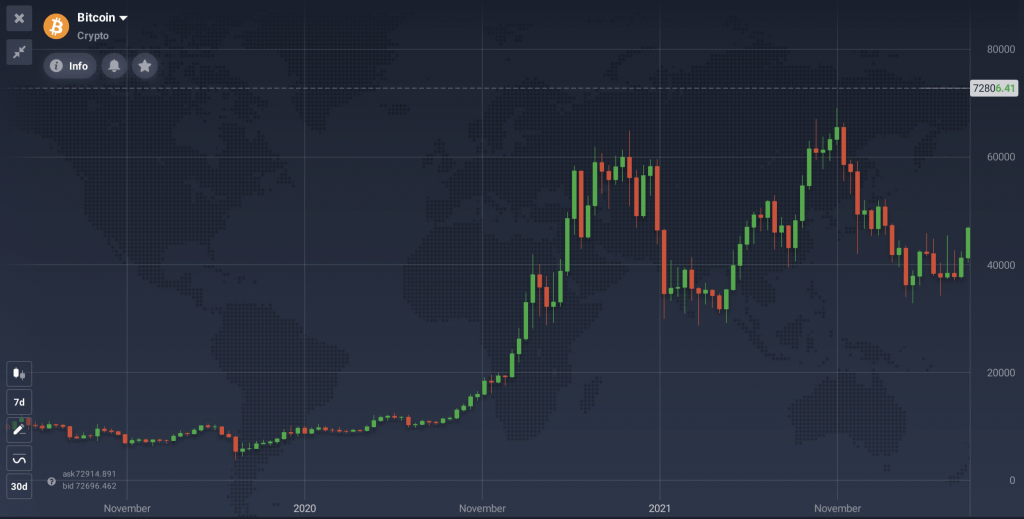

What happened after the last Bitcoin halving?

Historically, Bitcoin traders have witnessed halving events trigger additional volatility. It would, in turn, lead to both pre-halving rallies and subsequent price increases. For instance, the Bitcoin price gained a staggering 533% in the year following the previous halving in May 2020.

While this trend may suggest a bullish outlook, it’s crucial to consider various factors influencing the Bitcoin price. These might include market sentiment, demand, and other external events. Keep in mind that past performance does not guarantee any future price movements, as there may be various factors affecting assets at different times.

Some traders may also consider applying different approaches to catch trading opportunities among price swings following Bitcoin halving in 2024. For example, short selling may allow traders to trade not only long positions (BUY), but also short positions (SELL). Have a look at this detailed material to learn more about this method for trading price corrections: Trading Method for a Falling Market: Short Selling with CFDs.

How much will Bitcoin rise after halving?

The anticipation surrounding the Bitcoin halving in 2024 raises the question of how much the crypto asset will rise after the halving. Past halving events have seen substantial increases, but it’s important to note that the Bitcoin price is influenced by multiple factors, making precise predictions challenging. So, traders should carefully consider any additional factors that may affect their potential trades and apply appropriate risk-management tools.

Spot Bitcoin ETF momentum

The approval of 11 spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) in January 2024 marked a significant milestone. This added to the nearly 60% surge in Bitcoin prices, reaching a record high of $73,000 in March 2024. In just 2 months post-approval, the ETFs have acquired over 800,000 BTC. This amounts to 4% of all available Bitcoins, further reducing the supply on the market and driving the price higher.

Ethereum: key facts and figures

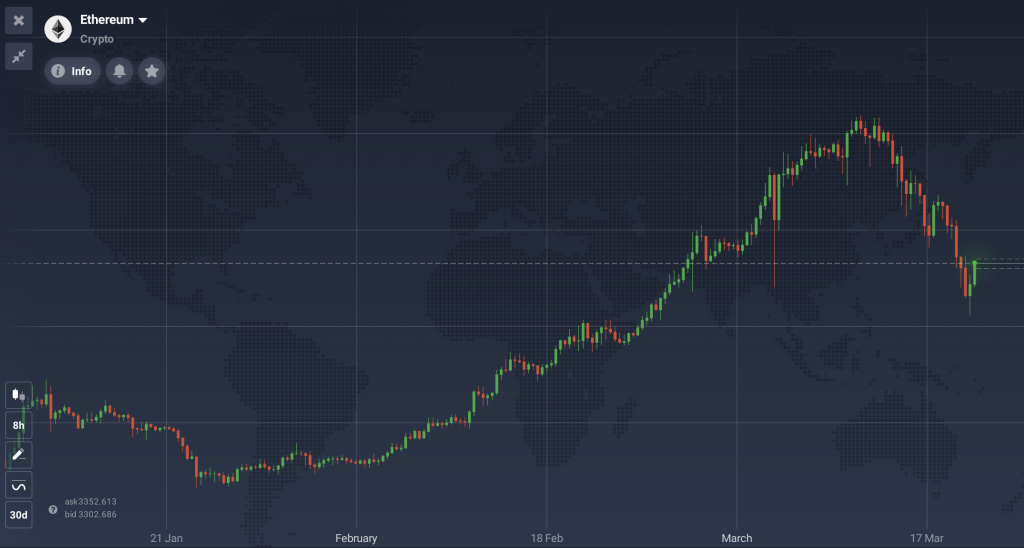

Ethereum boasts a market cap of $356.7 billion, making it a prominent player in the crypto market. The asset’s growth has been substantial, gaining over 50% so far this year. Let’s review some of the main events that may affect its price down the line.

Dencun upgrade

Ethereum recently underwent a significant upgrade known as Dencun. It aims to reduce transaction costs by storing large data chunks off-chain, resulting in lower fees for users. While Ethereum’s price hasn’t seen significant changes post-upgrade, it may be worth monitoring its performance in the near future.

Are spot Ethereum ETFs coming?

Some Ethereum investors are hopeful for SEC approval of the first spot Ethereum ETFs. There are several large firms, including Fidelity Investments and BlackRock, ready to launch spot Ethereum ETFs upon approval. Considering that Bitcoin prices skyrocketed after their spot ETFs were approved, it might be a good idea to keep an eye on any related news.

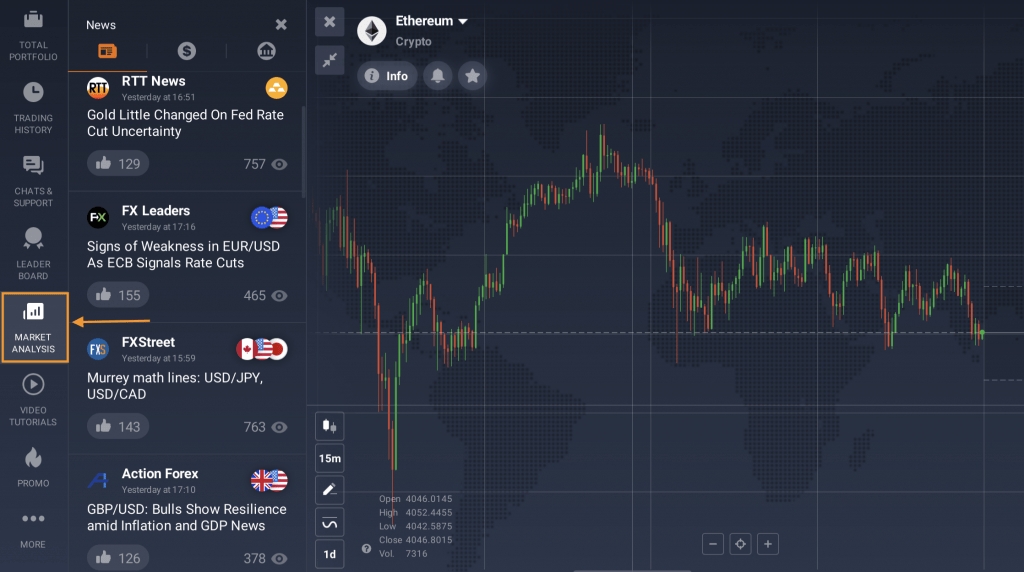

You may refer to the economic calendar to stay on top of the most important market news. The SEC is expected to decide on several applications to launch spot Ethereum ETFs around May. You may check the ‘Market analysis’ section of the IQ Option traderoom to stay informed.

Bitcoin vs. Ethereum: will Ethereum surpass Bitcoin?

Ethereum and Bitcoin are sometimes compared to silver and gold, respectively. Ethereum, similar to silver, is perceived as the more affordable and less traded counterpart to Bitcoin’s gold. This analogy suggests that while Ethereum may follow Bitcoin’s price movements, it has the potential to outperform in the longer run.

In the current landscape of 2024, both Ethereum and Bitcoin have attracted a lot of attention and investment. Bitcoin is currently trading below its historic all-time highs of nearly $73,000. Meanwhile, Ethereum is striving to remain close to its $4,000 milestone.

However, external factors such as the economic conditions might significantly influence both assets. Rising interest rates, for instance, triggered a crypto winter in 2022, leading to industry bankruptcies and plummeting crypto prices. Which means that high inflation levels and interest rates could challenge the crypto market’s bullish momentum. There is a general expectation that the US Federal Reserve might reduce interest rates before summer 2024. This highlights the importance of monitoring macroeconomic indicators for potential impacts on Bitcoin and Ethereum prices.

In summary, while both Ethereum and Bitcoin continue to play significant roles in the cryptocurrency ecosystem, their paths forward may differ due to distinct market dynamics and external factors, including macroeconomic conditions and monetary policy decisions. So it’s up to the traders to analyse the Bitcoin vs. Ethereum correlation and choose the suitable assets for their trading approach.

The Company offers CFDs on cryptocurrencies only.